If last week was painfully tedious at best and outright boring at worst, this week promises to break the monotony.

Of dictators and diplomacy

US officials spent the weekend arguing for regime change in Venezuela, where Nicolas Maduro has decided that going down with the ship is somehow preferable to accepting repeated offers from various stakeholders both foreign and domestic, most of whom have made it clear that the international community was open to allowing him to beat a hasty retreat to some far-flung locale, fortune in tow, never the be heard from again.

Suffice to say those implicit (and in some cases explicit) amnesty offers might be off the table after two days of turmoil that left at least two people dead and found regime troops blocking foreign aid convoys.

Maduro held a pro-government rally in Caracas on Saturday, where he danced to salsa music and declared he’s “stronger than ever.”

Marco Rubio seems to disagree:

— Marco Rubio (@marcorubio) February 24, 2019

As far as overt threats from the US government go, they don’t get much clearer than that. If you’re a Maduro loyalist, you’re probably doing your best Michael Scott impression at this juncture.

Of course it’s a lot harder to depose a dictator who has nukes than one who doesn’t, which is why, in stark contrast to the situation Maduro finds himself confronting, North Korea’s Kim Jong-Un gets to spend two whole days posing for photos with Trump in Hanoi on Wednesday and Thursday.

The summit is of course the second between the two cartoonish authoritarians, and it comes a scant eight months after their historic pow wow in Singapore, where the world was treated to some next level surrealness best captured in the following clip that found a visibly confused Chris Cuomo struggling to comprehend an alternate reality in which Dennis Rodman sobs on live television while clad in a MAGA hat and a “potcoin.com” T-shirt.

Predictably, the summit was long on fanfare and photos and short on substance. While Trump is keen to point out that Pyongyang has refrained from missile launches and nuclear tests, skeptics (where “skeptics” means experts and US intelligence) have pleaded with the president to be wary of trusting the notoriously recalcitrant regime.

Relive the Singapore summit

In the lead up to this week’s meeting, some (read: everybody) are concerned that Trump will end up getting hoodwinked by Pyongyang’s boy king, an amusing prospect that speaks to just how inept Trump’s advisors think the US president is.

“Inside the administration, concern about the upcoming summit has come from predictable skeptics, including national security adviser John Bolton, a longtime opponent of diplomacy with North Korea, but also from unexpected corners”, Politico writes, adding that “Secretary of State Mike Pompeo, the man charged with leading the negotiations, has expressed frustration to allies about the lack of diplomatic progress and voiced concern that his boss will get outmaneuvered, according to a source with direct knowledge of the conversations.”

Hilariously, North Korea is warning Trump not to get caught up in that kind of skepticism because if you can’t trust Kim, who can you trust, right?

“North Korea warned President Donald Trump on Sunday not to listen to critics who were disrupting efforts to improve ties, as its leader, Kim Jong Un, made his way across China by train to a second summit with Trump in Vietnam”, Reuters said Sunday.

But nobody should worry, because there is no way that Trump is so overeager for a foreign policy win that he would get himself “outfoxed” by Kim. Just ask the expert on all things Donald Trump … Donald Trump:

So funny to watch people who have failed for years, they got NOTHING, telling me how to negotiate with North Korea. But thanks anyway!

— Donald J. Trump (@realDonaldTrump) February 24, 2019

There was no word on whether the US delegation would bring along any autographed “Rocket Man” CD singles.

“I’ve never even heard of Michael Cohen”

While Trump is busy cavorting with a kid who once executed a top official with an anti-aircraft gun for falling asleep during a meeting, the president’s former personal attorney will be on Capitol Hill to testify before the House Oversight and Reform Committee.

“It’s a chance for Democrats to explore topics such as pre-election hush money paid to women who alleged they had affairs with Trump, and what Cohen knows about Russian influence in the 2016 presidential campaign”, Bloomberg notes. It’s also “a chance” for Cohen to reiterate, one more time, just how corrupt the President of the United States really is before he (Cohen) goes to prison for committing crimes at the behest of that same sitting US president.

On Friday, reports indicated that Cohen met with federal prosecutors in Manhattan again last month, this time to discuss “possible irregularities within the president’s family business and about a donor to the inaugural committee.”

Sources don’t know (or wouldn’t say) whether those potential investigations are headed anywhere, but Trump’s inaugural committee is under all manner of scrutiny as is the Trump Organization.

Deadlines that aren’t really deadlines

Technically, Friday is the cutoff for a “real” trade deal between US and China. If the Trump administration stuck to the original timetable as communicated to the market following the December truce in Argentina, tariffs on $200 billion in Chinese goods would more than double to 25% in the absence of a comprehensive deal.

At this point, there is little chance the US sticks to that. Principal-level talks have been going on for two straight weeks and Trump’s absurd Friday Oval Office presser with Chinese Vice Premier Liu He clearly indicated that an extension is in the cards considering recent “progress” and an ostensible agreement on yuan stability (which nobody knows how to enforce).

“With positive progress on China-US trade talks and a potential Xi-Trump summit in sight, we expect the two sides to reach an agreement that will forestall an increase in tariffs on USD200bn of Chinese goods to 25% from 10%, or possibly roll back existing 10% tariffs”, Barclays writes, in note that finds the bank positing two potential deal scenarios where the base case sees China reducing its trade surplus with the US “to zero in six years, with annual imports from the US increasing to around USD600bn by 2024, from USD155bn in 2018.”

So basically, that’s in line with media reports around a proposal China made back in January. Suffice to say everybody but the US “loses” in that scenario. To wit:

Overall, our estimation suggests EU countries as a whole are likely to be most harmed by any diversion of Chinese purchases to the US, mainly due to the EU’s significant role in China’s imports of aircraft and automobiles. Japan would be the next big loser because of its large share in China’s imports of vehicles, machinery and electronics, followed by ASEAN and Korea (mainly in electronics, machinery, energy and vehicle). The remaining countries in our analysis — Brazil, Russia, Saudi Arabia and Australia — would mostly see a reduction in their energy exports to China, with soybeans also being a big contributor to Brazil’s loss.

Bob Lighthizer is all set to deliver an update on the trade talks to the House Ways and Mean Committee on Wednesday.

Maybe they’ll ask him to explain the difference between an MOU and a contract, because clearly, the President and his top trade envoy aren’t on the same page.

Friday also marks the “deadline” for the borrowing cap suspension and thus the official start to the debt ceiling drama which is expected to drag on through the summer as both sides decide how far they’re willing to push things in terms of weaponizing America’s creditworthiness to secure political concessions.

We’ve delivered two deep-dives on this over the past several weeks. The bottom line is that markets have become somewhat accustomed to the brinksmanship, but Trump is everywhere and always a wildcard and Democrats aren’t likely to forgo an opportunity to leverage the issue.

Read more

Meanwhile, Still Lurking In The Background: The Debt Ceiling

A sale of six-month bills met with tepid demand last week, a sign of investor angst about the presumed “x-date” in August. Treasury will sell another $39 billion of six-month bills on Monday, and you can expect a similar outcome.

And so, until such a time as everyone gets together and agrees it’s a bad idea for the US to default, Mnuchin will resort to the customary “extraordinary measures”. Of course those measures are now the norm, yet another manifestation of the extent to which everyone has just come to accept that gridlock inside the Beltway is a “deplorable” fact of life.

Humphrey-(Non)’Hawk’ins

Lost (or maybe not) in all of this will be Jerome Powell’s semi-annual testimony on Capitol Hill. The previously embattled Fed chair will deliver remarks to the Senate Banking Committee on Tuesday and will speak before the House Financial Services Committee on Wednesday.

At this point, there’s not much else Powell can say. It’s hard to imagine how he could provide any more “clarity” on the Fed’s thinking with regard to the rate path and the balance sheet. There’s a sense in which the communications strategy is “in tatters” (to quote Barclays’ assessment from last month) where that means the committee is now seemingly doomed to careen from data point to data point rethinking things on a daily basis and swerving in and out of lanes depending on the S&P and credit spreads. But at the end of the day, a simple read is that it’s going to take a pretty dramatic/convincing inflection in the data to put hikes back on the table. As far as the balance sheet is concerned, an end date for runoff will be announced in March – or at least that was the clear message from the January minutes.

Read more

“Given the shift in Fed rhetoric, we expect Powell to reinforce the recent Fed message of patience and data-dependency”, Barclays wrote Sunday, adding the following lengthy color on the deluge of data on deck:

We forecast GDP to have increased 2.5% q/q saar in Q4 18, in line with the consensus, driven by a similar increase in consumption. We expect headline PCE to be flat on December and to increase 1.7% y/y. We forecast core PCE to rise 0.2% m/m and 1.9% y/y. We expect ISM manufacturing PMI to fall to 55.5 in February. We forecast housing starts to decline 0.5% m/m in December, reflecting the broader slowing in the housing market last year. We forecast home prices to have increased 0.3% m/m in December, leading the y/y rate to fall to 4.3%. The dollar will follow data releases, but month-end flows could modestly weigh on the USD this week. A preliminary run of our month-end rebalancing model produces weak dollar selling signals vs. all majors.

One assumes Trump will be too busy posing for pictures with dictators and being accused of crimes by his former fixer to “explain” why GDP growth in 2018 came in below the administration’s lofty “forecasts.”

Black swan

America is on tenterhooks after CNN reported last week that the Justice Department is preparing for Robert Mueller to submit his final report to William Barr.

Although one official would later say the report will not in fact be submitted until after next week, that denial in and of itself suggests that Mueller is indeed close to the finish line, which means Barr will have to decide what to include in the “summary” he’s required to submit to Congress.

On Sunday, Adam Schiff promised to subpoena the full report and made it clear that if necessary, he will bring Mueller to Capitol Hill to testify. Schiff also indicated he’s willing to sue if House Democrats believe there’s a coverup afoot at DoJ.

Read more

Adam Schiff Will ‘Obviously’ Subpoena Mueller Report, May Sue Some Folks If There’s A Coverup

Clearly, the odds of Trump being indicted for conspiracy against the country he runs while he’s still running it are infinitesimal, but that outside chance is the black swan to end all black swans.

Miscellaneous

Just like every other week, this is a “key” week for Brexit. “Playing for time, May on Sunday promised a binding vote on her divorce deal by March 12, but she’s promised to give Parliament a general vote on Wednesday, which members are threatening to use to delay Brexit”, Bloomberg writes, in an inherently futile effort to summarize what exactly is going on with that soap opera just weeks ahead of the date when the UK will dive out of the EU with no parachute. China PMI is on deck as well and that will be watched closely for signs that Beijing’s ongoing efforts to put a floor under the domestic economy are bearing fruit.

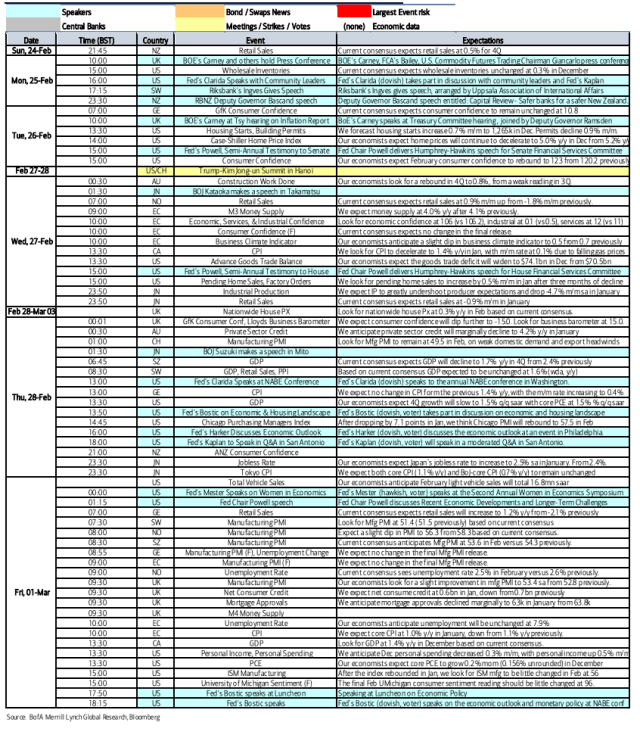

Full calendar via BofAML

Good to know that the roadmap for the global recession of 2024 has been agreed to!

One of your best front page visuals ever…add a little music from Elton John “rocket man”….perfection.

So after the trade deal is made, tariffs are lifted, and China agrees to buy more US goods, how will that affect the speculation on stable or declining interest rates and the stability of the fed balance sheet?

A busy week full of obfuscation and who knows what else. I’m just looking forward to some “Trump finally made it to Vietnam despite heel spurs” jokes…