While Wilbur Ross regaled CNBC viewers in his trademark sleepy monotone, the architect of the Trump administration’s adversarial trade policies appeared on Fox Business to discuss the latest developments and field questions about Wednesday’s big news, the inversion of the 2s10s curve.

Navarro was pressed about the inflationary impact of the tariffs and the unintended consequences of the trade war in multiple high-profile television cameos last week.

For lack of a better way to describe things, he folded up like wet cardboard under pressure from, in order, Chris Wallace, Maria Bartiromo and Sara Eisen.

Read more: Peter Navarro Will Never Test Sara Eisen On Currency ‘Manipulation’ Again

On Wednesday, Peter was in full propaganda mode and it was a disaster.

“[The president] made a strong and flexible decision”, he said, referencing Trump’s retreat on Tuesday that found the White House backing off planned tariffs on consumer goods in an effort to avoid driving up prices during the holiday season.

(If the video does not load, please refresh your page)

“First of all, they had already bought the stuff… there was no way they could shift the burden of the tariffs back to the Chinese”, he admitted.

You’re reminded that Navarro has repeatedly denied that tariffs push up prices in the US, despite being confronted with evidence to the contrary from his own labor department.

Peter used his Fox time on Wednesday to attack the Fed and Jerome Powell, who he blamed for the yield curve inversion. “It’s a signal [for the Fed] to cut”, he said, adding that the White House’s biggest fight is with the US central bank, not with China.

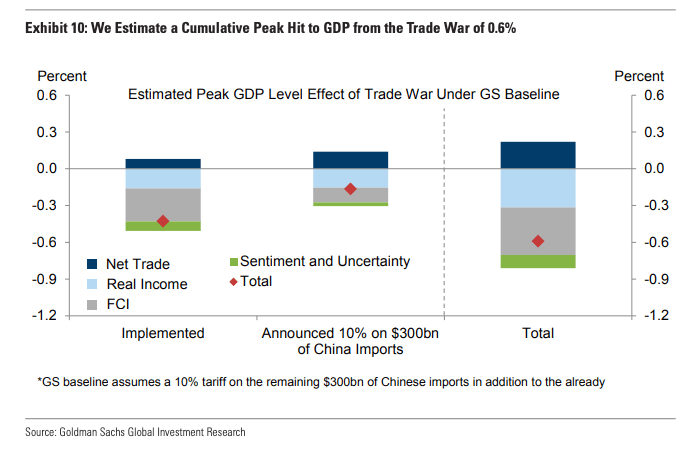

On the tariffs, Navarro insisted they will have no material impact on growth. Although it’s true that you’d be hard pressed to find an analyst who predicts the tariffs will sink the US economy based solely on the mechanical impact of the levies, it would be equally difficult to find anyone who would concur with Peter that there won’t be a material impact, although I suppose that depends on your definition of “material”.

As noted here earlier this week, the financial conditions impulse (i.e., the channel through which falling stock prices, a stronger dollar and widening credit spreads) impact the economy will itself serve as a drag on US growth, which is one of the reasons why the administration is begging the Fed to cut rates.

(Goldman)

Peter went on to say, explicitly, that the trade talks will never be conducted on even terms. “We can’t meet China half way”, he told Fox.

As far as whether Tuesday’s announcement is something investors and consumers can depend on Trump to stick with, Navarro said Americans now have “total certainty about how the scenario is going to unfold over the next three to six months”.

Not to put too fine a point on it, but you can be “totally certain” we will find ourselves juxtaposing that soundbite with a Trump tweet announcing a new escalation at some point – and likely much sooner than “three to six months”.

First Ross, then Navarro trotted out to damage control. God help us if Trump decides to send Kudlow out.

Or Munchkin.

“First of all, they had already bought the stuff… there was no way they could shift the burden of the tariffs back to the Chinese”

interesting quote.

According to his boss Chyyyna is paying hundreds of billions of dollars due to the greatest tariffs of all times.

Does this mean Trump is lying?

I’m shocked. Shocked!

Reuters reporting that China is restricting gold imports. One more piece of evidence that the government is supporting the yuan:

https://www.reuters.com/article/us-china-gold-exclusive/exclusive-china-curbs-gold-imports-as-trade-war-heats-up-idUSKCN1V41XN