The S&P hit an all-time high on Tuesday and as Bloomberg’s Luke Kawa reminds you, investors were saved by the yellow line on multiple occasions this year.

You can regurgitate the narrative here, right? Something like this: risk assets began the year on a torrid run as the S&P blew through multiple analysts’ year-end targets in the first three weeks of 2018, but a series of shocks including the largest VIX spike in history, a tech selloff tied to regulatory jitters and concerns about the burgeoning global trade war tripped up previously ebullient sentiment.

There’s your boilerplate first paragraph for every article about this milestone you’ll read on Tuesday. The narrative will continue as follows. Ongoing strength in the U.S. economy coupled with strong corporate earnings and the promise of record buybacks catalyzed by the tax cuts ultimately carried the day and pushed the S&P to all-time highs just a day ahead of scheduled talks between U.S. and Chinese representatives who hope to make some headway on the trade dispute before the Trump administration moves ahead with tariffs on additional $200 billion in imports.

There you go. I could be a journalist!

More important than the generic storyline and the S&P hitting fresh highs is what’s going on with the dollar, which hit a one-week low a day after Donald Trump again took aim at Jerome Powell’s Fed.

(Bloomberg)

The surging greenback (which has translated into stretched long positioning as everyone piles on) is the product of U.S. fiscal policy and what we’ve variously characterized as the President’s dollar “insanity loop“. Breaking that loop is key to arresting the slide in EM assets and restoring risk-on sentiment more generally.

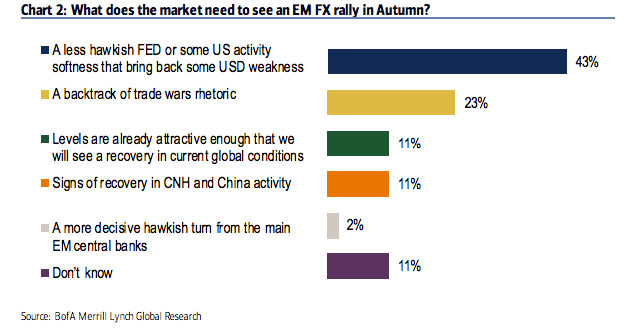

In the latest edition of their FX and rates sentiment survey (conducted from August 3 through August 8), BofAML notes that 43% of respondents (a group that includes 64 fund managers with $335 billion in AUM) believe that dollar weakness, either resulting from a Fed pause or a deceleration in U.S. growth, is the key to reinvigorating the carry trade.

(BofAML)

So as far as risk sentiment is concerned, the greenback taking a breather is just what the doctor ordered.

If you want to get an idea of just how important it is, do note that the Bloomberg Industrial Metals Subindex is on pace for its largest four-day rally since April thanks to a renewal of risk-on sentiment tied, in part, to a softer dollar.

(Bloomberg)

That is a welcome reprieve. Copper fell into a bear market last week and generally speaking, the sharp decline in metals and commodities more generally was a bad omen. Panning out, you can see the malaise and you can understand why something needed to turn around in a hurry.

(Bloomberg)

Again, whether or not renewed optimism in assets that aren’t U.S. stocks ends up being sustainable depends in no small part on whether the reversal in the dollar holds.

This was set to be a pivotal week with the Fed minutes on deck and then Powell at Jackson Hole less than 48 hours later. The minutes won’t include commentary on the most recent bout of EM turmoil, which means you can expect them to tip a committee that’s inclined to stay the course on rate hikes. It will thus be left to Powell to say something to soothe concerns about what Fed tightening and the previously bulletproof dollar might entail for EM at a time when the bottom looks like it wants to fall out for developing economy assets.

Trump’s weak dollar rhetoric took some of the edge off by pushing the greenback lower ahead of the minutes and ahead of Jackson Hole.

Now the question is whether Powell will end up negating this by reiterating his position later this week.

Don’t you think if Powell were inclined to pause, he’d do so in September (before the mid-terms) while keeping the December hike.

Would seem like the opposite — keeping Sept hike and pausing the Dec hike — puts him at more personal risk.