As bad as many strategists feared it would be in early trading Monday, you could argue it was worse than expected.

Oil’s knee-jerk reaction coming off a weekend that found Riyadh declaring a price war was breathtaking, and S&P futures traded limit-down for the first time since Trump’s election.

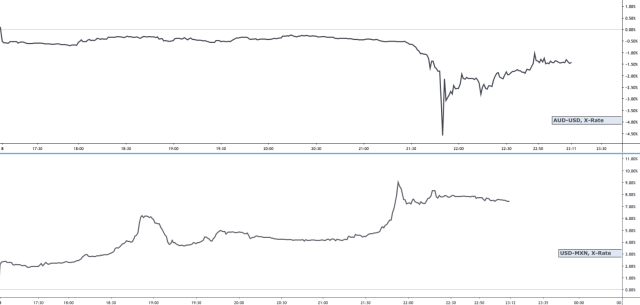

The moves across FX were astonishing. The Norwegian krone, for example, traded the weakest versus the dollar since 1985, while the Aussie, MXN and CAD were all similarly beset. It’s hard to know how to describe these moves. The Aussie was down nearly 5% at one juncture, more than the January 2019 flash crash. USD/MXN jumped nearly 9%.

The kiwi fell as much as 5.3% before staging a quick comeback. Traders blamed algos “who” hit small bids in a “hunt for liquidity”. That’s according to Asia-based FX traders who spoke to Bloomberg.

The yen of course surged. It’s highly amusing to note that less than three weeks ago, the market effectively decided the Japanese currency had lost its haven status. After falling 2%, USDJPY flash-crashed, diving around 3.5% to put 100 in sight. We’ve gone from “it’s no longer a haven” to “Japan needs to intervene to prevent further appreciation” in the space of less than three weeks.

Meanwhile, the entire US curve fell below 1%, as 30-year yields dropped more than 30bps (an astonishing encore after Friday’s dramatics) and 10-year yields fell below 0.50%.

The move in the yen came on top of a downward revision to Japan’s Q4 GDP data. Output shrank an annualized 7.1% QoQ in Q4, the Cabinet Office said Monday. Remember, Q4 was marred by the effects of the tax hike and a typhoon. The lingering impact of the trade war didn’t help. The downward revision is backward-looking, but it’s just insult to injury, and besides, the outlook going forward is hardly encouraging. With the virus set to weigh on the world’s third-largest economy, a recession seems like a foregone conclusion.

Between the sharp currency appreciation, the generalized risk-off tone tied to the oil price war, and the notion that the country is already in a downturn, Japanese equities fell nearly 6% intraday, the most since Brexit.

In South Korea, an unnamed finance ministry official said the country is monitoring currency movements which have become “excessive” and “one-sided” over a very short time frame.

That pretty much sums up Monday morning in Asia: “Excessive and one-sided”. One strategist called it “complete pandemonium”.

Although there were a number of readily identifiable catalysts (so perhaps these weren’t “pure” flash events, as it were), Monday probably deserves a spot in anyone’s top 20 list of “flash days”.

With that in mind, I’ll leave you with a visual I occasionally dig up that immortalizes other such notable episodes.

I hope you caught up on some sleep this weekend, H. It could be the last for a while.

Don’t know why people are surprised, this is what happens when excessive monetary policy builds up a highly unstable system over years. The larger the scale and scale of interconnections, the larger the collapse. That is simple complex dynamic systems (and logic).

That is called tampering……unregulated except by the would be beneficiaries