Monday was supposed to be the day when the purportedly systemic nature of Tiger Cub Bill Hwang’s epic blow-up manifested in an equally dramatic broad-based equity rout.

After all, such a breathtaking flameout surely deserved some follow-through. By Sunday evening, headlines claiming traders were “glued to their screens” garnered countless clicks across financial portals. The media promised a “volatile open.”

Alas, it wasn’t to be. Sure, there were some fireworks, notably in shares of Nomura and Credit Suisse. But if all you cared about were the benchmarks, you wouldn’t know anything was amiss Monday, although you might have noticed small-caps had another rough session. Big-cap tech outperformed the Russell by almost 3% (figure below).

For my part, I’ve tried to strike a balance with the Archegos story. Generally speaking, if things are going to be truly dicey on a Monday, you know it. On Sunday, I spoke to two people at two of the largest banks on the planet. Neither of them indicated that any kind of chaos was likely early this week.

Of course, none of that is to say we’ve heard the last of this story. We surely haven’t. As one widely-followed FT columnist suggested, it may well go down in history as one of the most spectacular individual blow-ups ever. And there may yet be systemic fallout. But it didn’t come Monday.

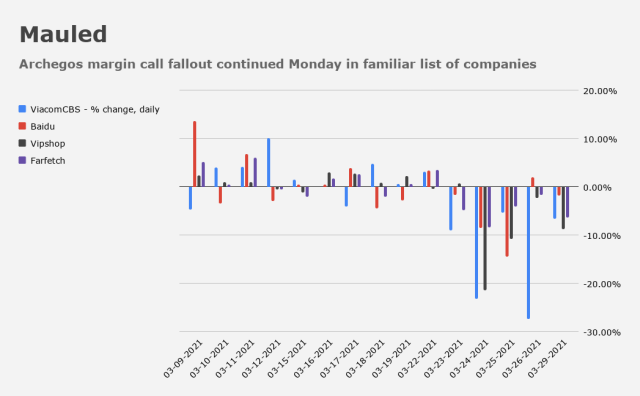

There were, predictably, more block trades as the unwind continued. Wells Fargo executed trades in Viacom and Baidu, among others, for example. If you were just itching for an opportunity to get your hands dirty in traditional media, Viacom is down almost 60% in a week. I guess that counts as a “dip.”

Separately (or not, depending on how you want to look at it), Morgan Stanley offered 20 million shares of Rocket Cos.

Treasurys bear steepened as bonds were heavy into the US afternoon. Joe Biden delivered good news on vaccines albeit while simultaneously warning that if Americans don’t stay vigilant, a fourth virus wave could materialize. His remarks came just hours after an impassioned plea from CDC Director Rochelle Walensky. Later this week, Biden will unveil a longer-term economic plan expected to cost between $3 and $4 trillion.

“Even a material pullback from Friday’s record high close for the S&P 500 wouldn’t be troubling by any means considering relatively lofty risk asset valuations – all things considered,” BMO’s Ian Lyngen and Ben Jeffery said, adding that while “Friday’s name-specific correction in the US stock market had echoes of corrections past, there are no obvious signs of contagion at this point.”

Once all “hope” of a new Black Monday was lost, outlets went looking for answers. The demonstrable lack of panic, reporters were told, was attributable to the Fed and drunks. “When the Fed has rates at zero and QE is ripping, they are essentially the bartender that is handing out as much booze as possible,” Peter Boockvar, who’s always ready to hand out a quote, told Bloomberg. “Many people get drunk on risk, like the fund on Friday, and they get into an accident.”

The same linked article contained four additional assessments, all of which cited the Fed for Monday’s missing calamity. A word search of the article turns up 19 hits for “Fed.”

It’s undoubtedly true that the Fed has encouraged and facilitated risk-taking over the past year, but sometimes it seems lost on many market participants that this is not a new state of affairs. The Fed has been in the business of encouraging risk-taking and underwriting bubbles for as long as I can remember. And I mean that literally — as long as I can remember.

What’s new in the pandemic era is the participation of fiscal policy, but I fail to see the connection between that and Bill Hwang.

Moral hazard isn’t new, and neither is monetary policy’s role. And blow-ups do happen. Leverage is risky. Running billions in concentrated positions is too. Sometimes, BASE jumpers die.

All of that said, Tuesday is another day. As is Wednesday, and so on. The fallout from the Archegos flameout isn’t fully known. Maybe it was the first domino. One thing I can tell you for sure is that there will be plenty of time and space to write about it if that turns out to be the case.

In a note out Monday, SocGen’s Andrew Lapthorne attempted to “identify stocks most impacted by focusing on the largest intra-day high/low spreads and where volumes were outsized.” The figure (below, from SocGen) shows how dramatic the situation was for the names caught up in the melee.

“The knock-on effects remain to be seen, although clearly there has been an impact on the sectors in which these stocks reside and on those banks with exposure to Archegos,” Lapthorne said.

And what else was there to say on Monday? Nothing, really. But some folks found plenty of words anyway. Such is the media business.

As a retired trader, my first thought last Friday was “where does the real problem lie”?. As Dennis Gartman always said: there never is just one Cockroach. If this was an “outlier”, where is the real problem stuff warehoused?