Market participants headed into the holiday-shortened week weary of increasingly absurd political theatrics and wary of dour COVID-19 headlines.

Moncef Slaoui, head of the US government’s cartoonishly-named “Operation Warp Speed,” told CNN Sunday that the first vaccinations in the US should begin “on the 11th or the 12th of December,” immediately after expected FDA approval for Pfizer and BioNTech’s shot, which the companies said last week is 95% effective.

“70% or so of the population being immunized would allow for true herd immunity to take place,” Slaoui told Jake Tapper. “That is likely to happen somewhere in the month of May. Or something like that.”

You have to love the qualifier: “Or something like that.”

“While we can’t predict how long FDA’s review will take, the agency will review the request as expeditiously as possible, while still doing so in a thorough and science-based manner, so that we can help make available a vaccine that the American people deserve as soon as possible,” Stephen Hahn said Sunday.

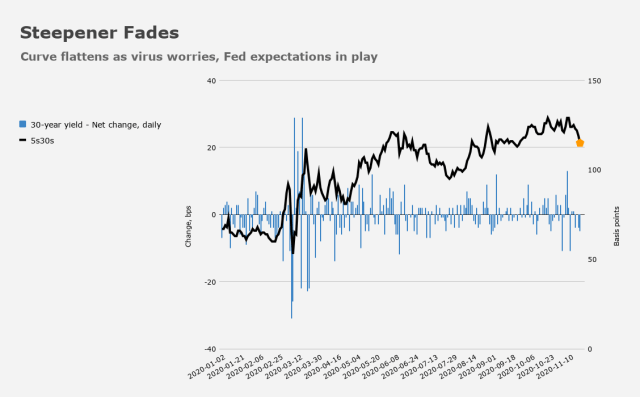

Markets are caught between assumptions about a brighter future in 2021 and the reality of lockdowns across western economies in the here and now. That tug of war, alongside expectations for the Fed to extend the average maturity of monthly QE and the notion that the GOP will manage to hold the Senate after the Georgia runoffs, are keeping bond yields in check.

Bloomberg captured it well over the weekend, writing that “a flurry of options trades has emerged betting the 10-year yield will fall to 0.7% by late December, but many firms are looking beyond the short-term economic headwinds to see a brighter 2021 that pushes up long-term yields.”

The same to and fro is playing out in equities via sector/style rotations and factor tumult, but on the whole, November has been kind to stocks. And equity inflows are robust.

It’s worth noting that both Kelly Loeffler and David Perdue (the two Republicans in the Georgia runoffs) were quarantining as of Sunday evening, while Loeffler tried to figure out if she did or didn’t have COVID. Loeffler ran the gamut from Friday though Saturday evening, testing positive, negative, and inconclusive, if you can believe it.

Donald Trump and Rudy Giuliani, meanwhile, are angling to have the Supreme Court intervene after a federal judge in Pennsylvania dismissed a lawsuit which sought to block the state from certifying Joe Biden’s victory. The judge, Matthew W. Brann, called the Trump campaign’s case a “Frankenstein Monster.” (That is an actual quote — Brann literally said that.)

For her part, Sidney Powell went rogue even by Giuliani’s standards. She was apparently dismissed from the Trump legal team on Sunday after a truly inflammatory interview with Newsmax, during which she threatened to “blow up” Georgia, accused Governor Brian Kemp of taking kickbacks, and again insisted that technology created by the late Hugo Chávez was ultimately responsible for Biden’s election win.

“Sidney Powell is practicing law on her own,” Giuliani said, in a Sunday statement. “She is not a member of the Trump Legal Team. She is also not a lawyer for the President in his personal capacity.”

Chris Christie has seen enough. He called Trump’s legal strategy a “national embarrassment” in an interview with ABC Sunday. “Sidney Powell accusing Governor Kemp of a crime on television yet being unwilling to… lay out the evidence that she supposedly has, this is outrageous,” he added.

I wish it wasn’t necessary to document this sad spectacle — I really do. But unfortunately, it’s America’s reality. On Saturday, Trump reportedly skipped out on a virtual G20 “Pandemic Preparedness” event, eschewing the latter part of the proceedings for a round of golf.

Housing data, consumer confidence, claims, Fed minutes, and another vintage of Q3 GDP are all on deck during Thanksgiving week. Americans have, of course, been discouraged from traveling. COVID hospitalizations sat at nearly 84,000 as of Sunday, according to the COVID Tracking Project.

The seven-day moving average for fatalities is climbing and now sits near 1,500.

On Friday, more than 2,000 Americans died from the virus (or complications) in just 24 hours.

Long UST bond yields unfortunately are likely to decline significantly. Unfortunate because that will indicate just how much stress is out there in the real world. Unlike stocks, UST bonds exist more in the here and now. The here and now are just scary. Bonds will reflect that. Stock jockeys will be filling the airwaves with happy talk, but there is and will be a lot of pain and suffering in the real world ….

Totally agree. I just don’t see bond yields rising from here. Especially now that the reflation trade is on the bench again, where it will probably remain until early spring. In the meantime, a dark winter, as you say…and an opportunity to start adding to positions.

The Fed has got to be relieved that yields have backed off the last two or three sessions.

Yes but now stocks and bonds are talking opposite. Will be interesting to see if the “smart money” prevails.

Can someone please explain what Donald Trump was thinking back in the spring?

On the one hand: his indifference and arrogance towards the Coronavirus task force, it’s members (those experts he picked, right? ) and his apparent belief the virus would just go away.

On the other hand, authorizing the spending of $10 Billion (even in an era of multi-trillion deficits, no small spit in the budget bucket) on Operation Warp Speed. Was it all just a political calculation to try to seal the deal of the election? Or maybe it just reality show drama? Or was it just, oops?

Now, the United States appears to be 4 to 5 weeks behind Europe, in terms of the second wave’s impact on economies. Happy Christmas! Happy year end market rally! And BTW, the Senate runoff election is just a week into the new year. Weary and Wary? Republicans should be screaming at Trump to go away instead of cowering in the shadows.

Q: Can someone please explain what Donald Trump was thinking back in the spring?

A: Damn, this virus chatter could tank the stock market! Make it go away!