It used to be possible to kick these pieces off by saying, with some degree of conviction, what will be in the driver’s seat for markets in the week ahead.

Unfortunately, that’s no longer possible. As last week made abundantly clear, anything can happen. “The best-laid plans of mice and men often go awry”. Etc. Etc.

‘May’ the farce be with you

Assuming Theresa May goes ahead with the Brexit vote in Parliament, that will be closely watched. We previewed that on Sunday afternoon, and the bottom line is that it’s highly unlikely to pass on a first try. The only question is whether the margin of failure is narrow enough to pave the way for a second attempt. Traders are bracing for FX volatility around the vote.

Read more

‘Witching Hour’ FX Brexit Prep Conjures Ghosts Of Flash Crashes Past

“We do not expect the current Brexit deal to pass on its first attempt in the House of Commons, but we do expect it to pass on a subsequent attempt, likely in January”, Goldman wrote over the weekend, adding that if it does manage to get through later, that would “pave the way to a status quo post-Brexit transition phase, beginning in March 2019.”

“GBP puts remain at a premium to calls at longer tenors, but 1-week GBPUSD and EURGBP risk reversals have re-priced, likely due to the market’s perception that the Grieve amendment materially lessens the risk of a no-deal scenario, hence capping the pound’s near-term downside if the WA gets rejected this week”, Barclays notes.

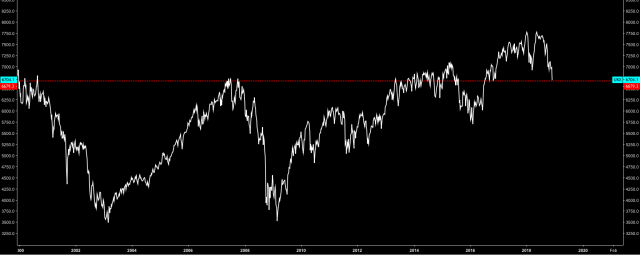

U.K. stocks wiped out their 21st century gains amid last week’s market turmoil and although the total return picture looks a lot better, this is still an annoying chart for anyone in U.K. stocks.

There’s also a raft of data due from the U.K. including the labour market report, trade balance and industrial and manufacturing production.

Super Mario don’t fail us now

In addition to the Brexit drama, we’ll also get the ECB this week. APP is set to be wound down at the end of this year and this comes at a particularly delicate juncture, with Italian political risk still front and center and with European risk assets squarely on the back foot. The allure of USD “cash” still seems like it’s sucking the life (life=flows) out of € credit.

(BofAML)

It’s been the same story for European equities (see the purple shading in the left pane above). Last Thursday, the Stoxx 600 had its worst day since Brexit and is sitting at a two-year low.

Here’s the YTD sector-by-sector breakdown across the pond:

(Bloomberg)

“Our concern for 2019 is that the hubris from the QE era will come back to bite”, BofAML’s Barnaby Martin recently wrote about the prospects for € credit in the new year. “Debt maturities rise substantially over the next few years because companies took the easy route and issued short, not long, yet, the two big marginal buyers of credit — the ECB and retail investors — are now absent”, he continued, in same December 7 note, before warning that on BofAML’s calculations, “there will be a demand deficit in high-grade to the tune of €125bn next year.”

The truly ironic thing here for € credit is that last week (i.e., in the week ahead of the meeting during which the ECB will confirm the end of QE), additional outflows took us right back to pre-QE levels.

(BofAML)

So, that’s the backdrop against which the ECB is set to wind down APP.

“We expect the Governing Council to follow through on its current guidance and confirm the end of net asset purchases by end-year”, Goldman writes, in their ECB preview, adding that the GC should “continue to note that full reinvestments of its bond holdings will take place ‘for an extended period of time’ and ‘for as long as necessary’.”

Draghi will have to strike a balancing act between talking up the economy and making it clear that the ECB is aware of the myriad risk factors emanating both from within the bloc (e.g., Italy) and without (e.g., the trade war and the prospect of tariffs on European autos). In other words, he’ll need to pull another rabbit out of his hat like he did in June when he somehow managed to put a dovish spin on the announcement of the end of QE by implementing more powerful forward guidance on rates.

Read more

Expect a discussion of TLTROs as well and you’d certainly imagine there will be heightened focus on the reinvestment plans now that the monthly flow of new purchases is set to end.

“Markets are priced for a dovish end of QE at Thursday’s ECB meeting, leaving scope for a temporary squeeze higher in the EUR if communication appears balanced”, Barclays reckoned on Friday, before contending that “with markets pricing the depo rate at 0bp only in Q1 21 and close to 5bp by end-2019, a reiteration of forward guidance and a balanced message could be interpreted less dovishly by markets.”

Recession obsession

Stateside, there’s a veritable deluge of data on deck, including CPI, import prices, retail sales and IP. In light of recent events, CPI and retail sales will be watched even more closely than usual. What you probably don’t want is a hotter-than-expected CPI print and a below consensus retail sales number. I mean, you never want that, but especially not now, because the market is i) hanging its hat on well-anchored inflation giving the Fed scope for a pause and ii) extremely nervous about an economic slowdown. This of course comes on the heels of the November jobs report which missed on the headline and betrayed steady wage growth.

(Bloomberg)

Investors will continue to obsess over the yield curve after last week brought inversions in the 2s5s and 3s5s. Remember folks: this is a leading indicator, not a “right now” indicator.

(Bloomberg)

Meanwhile, the market continues to price out the Fed. This is truly something to behold (top pane is amount of tightening priced in for 2019 and the bottom pane shows mounting expectations for Fed cuts in 2020).

(Bloomberg)

“We believe the narrative that the US is heading toward a significant slowdown and that the Fed will pause its hiking cycle in the near term appears overblown”, Barclays said Sunday, before underscoring the points other analysts have made lately with regard to how “public spending and a still-strong labor market should support the economy” – at least into the first half of next year. Here’s a 5-day of the dollar:

(Bloomberg)

Hostage situation

On the trade front, the elephant in the room is clearly the Wanzhou Meng debacle. On Sunday, Vice Foreign Minister Le Yucheng summoned U.S. Ambassador Terry Branstad to protest what Beijing is now calling a violation of the “legitimate rights and interests of Chinese citizens”. Basically, China is now framing this is as Meng being held hostage by Canada on behalf of the U.S. and that characterization isn’t entirely without merit.

Read more

Meanwhile, the Wall Street Journal reported that China is indeed moving ahead with plans to step up purchases of U.S soybeans and natural gas, so you know, they’re “trying”, I guess.

Miscellaneous

There’s all kinds of data on deck for Japan and China, including the final read on GDP, Q4 Tankan, current account balance, trade balance, and manufacturing PMI from the former and credit data and the FAI/IP/retail sales trio from the latter. China’s numbers will be watched extremely closely in light of November’s lackluster trade data.

In EM, we’ll get CBT and CBR this week, both of which could be mildly interesting.

Oh, and then there’s oil. Analysts are still trying to determine precisely what the outlook is after last week’s OPEC meeting. We’ll get to some of the summaries and commentary on that tomorrow. For the time being, one assumes prices will stabilize until Trump tweets out his latest commodities “strategy” note.

Finally, the Mueller probe is clearly gathering momentum and if Friday was any indication, we’re going to be in for a whole lot more drama on the domestic political front in the weeks ahead.