Equities attempted to coast out of what felt like a frustratingly long week on a mostly positive note, despite a lack of clarity on… well, on anything, really.

The data was decent, on balance, with a big beat on retail sales grabbing headlines and helping to push a decidedly poor set of industrial production numbers to the background. Similarly, a headline beat on University of Michigan sentiment masked a deterioration in consumers’ assessment of current conditions amid maddeningly laborious stimulus talks and slowing labor market momentum.

As of Friday afternoon, many of the same roadblocks to a comprehensive virus relief bill in the US remained. Although a deal between Steve Mnuchin and Nancy Pelosi on testing appeared done, a variety of disagreements stood in the way of a final compromise. Larry Kudlow told Fox that “if Pelosi wanted a deal I think we could round up enough Senate Republicans” to get it done, but he admitted that “even if you made a deal it would be almost impossible to execute” by election day.

Again, one cannot help but wonder if Mitch McConnell is “in on it,” so to speak. Not in a true conspiratorial sense (I abhor conspiracy theories), but it’s hard to shake the feeling that Senate Republicans are scarcely more eager to help Trump win next month than Democrats. If they were, you’d expect more vocal support for a big stimulus deal that would allow for direct payments and other types of aid that the president could take credit for.

There is virtually none of that from Senate GOPers — at best, you get perfunctory nods to the desirability of “targeted” relief with a price tag that’s just a fraction of the deal Trump wants.

None of this is to say something won’t get done. But a grand bargain that results in Trump putting his famous Sharpie to a multi-trillion package before November 3 is all but impossible.

Pfizer and Boeing both performed well during Friday’s session as the former prepares to seek emergency authorization for a COVID vaccine next month and the latter got word that Europe thinks the 737 Max might be safe to fly again. Fingers crossed on both fronts.

Stalled stimulus talks took some of the wind out of the sails for the nascent bond selloff. 10-year yields were richer by ~4 bps in the holiday-shortened week.

“The reality is that until the outcome of the election is in hand, there will be a collective reluctance on the part of market participants to drive a new trend in the US rates market,” BMO’s Ian Lyngen, Jon Hill, and Ben Jeffery wrote Friday afternoon. “Add to this the fact that viral uncertainty will almost surely define the second part of Q4, and it follows that the data has been relegated to a second-tier influence on trading.”

Generally speaking, the market expects a selloff at the long-end in the event a “blue wave” in fact materializes, but right now, there’s still too much uncertainty.

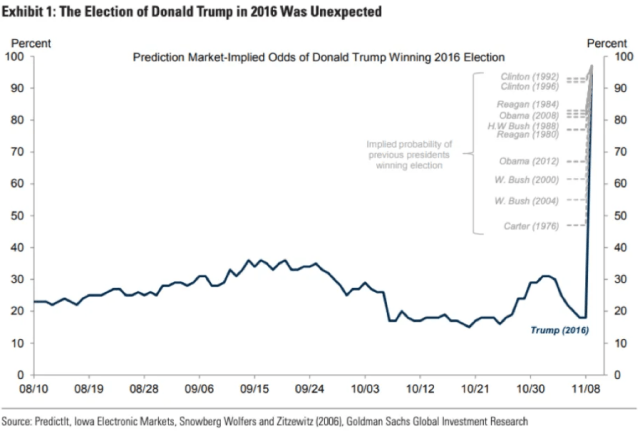

That’s a wholly generic assessment and yet, it can be taken 100% literally — nobody trusts the polls. And nobody trusts the betting odds either. Not after 2016. Charts like the one below are amusing, but they might as well be meaningless.

When it comes to fully pricing in a Democratic sweep across assets, markets will demand much more than just a purportedly “insurmountable” poll lead.

Let us not forget the lessons learned (figure below from Goldman). Nothing is impossible.

There are, of course, differences this time around, including and especially the fact that now, Americans have had a chance to experience four years of a Trump presidency. Not everyone who voted for the president four years ago is still enamored.

Elsewhere (and speaking of populist experiments that started in 2016) Brexit negotiations will apparently continue next week. Boris Johnson now says a deal is unlikely, and reiterated that the UK will dive out of the proverbial plane with no parachute later this year if Brussels doesn’t make further concessions.

If you have no idea what Boris and Brussels are arguing about in this latest round of Monty Python-esque absurdity, you’re not alone.

The dollar slipped Friday, but logged a gain for the week, its first in three. Oil was little changed, caught between too many factors to fathom, not least of which is the distinct possibility that the pandemic may have pounded the final nail in the coffin when it comes to any long-term bullish case for fossil fuels. What happens between now and, say, 2050 is anyone’s guess, but the bottom line is that either the world transitions to clean energy or everyone dies — not this generation, but maybe the next one. Everyone knows this, even if most are reluctant to say it. Just ask BP, for example.

In any case, another week is in the books on the way to the most consequential election in modern US history. We’re just marking time. As BMO’s Lyngen put it, “Let’s face it, one investor’s listless market is another’s coiling price action.”

When I read the title “T-Minus,” I thought it was about the decline of growth and the emergence of value, and this switch over occurring in the next downturn…to soon.

But, rather, the reference that saddens me is the fate of the grandchildren of my 19-year old nephew. (Referring to his generation, whether they thinks it’s wise or not to have children at this point, whether they can afford it, I’ll leave to him.) There’s nothing I can say to the the future grandchildren that changes anything. “Yeah, we siphoned off the natural wealth and pissed it away. People knew this was happening. Read Tainter. It was inevitable. Sorry.” I don’t know.

I do not know if young people are Generation X, Y, or Z but I do know they are generation screwed. That we are screwing the offspring of our offspring makes for non-complimentary assessment of human morals.

Let’s just hope the long lines at the polls and massive early voting indicate folks are considering their grandchildren.