China’s commerce ministry posted a statement to its website on Monday which appeared to underscore the notion that Donald Trump pushed the envelope too far last week when he threatened to slap 10% tariffs on an addition $300 billion in Chinese goods.

Beijing said Monday that it has not ruled out taxing US farm goods traded after August 3. Trump’s threats delivered last week are in violation of the Osaka agreement between the US president and Xi Jinping, the ministry went on to contend.

Although “relevant Chinese firms” have ceased buying American farm products, the ministry reiterated that “high-quality American agricultural goods have bright prospects in the large Chinese market, but the US side should keep its promises and create the necessary conditions for agricultural cooperation”.

Read more: Trump Said Democrats Would Cause A Depression — And Then The Dow Plunged 1,300 Points

Suffice to say Trump did not “creating the necessary conditions” for agricultural cooperation – or any other kind of cooperation for that matter – on Monday. Instead, he spent hour after hour railing against the PBoC on Twitter.

Following a series of morning tweets that found the president lobbing accusations at Beijing and implicitly begging the Fed for help, Trump was back at it on Monday afternoon.

“Based on the historic currency manipulation by China, it is now even more obvious to everyone that Americans are not paying for the Tariffs — they are being paid for compliments of China, and the US is taking in tens of Billions of Dollars!”, Trump shrieked into the digital void.

Again, that isn’t true. Under no plausible interpretation does it make sense to say that China is “paying” Donald Trump “tens of billions of dollars”. That’s not how tariffs work and it never will be. The only thing that’s more “obvious” to everyone on Monday is that if Beijing wants to hit back using the yuan, they can wreak havoc across markets overnight.

US stocks fell more than 3% to start the week and were sitting at session lows following Trump’s afternoon tweets. With less than an hour left to go until the close, it was the worst day for big cap tech since October. The Nasdaq was down more than 4%.

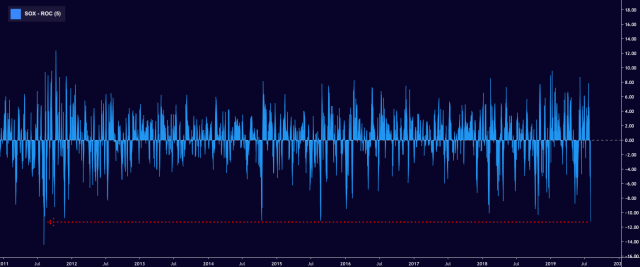

The VIX staged one of its five largest single-session gains since Vol-pocalypse.

For Semis, it’s an unmitigated disaster. The SOX was down nearly 5% on Monday and the losses are piling up very, very fast.

“The likelihood of a full-escalation scenario materializing — which we define as 25% tariffs on all Chinese imports by the US — has increased [and] we expect the CNY CFETS Index to decline towards 90.0, corresponding to a move higher in USDCNY towards 7.23 in this case”, Barclays said Monday, on the way to marveling at just how quickly the situation has deteriorated.

“While we have been of the view that the differences between the US and China are irreconcilable, we had expected the trade ceasefire agreed at the G20 summit to last through the year-end before tensions likely rose again early in 2020”, the bank remarked, incredulous.

(Barclays)

The China ETF fell more than 4% Monday. Implied vol. soared.

All at once obstinate and desperate, a flustered Trump continued to berate Beijing as US stocks careened lower.

“China has always used currency manipulation to steal our businesses and factories, hurt our jobs, depress our workers’ wages and harm our farmers’ prices [but] not anymore!”, the president shouted.

By that time, nobody could hear him over the blood-curdling screams of those watching in horror as their portfolios were vaporized in the afternoon heat.