Last month, Facebook’s dramatic plunge following second quarter earnings highlighted the risks inherent in assuming that what goes up never comes down.

The subsequent correction in the FANG+ stocks underscored that risk and seemingly validated a high profile call from Morgan Stanley’s Mike Wilson who, on July 8 in a short “Sunday Start” piece called “Unsettled Weather”, cut U.S. tech to underweight as part of a broader call for a long-awaited market rotation.

“We have been out on a limb the past month with our defensive rotation call and truth be told we haven’t had much interest from clients wanting to follow us down this path”, Wilson wrote late last month, in a note reiterating his cautious stance on Growth.

If Wilson is right, it’s about time (just ask David Einhorn). After all, the relative outperformance of Growth versus Value now borders on the ridiculous:

(Morgan Stanley)

Complicating all of this is the extent to which Growth has become synonymous with Momentum and other factors used to construct smart-beta products. Goldman warned about “factor crowding” in June of 2017 and this dynamic is part and parcel of Howard Marks’ “perpetual motion machine” characterization as described in an infamous memo released last summer called “There They Go Again – Again“.

Multiple analysts have recently jumped on the “rotation” bandwagon and I have to say, Tencent’s trials and tribulations cast further doubt on the notion that global tech heavyweights can be relied upon going forward. That adds to concerns about the viability of a strategy that revolves mostly around staying long Growth.

Caught up in this are hedge funds, which have of course crowded into the market high fliers in an effort to avoid underperforming benchmarks that, thanks to the “perpetual motion machine”, only seem to rise.

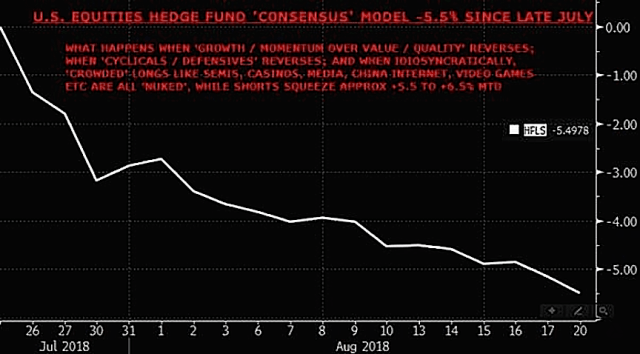

Well on Tuesday, Nomura’s Charlie McElligott is out noting that according to his models, the “consensus” hedge fund strategy of being long Growth and Short value is having a rough go of it.

“Another day for U.S. Equities funds, another sizable underperformance thanks to the Tech sector’s ‘lag’ / ongoing agitation in ‘Secular Growers’ / Growth (long / overweight) vs Value (short / underweight)”, he writes, before adding that his “U.S. Equities Long-Short Hedge Fund ‘Consensus Positioning’ model is now down 5.5% since July 25.”

(Bloomberg, Nomura)

That, Charlie says, is the “wrong-kinda heater”, down 14 of the past 18 sessions.

(Bloomberg, Nomura)

At the heart of the underperformance: a dastardly run for long Growth/ short Value. “U.S. equities ‘long Growth, short Value’ is having its worst 2-month stretch since the ‘great market-neutral unwind’ of 2016,” he adds.

(Bloomberg, Nomura)

Is there any good news for the folks caught up in that? Well, yes. “This sets up VERY well (from an entry-point perspective) for a tactical ‘Long U.S. Equities Momentum Factor’ trade for the month of September–or, just ‘Short Momentum Shorts’ as this leg is what drives essentially all of the seasonal performance trend for Momentum in September”, McElligott writes.

That is until October, when Charlie warns that there could well be a “QT escalation from the Fed / ECB / BoJ” which has the potential to tighten financial conditions and push up rates vol.

And you know what happens when rates vol. rises, right?