Noted cross-asset strategist Donald Trump has made a lot of market calls in 2018.

He told you to buy in January, for instance. That worked out great for about three weeks before it crashed and burned in early February in part due to concerns that his Presidential alter ego’s pursuit of debt-funded, late-cycle stimulus would lead to an inflation overshoot, but mostly due to the realization of the rebalance risk embedded in inverse and levered VIX ETPs.

Starting in April, he suggested crude should be lower, a call that was again foiled by his alter ego, who decided to reimpose sanctions on Iran, stoking fears of a nuclear arms race in the Middle East. After a couple of strategy sessions, Trump the cross-asset strategist and Trump the President crafted a “stable genius” strategy to manipulate the oil market, which culminated in an outright price collapse last month, vindicating the original short crude call.

As stocks hit new record highs in September, both Trumps took a break from obstructing justice and rigging oil prices to congratulate themselves on new record highs for equities. Recall this implicit “buy” call delivered on September 20:

S&P 500 HITS ALL-TIME HIGH Congratulations USA!

— Donald J. Trump (@realDonaldTrump) September 20, 2018

That turned out to be one of the worst calls in the history of markets. Just three days later, President Trump undermined strategist Trump by moving ahead with tariffs on $200 billion in Chinese goods. Then, on October 3, strategist Trump’s SPX call suffered a veritable death blow when President Trump’s Fed pick doled out some fresh “plain English” catalyzing one of the worst risk asset routs in recent history.

(Bloomberg)

Again, the horrendous late-September buy reco on the S&P was mitigated a bit by the success of the short crude call in November, but strategist Trump made another terrible call just ahead of the December FOMC meeting when, in a short note dated December 18, he suggested that, contrary to market pricing, the Fed would take a pause.

They won’t “let the market become any more illiquid than it already is”, strategist Trump wrote, adding that the committee would probably “stop with the 50 B’s” in the interest of “feel[ing] the market.” Jerome Powell wouldn’t, Trump said, “just go by meaningless numbers.”

31 hours later, Trump’s clients were devastated when the Fed hiked, sending equities careening lower. Then, in the days that followed, Trump failed to warn investors that his alter ego was planning to hold the government ransom in lieu of $5 billion in taxpayer money for the construction of a steel border fence with spikes on top.

Stocks fell further still.

By the time Christmas Eve rolled around, strategist Trump’s reputation was in tatters and “clients” were bailing. His persistent bullishness did not align well with the worst December for U.S. stocks since the Great Depression.

(Bloomberg)

Despite having racked up horrendous losses on his equity book, strategist Trump was undeterred. On Christmas Eve, he made a number of calls to his few remaining clients to assure them that the tide was about to turn.

In remarks to reporters, Trump doubled down one last time. “We have companies – the greatest in the world, and they’re doing really well,” he said on Christmas Day, adding that despite it all, “it’s a tremendous opportunity to buy.”

“Really”, he went on to insist, “it’s a great opportunity to buy.”

Read more

On Christmas Day, A Desperate Trump Begs America To Buy The Dip In Stocks

And behold, a late Christmas miracle.

On Wednesday, Trump’s BTFD call was borne out. The S&P logged its best day since 2009, surging some 5% on the session. It rose so fast in the last hour of trading that I almost gave up trying to update the chart. Here’s what things looked like at 3:30-ish in New York:

(Bloomberg)

And here is a more dramatic snapshot of how things closed.

Everything was green, with the old regime risk-on favorites + energy leading the charge.

(Bloomberg)

The Dow jumped more than 1,000 points.

The VIX fell the most since February (point wise) and continued to fall into the close.

(Bloomberg)

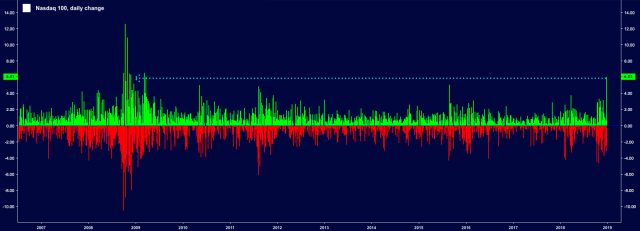

This was the best day for the Nasdaq 100 since the crisis era.

The FANG+ index, which came into the session more “beleaguered” than Jeff Sessions after an early morning Twitter tirade, jumped more than 4% for what looks like its second-best session in years.

(Bloomberg)

Crude, bolstered by the broad risk-on move and comments from Novak, staged an astonishing rally (hopefully, strategist Trump had already taken profits on his short crude trade).

(Bloomberg)

Earlier this week, it became apparent that at least in the near-term, dollar weakness would likely be bearish for risk assets to the extent it emanated from concerns about domestic political instability in the U.S. and Fed independence. Trump and Kevin Hassett attempted to calm market nerves about the latter concern, and although the shutdown hasn’t been addressed, the dollar welcomed ostensibly conciliatory comments about Powell and Mnuchin. Breakevens jumped with crude.

(Bloomberg)

All of this (especially crude’s surge) was good news for junk. CDX HY spreads tumbled on the day.

(Bloomberg)

Finally, mom and pop’s favorite liquidity-mismatched junk ETF had its best session of 2018.

(Bloomberg)

And so, all’s well that ends well – unless of course you count the fact that the quarter still looks like this:

(Bloomberg)

Oh, and there could be one very simple reason why stocks were able to stage such a monumental rally on Wednesday: Trump left the country.

President Trump and the First Lady traveled to Iraq late on Christmas night to visit with our troops and Senior Military leadership to thank them for their service, their success, and their sacrifice and to wish them a Merry Christmas. pic.twitter.com/s2hntnRwpw

— Kayleigh McEnany 45 Archived (@PressSec45) December 26, 2018

US is a real democracy. When the President leaves the country the stock market rallies. In Africa they make a coup d’etat.

It was a great call!

We know Trumpt called to bottom. Maybe without him we would have seen 7% gain. No joke; It really bothers me, that one guy calls the direction of the market. Should we opt, in the interest of satisfying our own greed, for a destruction of democracy, only for the benefit this one guy hands you a profit ? I would a l w a y s opt for democracy. No matter how happy that -one guy- may intend to make me. The price to loose freedom for serving my greedyness no one shld be able to pay.

If Tesla ever needs a new CEO, I think Trump would be perfect. Shorts beware!

Mnuchin Trump Manipulation$

This just emboldens the guy and now we will get more of this (more cowbell). It is going to get obnoxious and messy. Of course if they didn’t rally he would have fired Powell, Mnuchin, the person that brings him his KFC and knocked over the Christmas trees. I would love to know the trades his family and his late night phone pals make. Knowing you can rile him up (if you are short) and get him to talk about the Fed etc knowing it will tank the market…………… But he and his family and “pals” would never do that.

Undoubtedly the Iraq campaign rally was hastily arranged after the Syria debacle, probably without consent of the Iraqis. Now they will probably kick us out and giving Qasem Soleimani a free hand. Nice move Mango Man.