US equities “crashed” up, in predictable fashion into the cash close on Tuesday, as the very same “accelerant” dynamics play out day after day, exacerbating directional moves and momentum overshoots.

The Dow recaptured nearly 1,200 points after Monday’s grievous 2,000-point bloodbath left the Trump administration in disarray over how to stanch the bleeding. Of course, this can all go up in smoke in futures overnight – or not. Who knows anymore.

Ultimately, the narrative now revolves around still nebulous promises of “major” stimulus, but Republicans who spoke to Trump at a weekly luncheon said the White House’s plan is short on specifics. That’s a euphemistic way of saying there is no plan, but we do know that a payroll tax cut is on the table, as is some relief for hard-hit sectors like travel and hospitality. Hilton on Tuesday became the latest company to pull its guidance citing the virus.

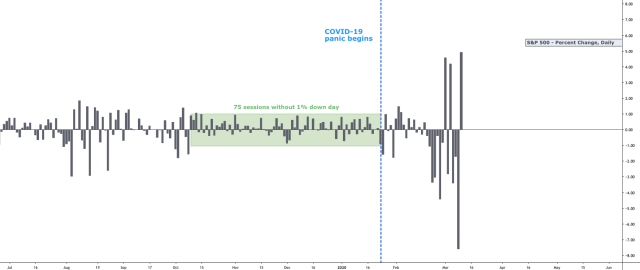

The daily swings are beyond absurd. Since February 24, there have been eight sessions during which the S&P has moved 3% or more in either direction. Since February 21, there have only been two sessions that didn’t see at least a 1% move.

“Monetization of dynamic hedging in futures shorts [is turning] into a rather violent ‘squeeze’ as the enormous ‘short delta’ via SPX/SPY options will continue to act as a ‘core’ catalyst for these raging up trades”, Nomura’s Charlie McElligott wrote Tuesday, in a note that also showed forward median returns for equities following 7.6% down days like Monday. Generally speaking, you can expect upside, but what’s different right now is the nature of the dual threats – one biological and one geopolitical.

As stocks swung back into risk-on mode, the yen fell the most against the dollar since 2013 on short covering and a quick snapback in US yields, which had clearly overshot to the downside during Monday’s panic.

Yields were cheaper by as much as 22bps on the day, with the 10-year now back at levels seen Friday, as stimulus hopes (not just from the US, but also Italy) helped bear-steepen the curve.

TLT – which had been trading more like a hot crypto stock or TSLA than a bond ETF – finally buckled, diving the most ever as yields rebounded.

That, folks, is a preview of what you can expect if the market ever does get the idea that the fiscal impulse is “real” and that the virus may be running its course.

Remember, Monday saw 30-year yields fall the most intraday in history, and things have clearly been exacerbated by a lack of liquidity and convexity flows. In other words, the bond rally has likely run way too far, way too fast, although that’s a refrain of the “famous last words” variety these days.

I suppose one should never say never, but irrespective of whether we get global, coordinated fiscal stimulus, it seems highly unlikely that another “great rotation” (reminiscent of 2013) into equities will play out in 2020.

Lawmakers from Oklahoma and North Dakota are pushing for federal bailouts of the US shale industry, which is now staring down a barrel – and not a barrel of oil. High yield energy spreads ballooned out to 1,422 on Monday, the widest since the depths of the early-2016 oil plunge/ deflation scare. The 342bps one-day jump was the largest in percentage terms in recorded history.

The daily coronavirus briefing from Mike Pence and co. was less than inspiring. Larry Kudlow reiterated that Trump wants a payroll tax holiday through year end, news that was out hours earlier. Kudlow also said the administration is working on the specifics of the economic package right now, and that officials will provide a more detailed outline in the near future. “Tax cuts 2.0” (as the long-rumored sequel to the 2017 legislation is known) will come later in the summer or in the fall, Kudlow went on to say.

Futures did not seem to be particularly enamored with the lack of specificity, although it’s hardly surprising. Trump’s decision to announce on Monday afternoon that something “major” was coming within 24 hours surprised advisors, given that the details weren’t ready. But, that’s Trump for you.

Lawmakers on both sides of the aisle cast a wary eye at the payroll tax cut idea. It’s not D.O.A. (like so many other administration proposals), but it’s not getting the kind of traction you might expect.

Steve Mnuchin met with Nancy Pelosi on Tuesday for a chat that was apparently some semblance of cordial. Treasury is reportedly working on its own set of measures.

Trump went after Jerome Powell in a series of irritated tweets but even he likely understands that’s an exercise in futility. “I do not think just cutting interest rates is going to do it”, Louisiana Republican John Kennedy remarked. “I don’t think doing this on the monetary side will succeed. We’re going to have to do it on the fiscal side as well”.

Thanks, John. We know.

“The market is now pushing around the Fed. For the Fed to chase it downward, desperately trying to give candy to the spoiled child, would only exacerbate the problem”, veteran trader Kevin Muir said, in a Tuesday note, calling the central bank “secondary players”, on the way to saying that while “the Fed should cut rates at regularly scheduled meetings, the days of special, emergency cuts are over. It will no longer help”.

“Expectations for a ‘major’ fiscal stimulus package by the US government have underpinned sentiment – even if the volatility suggests the market still needs a bit of coaxing”, AxiCorp’s Stephen Innes said. “Central banks can do their bit, but in times of viral cataclysm, it’s governments that must be seen as in charge of the proceedings”.

And yet, the market and Trump want more from Powell. A trip back to the lower bound seems inevitable. But what about beyond that?

“We don’t think US rates will go below zero”, Brown Brothers Harriman & Co’s Win Thin said Monday, adding the following color:

To us, there is no definitive example that suggests that negative rates work. The eurozone, Switzerland, and Japan have all tried negative rates but have little to show for it. If rates hit the lower bound and further stimulus becomes necessary, we think the Fed would favor balance sheet expansion over negative interest rates.

Lawmakers are, for now, demonstrating their traditional preference for moving at a relatively glacial pace in the face of a pressing threat that requires a government response. In some respects, both the White House and congressional leaders are mobilizing as quickly as can be expected given the nature of the problem, but just like whatever Powell delivers will “never be enough” for markets or for Trump, nothing Trump and lawmakers deliver has any hope of convincing a terrified public that the nation’s burgeoning health crisis is being adequately addressed.

And that, folks, is why it’s probably far too early to expect markets to calm down.

Finally, for whatever this is worth, after all nine Mondays since 1952 when the S&P fell 5%+, US stocks rose at least 2.2% the following day. Tuesday “makes it 10 for 10”, Bespoke notes.

(Bespoke)

Let them eat gummie bears. Barrels and barrels of ‘em!

H-Man , if rates hit zero why buy our debt?

Helping out cruise lines – WTF? Not registered in US – Don’t pay US corporate taxes, and staffed almost exclusively by those from the developing world….

What happened to all Mafia Don’s criticism of Obama for helping the banks and US auto companies (and getting repaid + whicg he and the REps never mention)

Just more BS from the BS’er-in-Chief…

How much fiscal stimulus and QE is it going to take to finally get some inflation? Let’s push it to the limit and find out! Mr. Market needs to be shown inflation is still possible

If not for that tax cut gibberish headline the markets would have been down another 5%. You are right about this being a bear market rally. Why don’t we just cancel trading on the markets for the rest of the quarter that way it can’t go down anymore…. Problem solved

Watch out what you ask for…..

The freight train of confidence keeps rolling downhill. Forget the stock market- swap spreads are widening vs. risk free assets such as OIS. Corporate bond spreads keep gapping out. You know it is trouble when the stock jockeys start talking about balance sheet strength rather than earnings growth, valuations, cash flow or P/E ratios. The jockeys are scared. So there will be rallies when too many go to the short side of the boat. But unless there is some major fiscal interventions/stimulus the rivets are going to pop on the submerged submarine until the boat can be repaired…

Vix/10yr at 70

Lmao Trump is like a giant child, being so loud you can’t ignore him, barking orders that usually mean nothing, sometimes getting his way, and is generally non-sensical. Definitely what you want your leader to be through a crisis!