“We are sellers” into vaccine strength, BofA’s Michael Hartnett said, in the latest edition of his popular weekly “Flow Show” series.

I suppose it’s fair to call that “contrarian,” although I’d note there are pressing concerns in many corners that after a decade of the “slow-flation,” Goldilocks macro environment, the market simply isn’t set up to handle a sustained reversal of the associated duration-linked trades which have become entrenched across the equities complex. Mega-cap tech leadership is the quintessential example.

For Hartnett, the next several months will bring “peak positioning, peak policy [and] peak profits.” He suggests that the “best analog” is early 2018, when the Trump tax cuts facilitated a melt-up and a blow-off top in late January, just prior to the implosion of the VIX ETP complex.

Equities are, of course, stretched on most metrics. The figure (above) is admittedly a bit hard to sort considering the pandemic’s impact on profits and earnings expectations, and the distortion from the FAAMG cohort.

Still, Hartnett wrote that getting the S&P above 4,000 “requires a belief in EPS greater than $180 and/or a 25X multiple.” The figure (below) shows you various permutations.

“[It’s] silly to think big stock market gains from here won’t provoke negative political, economic, and financial responses” in the form of higher taxes, higher inflation, and higher yields, he remarked.

I’m certainly sympathetic to the thrust of that message, and it should be considered in the context of Hartnett’s signature cadence and style, which is defined by key themes and levels condensed into bullet points. But without a Democratic Senate, tax hikes in a Joe Biden administration will be a heavy lift. When it comes to inflation and rates, I’d just note that asset price inflation is something different from “real world” inflation and central banks will cap a disorderly rise in long-end yields.

Hartnett is obviously aware of all that. He sees “a big jump in central bank QE” in the near future if a policy response is required to cap rate rise at, say, 1.25% on 10s and 2% on the long-bond. He notes that “successful targeting of higher asset prices by policymakers” has engendered the vaunted household “wealth effect.” Bank of America card spend, for example, is up 7% YoY.

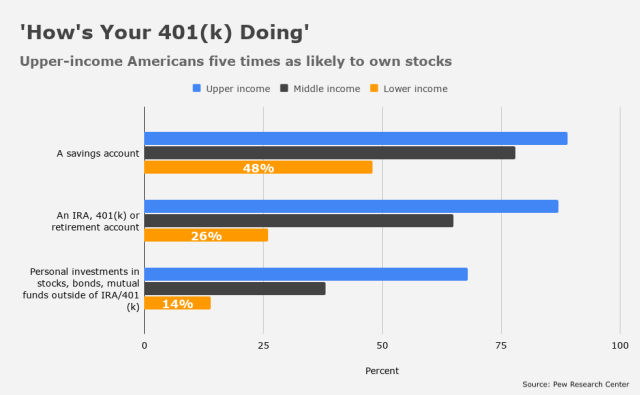

I feel obligated to remind you that the “wealth effect” is by definition confined to Americans who hold financial assets. That is not the majority — or at least not if what you mean are financial assets held outside of retirement funds. For example, a Pew study conducted in September of 2019 showed that around one-third of US adults (35%) personally owned stocks, bonds, or mutual funds outside of retirement accounts.

Of course, higher balances in retirement accounts can prompt higher spending by the middle- class to the extent they feel more comfortable in parting with their disposable income.

But the bottom line is always the same: The rich own most of the stocks, and they have the lowest marginal propensity to consume. When they do consume, they’re generally buying things that don’t necessarily contribute to “good” or “healthy” inflation. For instance, up until about three days ago, when it apparently sold out online, Hermès was selling a men’s reversible hooded sweatshirt for $16,500. In middle-class terms, that’s called: One Honda Civic.

In any case, the overarching message from Hartnett this week is that 2020 was the year of the virus, lockdowns, and a recession, which he said is “bullish Wall Street.” 2021, on the other hand, will be the year of a vaccine, reopening, and recovery, which is bearish for Wall Street.

Note the figure on the right. Last week saw an all-time record for inflows into equity funds. The total haul globally was $44.5 billion.

For those wondering, BofA’s pseudo-famous “Bull & Bear Indicator” sits at 4.2. That’s up from 3.8 last week, but nowhere near euphoria.

We are on the precipice of P/E compression for the market, in my view. It won’t mean a price crash- but it will frustrate the stock jockeys. That is how the stock market will reset, again my guess. Some of the hot sectors like tech and growth will probably not be the leaders in 2021. Again, not calling for a price crash, but there is going to be a lot of churn and a lot of return free risk in the stock market. Eventually you will get a yield curve steepening trade, but those betting on this outcome are going to be early if they think that is now. You might see a real bear steepener in a few years. Right now the economy has to work through a lot of stranded assets and bad debt. That takes time.

Ria has a point. Remember how long it took tech stocks to start marching back up after the tech bubble burst? Shares of tech companies with real and often growing earnings traded sideways for years as their earnings “grew into” their still-elevated P/Es. It was frustrating for those who bought them back then.

I tend to agree with Acer. Basically everyone know who’s a homeowner has recently refinanced into much lower rate. They’ve saved money and paid down/paid off small debts and installment loans. Many people are in better shape financially than ever before. The death of family members has unlocked inheritance wealth. There’s tremendous pent up demand at a time of tremendous suffering

Among other offices, the mythological Hermes is patron of trade and thieves. A hooded sweatshirt for $16,500 leaves lots of price undercutting for H’s new line of goods.

I appreciate hearing different perspectives, vis-a-vis Mr. Harnett. However, I fail to understand his outlook. Having been a contrarian myself for many years, and suffering returns to match, I’m always listening to what “investors” on the other side of the boat have to say. I’m not sympathetic to his view.

Primarily, I find it difficult to perceive an equity market that doesn’t bolt consistently higher in 2021, say, starting in Q2, Once COVID breaks later in the spring, and some portion of the population starts getting vaccinated, and they don’t get sick, we are going to have national tailgate party that lasts all summer.

Of course, the improving scenery will not help many who have been left behind. There is going to be a lot of scarring. At this point, it seems evident that this crisis is not the one that sparks the nation to be introspective, to want to address and make progress on some of our problems. Not all will participate, I’m sad to say. Yet, I’m not sympathetic to the “bear” characterization.

All the while, we don’t want the deflationary death spiral. We need the financial economy party to go on. We need equities to continue up to the right. We need exciting, overpriced IPOs. We don’t need the yield curve to steepen. And if there is a plunge that stirs a loss of confidence, we want the Fed to come in and reassure the market in the manner that only the Fed can do.

About the soundest view for forestalling a Depression currently. Thanks

I’m not sure why is balance sheet analysis is so underperformed. As we flirt with the idea of a Great Rotation, the fact remains that a very large percentage of value stocks have absolutely horrific balance sheets. I have yet to hear a credible theory of how these problems will be alleviated. For a great many of them, their equity is really underwater. How can a baton be passed to runners who are not running, but in the drowning part of the triathlon? Furthermore, it’s not as if the US corporate sector has used all its debt to invest in a way that will drive sustained growth in years to come; just the opposite. They simply have not built their own runways. I keep hearing how value is historically undervalued on a relative basis; and yet the DOW and Russell 2000 are, in fact, trading at all time highs in a world of structurally lower future growth.

The same can be said for the global economy. I have yet to hear a credible theory of structural reform that would enable a sustained global reflation. The developed world corporate sector is not investing, and neither are their governments. The US consumer is no longer in a position to prop up the whole apparatus. Even China knows it must shift to a consumption model, but has not been able to do so.

Simply put, something has to give. Otherwise, it seems to me, we will remain in the Ice Age.

These kind of disagreements make the market! Here’s my reflation case:

1) continued/accelerated monetary easing from Fed, ECB

2) some level of fiscal support (~$1 trillion) via govt stimulus in February

3) “pent up demand…” american consumer is saving for the first time

4) current layoffs/pay cuts lead to increased profit margins for corporations

5) GOP senate and Biden’s moderation means no real progressive policies–corporate taxes stay low

6) capital flight out of china (look at Big China tech right now)

7) multiple vaccines approved by January 1st–moderna will be next, followed by Astrazeneca, followed by the blockbuster, 1-shot JNJ

More detail on #3…this is a tale of two economies. A large majority of Americans have BENEFITED from COVID…heightened disposable income because their overconsumption was disrupted via Work from home, reduced interaction with peers (less need to “keep up with the jones'”)…these consumers skew rich…they own stocks so additional wealth effect as H lays out above…

Also, to correct something…not “saving for the first time” but saving for the first time in such a large magnitude.

A market indeed. I’ll buy your long duration Treasuries.

Acer, it is not as if are there zero opportunities to spend money now. Buying online is fast, easy and convenient. As a thankful member of the “benefiter” class, I hear many stories of stupid “Covid Boredom” purchases being made in my cohort, including by myself. It is not hard to waste money now as long as you are not living hand-to-mouth.

So that leaves leisure travel and dining out. Both are still restricted, but that’s a subset of the larger economy, isn’t it? Can a recovery at DisneyWorld and Carnival Cruises carry the whole economy? Leisure and hospitality did account for a large portion of employment growth in the pre-Covid years but will a gradual recovery in those sectors be enough?

Will the 99% go back to their old spendthrift ways? Perhaps, but my parents who lived through the Great Depression never were able to throw off the lesson of thrift that experience burned into their psyches. How confident will younger people who lived through the financial and Covid crashes be confident enough to run up huge credit card debt to fund current consumption? Especially since many are already carrying large burdens of student loan debt. They are eerily similar to the zombie companies Anaximander points to.

I’m afraid that the repeated failure of the periodic rotation trades is logical. The great market rotation was never able to get much traction, even before Covid hit. I’m not sure why it should now.

I think Acer means ‘A large majority of the top 1% Americans have benefited….’

I politically agree with what you’re implying, which is that wealth inequality is a terrible problem and that the Pandemic has only accelerated it.

Thinking of this from the context of macro level, though…inequality as a 1% problem is really just not accurate however. It allows wealthy liberals to distance themselves from “the rich.” Inequality today is a story of college educated/vs college uneducated. When we’re looking at consumption overall, it is fair to say that the large majority of consumers in dollar weighted terms have benefitted.

Savings rates are way up, cash balances are up, asset prices are inflating, and among consumers there has been a marked reduction in extraneous consumption–things we were buying because we were commuting and going into the office.

This isn’t just limited to the 1%. Huge swaths of consumers are going to go bonkers this Spring and spend money like you’ve never seen before.

Derek, whilst I know it is not scientific, I don’t think I know anyone who won’t go back to very close to how things were before. True, I don’t know folks who suffered great hardship, but the reality is those who did are unlikely to have enough surplus income to be frugal to a degree that will material impact the economy. They will spend because they live paycheck to paycheck. The Great Depression was both much deeper and longer than it looks like this downturn is likely to be. There will be changes, but I get the feeling they will on the margins rather than being fundamental.

I agree with a lot of what Bob is saying. Rich people have flexibility in their consumption–the poor will continue to spend 100% of each paycheck because our society will continue to fail to provide help to the lower class. Consumption growth will be an 80/20 split…20% of the top American (elite) consumers will drive 80% of the increase in consumption. Derek, buying online has been fast/easy/convenient for at least a few years now. As I see it, there hasn’t really been a big change in ecommerce outside of grocery delivery and growing market share by the big tech etailers. How is Amazon today any different than it was in February 2020? It’s just more appreciated by elite consumers. That is the “carry forward” effect that I’m predicting…not only will the elite consumers continue to purchase unnecessary items online, they will also return to traveling, buying clothes, cosmetics, bigger houses, nicer cars, etc to impress other elite friends. The end of COVID will be the beginning of a new age of conspicuous consumption for the elite consumer. Because of wealth inequality, that’s the story of the elite consumer is the story of America consumption overall.

Still drinking my coffee…please forgive the typos and thank you for the discussion

***Because of wealth inequality, the story of the elite consumer is the story of America consumption overall.

Do you feel that most Americans will go back to running up credit card debt to maintain their spending after this experience?

If the views above prove correct, the only stocks to buy will be LVMH, Burberry and such as well as guns/ammo producers and providers of personal protection services.

What is America without credit card debt?

I think that conclusion is too reductionist. Again, I’m arguing that the “elite consumer” is much broader than the leftist/liberal conception of inequality as a 1% problem.

Investments that will do well going forward include materials, “elite consumer” REITs (AvalonBay, Essex, Equity Residential), health care, and small cap tech that is actually poised to profitable and hasn’t been bid up to insane valuations. This is where we are overweight.

Hasn’t the rise of populism given you sufficient reason to rethink your nation that income inequality is some kind of liberal elitist notion?

If so, why was it next to impossible to buy 9 millimeter or 380 pistol ammo in the months ahead of the election? (Well, I did see some offered for $2 per round.)

I think income inequality is a terrible problem. Even though I am rich, I advocate for extremely high taxes and progressive policies and think inherited wealth is morally wrong.

To actually tackle the problem though, we need to surrender this idea of the 1%–created by liberal elites so that they can disclaim responsibility. The truth is that the top 20% have been handsomely rewarded over the last 50 years in America because they enable the 1%.

We don’t hear that much because it implies the blood is on our hands, too. It’s a lot harder to cry “eat the rich,” once you realize you are the problem.

I would like to point out that most of those I know who will go back to there old behavior are not part of the 1%, or even the 10%. They are simply people who didn’t lose their middle income jobs and as such haven’t suffered great hardship. If they do lose their jobs in future then their outcomes will alter. But otherwise…

Also whilst I accept that inequality is much increased, the common characterization of the 1% vs the debt enslaved masses is far too oversimplified. I don’t think I know anyone who fits in either category. Yes, the 1% are richer than ever. Yes there is a sizeable minority that are living paycheck to paycheck. But I think most are still in between. The middle may have been squeezed over the years but it still exists and is still a large if more precarious group.

When you look at the global numbers (from Brookings Institution), the global middle class economy is expected to grow significantly between 2020 and 2030. North American and European are estimated to remain relatively flat.

However, the Asian middle class markets are expected to grow from $20T to $36T in 2030; and the global middle class is expected to grow to 5.5 billion people.

This article was published in 2017, pre-covid, but if you believe in this demographic shift over the next decade or so, it seems that the American based international companies and investors that can tap into this growth will do well.

It will continue to be up to our elected politicians to redistribute the country’s wealth in such a manner that is supported by the electorate.

Not sure how RCEP impacts US ability to capture more international trade…..

Putting aside the 1% debate where I must confess I like Acer’s idea that it gives some moral cover to the fortunate 10%.

But I am colored by 3 things. First were those Fed and other surveys which indicated that over 50% of US families could not come up with $500 to cover an emergency.

Second is my memory of the losses I suffered when I got suckered into buying stocks in purveyors of aspirational/affordable luxury such as Coach (now Tapestry), Avon and more recently Macy’s. The demise of middle-tier retailers and malls squeezed out by dollar stores and luxury retailers. It is pretty solid evidence that there is no happy, prosperous 20%, much less a majority, of Americans better off thanks to the pandemic.

Third, thanks to a pretty serious rock music hobby, I hang out with many, many people eeking out a living on the edge. Some of them with college degrees. Those $1200 stimulus checks were truly lifesavers for some of them. Every day they had to wait was one of terrible uncertainty and fear.

I was tempted to suggest that you guys step out of your prosperous cocoons and speak to the many people outside of your gated communities ( if you live in the south). It’s amazing, but many people cannot afford, a Pelton!

But as a portfolio manager that is a big mistake. The people managing investment portfolios live in that cocoon and assume that represents the majority of the population. So I often am forced to shrug my shoulders and invest based on the notion that everyone is wealthy. We follow Peter Lynch’s advice to buy what we know.

Fiddling while Rome burns 🔥. At some point the guy manning the gate to your gated community will decide it is not worth risking his life for $11 an hour.