If you’re a market participant, there are risks out there. Perhaps you noticed.

Or maybe you didn’t. Because if all you were going by was benchmark equity indices, you’d be inclined to think COVID-19 was cured sometime early in April.

You may scoff at forecasts for additional gains on top of the 31% bounce off the March nadir. But then again, you would have scoffed at the same forecasts after 15%. And then after 20%. And surely after 25%.

Money is money, folks. And if there’s anything we should have learned from the post-GFC experience, it’s that any gains you locked in over the course of the longest bull market in history were rendered no less “real” by incessant banter from the “it’s all a central bank-fueled bubble” crowd. A triple-digit return isn’t “ephemeral” if you book it. It’s not a “paper gain” anymore if you sell.

And yet, the juxtaposition between an outright depression and surging equities is difficult to ignore – it’s impossible to resist the temptation to lampoon it. Allow me to indulge:

But stocks “pull forward” expected outcomes. Between western economies tentatively reopening, and the notion that things “can’t possibly get much worse”, you can make the case for further gains.

“Admittedly, only limited steps have been taken so far and the situation will remain far from normal in the near term, with various social distancing measures remaining in effect [but] by the end of May, most of the population should be out from under stay-at-home orders, and millions of people should be able to return to work in June”, UBS writes, in a knock-on-wood-ish note called “Nearing the bottom”.

(UBS)

Goldman’s year-end target for the S&P bakes in another 2% to 3,000. And yet, the bank’s three-month target of 2,400 implies 18% downside from current levels.

“A single catalyst may not spark a pullback, but a number of concerns and risks exist that we believe, and our client discussions confirm, investors are downplaying”, the bank says, in a new note.

I’d argue that “a single catalyst” could well spark a pullback. Indeed, a single tweet could do the trick, especially with dealers’ gamma profile straddling the “flip” line.

Let’s face it: Friday’s phone call between Bob Lighthizer, Steven Mnuchin and Liu He was little more than a publicity stunt aimed at reinforcing the notion that the trade deal isn’t in jeopardy despite rising tensions between Washington and Beijing.

But it is in jeopardy – just ask Donald Trump, who has repeatedly threatened to cancel it over the past two weeks. The president, along with Mike Pompeo, is aggressively pushing the theory that Beijing covered up a lab accident at the Wuhan Institute of Virology. If that becomes the “official” US position and Congress gets on board with the idea of trying to extract virus “reparations” from China, you can forget about the trade agreement.

“The nature of the tension seems multi-faceted going beyond conflicts in merchandising and service trades, with the US administration’s rhetoric and actions towards China turning more hawkish in the past month across various issues and strategic domains”, Goldman warned on Friday evening.

So, that’s one risk. Beyond that, Goldman notes that “COVID-19 infection rates outside of New York continue to grow”. You can see that in the following visuals which, when considered together, are disconcerting.

Without delving too far into the politics of reopening, suffice to say Andrew Cuomo has a tighter grip on reality than most governors, some of whom seem to be subscribing to the notion that preserving Americans’ sacred right to get a new tattoo or catch a wave at the beach, trumps concerns about catching the virus in a second wave.

I have repeatedly emphasized that as painful as the current economic collapse most assuredly is, the damage to investor psychology from having to re-shutter the US economy after opening it back up would be potentially catastrophic, as it would raise questions about the viability of any thesis which revolves around a return to normalcy.

“Lockdown measures are being eased earlier than we expected, although that could end up backfiring if there is a big second wave of COVID-19 cases”, UBS goes on to say, in the same cited note. “If restrictions have to be reimposed later in the year, it would likely trigger the second downward stroke of the ‘W'”.

You’re reminded that the latest edition of BofA’s closely-watched global fund manager survey showed more investors see a “W” shaped recovery than a “V” shaped rebound.

In that context, consider this excerpt from IDEX’s call (this is CEO Andrew Silvernail speaking):

And so that means, it just takes longer, and that’s what we’re seeing certainly in Italy and that’s what I expect here. And just to be clear, our expectation here is that this is going to be fits and starts. I’m not someone who has bought into a super aggressive, everything gets fine in the fall sort of thing. I think that’s crazy talk.

And I think we have to face the reality that’s in front of us. And what if we get lucky and for some reason, this goes away with whether or something else or a vaccine is found more quickly than we think, or you have very, very effective treatments. Great news. I don’t think anybody should bank on that, and I certainly wouldn’t manage the company expecting that.

There you go. At least some executives think the notion that we’re going to be back to normal anytime soon is “crazy talk”.

Meanwhile, Goldman reminds you that bank loan loss reserves in Q1 were more than the entirety of 2019. I’ve used the following chart before, as I think it’s a particularly poignant illustration.

“All of the banks marked to market their provision estimates assuming a 9.5-10% unemployment rate”, Goldman notes. Of course, the jobless rate is now near 15%. It will likely move higher.

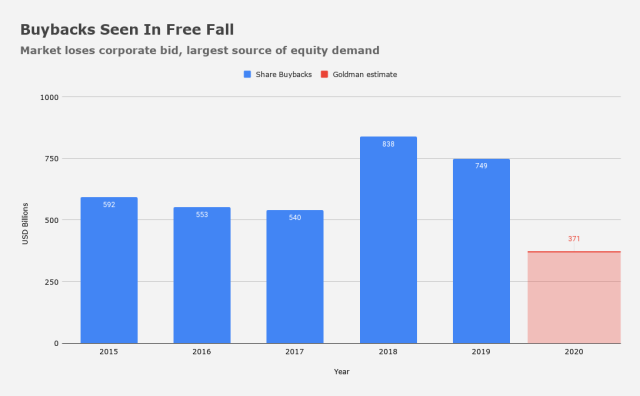

Goldman’s estimates are for $115 billion in provisions over the next four quarters, while buybacks are, of course, expected to crater, something the bank says “delights credit investors but equity investors should be concerned [about] because buybacks have been the only source of net demand for shares in the past decade”.

On the dividends front, smart people can disagree. Morgan Stanley, for example, thinks projections for dividend cuts are too pessimistic, and that’s part of the reason why the bank’s Mike Wilson remains constructive.

Goldman sees dividends falling 23% this year, but Bloomberg’s Pimm Fox on Saturday delivered the following take which is certainly worth a mention:

While the global economy has collapsed, corporate revenue and profits have tanked and Great Depression-sized job losses are taking place, companies have raised the amount they’re paying their stockholders. Yes, that’s correct. Only 48 companies have discontinued, cut or omitted their dividends YTD. But 285 companies have increased their dividends, 86 have maintained their payouts and two have initiated new ones. Cash distributions so far in 2020 are $192.2 billion, up slightly more than 1.5% from the same period in 2019.

Again, you can choose a side, but just know that like everything else right now, the outlook is murky.

Finally, don’t forget that this is an election year – or at least that’s the plan right now. It’s not clear what would happen in the event the virus is ravaging the country in November, but assuming the vote goes ahead as planned, it’s at least possible that Democrats gain ground on one or more fronts.

If the Trump tax cuts were to be rolled back (and I’m just saying “if”), that would imply a roughly $19 hit to 2021 EPS.

Just for fun, I added (or, actually, subtracted) that from Goldman’s downside earnings case for next year and then calculated the current multiple. The visual below shows the results.

Suffice to say this is a market where there’s quite a bit more to fear than “fear itself”.

Great analysis as usual, but as an avid surfer allow me to pontificate and affirm that indeed, the right to catch a wave at the beach should be sacrosanct for everyone, not just every American, when it comes to surfing I subscribe to a philosophy that mirrors the motto of my neighboring state, surf free or die…

lol. i’ll grant you that.

Alas, a shark took out a surfer on a Santa Cruz (CA) beach yesterday… stay safe.

That harkens to the philosophy of ‘the right to pullute’. We live in a real world where our actions can affect others.