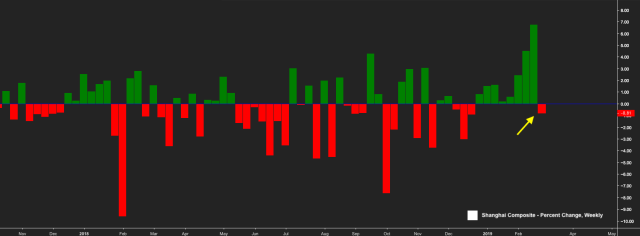

Anyone who was just itchin’ to write a story about the day it finally fell apart for mainland shares in China got their chance today.

The country’s world-beating equity rally came to a screeching halt on Friday after Citic issued a government-approved sell call on red-hot People’s Insurance Company (Group).

Sour sentiment was exacerbated by lackluster February trade data, which only added to the gloomy outlook for global growth following the ECB’s dramatic forecast cuts.

Read more

And Now China Will Heighten Global Growth Concerns By Reporting Lackluster February Trade Data

As far as People’s Insurance Company is concerned, just note that Beijing had seen enough after the stock, which started trading in Shanghai in November and changes hands at nearly four times the price of its Hong Kong-listed shares, almost quadrupled.

It looks to me like PICC had risen by the daily limit for five sessions in a row, an encore of sorts, reminiscent of the euphoria that gripped the shares after they debuted in Shanghai late last year. On Friday, the stock traded limit down.

If you ask the government Citic, the stock is “significantly overvalued” and might well get cut in half by the end of the year.

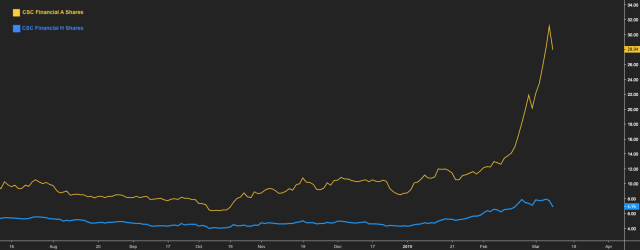

Separately (or not, depending on how you want to look at things) Huatai cut CSC Financial to sell, calling the shares “overvalued.” Huatai’s new price target on the shares (13.86 yuan to 17.33 yuan) tips as much as 56% downside. Traders baked in 10% of that on Friday, with the stock diving by the limit. Huatai called the shares’ valuation “severely” overblown relative to its growth expectations, and pointed to its A-share premium, which analysts led by Shen Juan suggested was excessive, although I don’t know where they would get that idea.

And so, it was a wipeout by the end of the session. The SHCOMP had its second worst day since 2016, falling below 3,000 in the process. This comes not even two weeks after mainland shares staged their best one-day rally since 2015.

The eight-week win streak is now history.

Obviously, A shares were overdue for a breather, the only question now is whether mainland shares can pull back in a “healthy” fashion or whether this casino will continue to exhibit signs of being, well, of a being a casino.

Next week will be key in that regard.

Regulators in China doubtlessly wanted to cool things off after benchmarks surged into a bull market to start the year, but action like what we saw on Friday is indicative of how difficult it is for Beijing to engineer a controlled demolition.

Hopefully, things won’t implode entirely, because if we do get a bout of panic-selling from China’s hordes of uneducated retail investors against a backdrop of slowing growth and lingering questions about a trade deal with the US, it could serve to further undermine risk sentiment at a delicate time for global markets.

Read more about 2019’s euphoric run for Chinese equities.

Suddenly, China Has The Best Performing Stock Market On The Planet — What’s Next?

Hey Heisenberg, remember when you said the US had more to lose from a trade war than China?

Yeah. I’ve said it a ton. And it’s still true. Not sure what your point is.

Did that go the way you thought it was going to go?

you need to be careful your commentary is always to the negative reporting the past not much commentary on lead indicators, it will take a lot to kill the uptrend in Chinese equities, most of which you write about is priced into markets.

“Not much commentary on lead indicators”… really? Is that a serious comment? I talk constantly about leading indicators and your comment doesn’t sound like you read the article. China itself (i.e., the actual government) killed the rally on Friday. Do you imagine Citic issued a sell call without the Politburo’s permission?

See post below on some “leading indicators”.

https://heisenbergreport.com/2019/02/03/unavoidable-option-only-analyst-to-nail-pboc-in-2014-says-china-rate-cut-imminent/