An agreement to postpone or otherwise abandon a planned tariff escalation on December 15 is not enough to secure an interim trade deal with China.

That’s according to a tweet from the Global Times, a Party mouthpiece.

In addition to scrapping the planned imposition of 15% levies on another $160 billion in Chinese goods, Beijing wants existing tariffs rolled back, the tweet insists.

“Sources in Beijing informed the Global Times that China insists the tariffs must be rolled back as part of the first-phase trade deal”, the paper tweeted. “A US pledge to scrap tariffs scheduled for December 15 cannot replace the rollbacks of tariffs”.

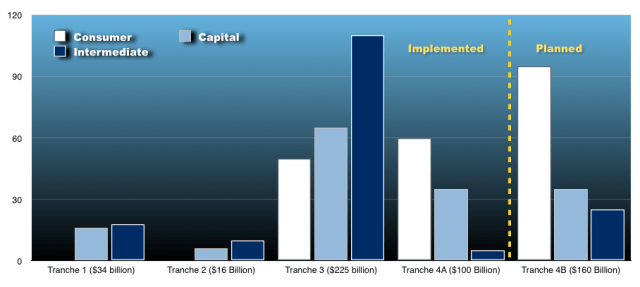

By way of background for anyone who needs a refresher on this convoluted protectionist nightmare, the scheduled December 15 escalation was originally part of the tariffs that went into effect on September 1. Trump announced duties on the remainder of Chinese imports the day after the July FOMC meeting, which he felt didn’t convey a dovish enough message, despite the rate cut. Two weeks later, the administration split the tariffs into two tranches in an effort to avoid driving up consumer prices ahead of the holiday shopping season. 10 days after that, on August 23, Trump raised the tariff rate on both tranches from a planned 10% to 15% after China conveyed their intention to retaliate. During the same Friday tantrum, Trump threatened to raise the rate on $225 billion in taxed goods (the third tranche in the visual) to 30%, but later abandoned the idea after meeting with Liu He in Washington.

What’s especially notable about China’s apparent insistence on rollbacks in addition to a promise not to go forward with new levies, is that it strips Trump of the ability to claim he secured concessions simply by agreeing not to slap Beijing with new tariffs. That’s important, because the provision of tariff relief will be more difficult to spin when it comes to suggesting that the US is “winning”, especially if the terms of the “Phase One” deal don’t include many concrete concessions from China.

Late last month, China did release a sweeping decree containing a lot of aggressive-sounding rhetoric on combatting intellectual property theft, but the measures Beijing mentioned will take years to implement.

Meanwhile, there are significant doubts about whether Trump’s lofty promises on farm purchases are realistic. You can read the full account here, but suffice to say this chart tells the story:

Over the past two weeks, officials on both sides have variously suggested that the first-phase agreement may be put off to 2020. That may be tied to Trump’s reluctance to countenance tariff rollbacks, something he’s refused to overtly endorse in the three weeks since the Chinese Commerce ministry said, on November 7, that “top negotiators” on both sides had “agreed to remove the additional tariffs in phases as progress is made on the agreement”.

Read more: Markets Get Clearest Picture Yet Of Tariff Relief Plan — And It’s Still Pretty Darn Murky

In addition, Trump’s signing of the Hong Kong bill muddied the waters further, although Xi is likely apprised of the extent to which his US counterpart had no choice in the matter.

“The principle that the two sides were able to agree on was just the principle that the issues need to be solved through different stages”, Shen Dingli, a professor of US studies in Shanghai, told the South China Morning Post over the weekend. “But when they got to the details [on the first stage deal], and how to implement them, the two sides were again not able to reach a consensus”.

It’s also possible that Trump sees recent gains in US stocks as a form of leverage, especially considering the marked outperformance of US financial assets since the spring.

“China’s attitude towards its bottom line of requesting the US rollback all tariffs has been much clearer and stronger than the US stance of keeping the tariffs. Therefore, it points to whether or not the US is willing to compromise”, Liu Weidong, a US affairs expert at the Chinese Academy of Social Sciences, explained, weighing in on the Global Times tweet in remarks to SCMP.

Although the White House continues to insist that China needs a deal more than Trump, that’s a debatable claim. It’s true that the Chinese economy is struggling (an upside surprise in the November PMIs notwithstanding), but Trump is facing an existential crisis in the Ukraine affair and besides, he’s got an election coming up.

It may be that the best markets can hope for this month is a postponement of the December 15 levies while the two sides keep talking into 2020.

Don’t worry, I heard Larry Kudlow say that everything will be fine. So we have that going for us … which is nice…

Trump probably sees unilaterally postponing the Dec 15 tariffs as weakness. That would be correct. He is in a weak position.

Xi and the markets have Trump in a position that imposing the Dec 15 tariffs, or failing to roll back the previous tariffs in reasonably short order, will very likely trigger a meaningful market slide, which will hurt Trump more as the election gets closer.

So the pressure on Trump is rising and he will either cave to avoid the slide – or miscalculate and trigger it. Either should be fine with Xi, either he effectively wins the trade war or he gets rid of Trump.

I think the relatively greater weakness of Chinese economic data compared to the US data is somewhat irrelevant, to figuring out what will happen. Xi should be pretty unconcerned about China’s current economic travails. They are very far from significant enough to affect his hold on power even a little bit.

Why be deterred by domestic pork prices when he is very close to inflicting a major defeat on the US? Arguably no other country’s economy can withstand two years of “trade war” attacks from the US, so he’ll have proven that the Chinese economy is at some sort of parity with that of the US. And he may succeed is getting rid of a President who, while he has helpfully inflicted great harm on US global interests, is possibly becoming more trouble than he’s worth from Xi’s point of view.

I think the Chinese will continue to insist on complete or near-complete tariff rollback while offering only a routine level of agricultural purchases and some fairly meaningless talk about IP. Trump is gonna have to cave or blow up. Attention should turn back to whether Powell will then resume caving to Trump.

I tend to disagree

I think Trump can easily weather dissatisfaction with the electorate now. He’ll have plenty of time to roll back tariffs in the spring to launch a rally into election season

Arguably, the market is rallying too early now to be of much benefit to Trump a year from now.

Suppose he fails to make a deal before then, merely postpones the Dec 15 tariffs in return for no real Chinese concession, so tariffs and uncertainty continue for another 4-5 months. Seems negative for economies and the markets. Then suppose in spring he wants to roll back tariffs to launch a timely rally. He will have to get Chinese concessions to do that without seeming to surrender. At that point, his position is even weaker – it gets weaker as the election approaches.

It is all just a game to trump. Sad because some people are being hurt. But as always it is about trump and how he stays in power. And his base either can’t see it or doesn’t care. And the market doesn’t force him to do the right thing (yet?). And the Fed inadvertently enables him. It is seriously a joke to run a country like this.