The US economy may be heading into a recession, Donald Trump conceded, during a coronavirus press briefing on Monday afternoon. “Pent up demand” will reverse the damage, he half-heartedly mused.

Stocks, which were already down around 9%, sank back to the lows hit early Monday after an initial trading halt was lifted. The Dow extended losses to 12% as the press conference unfolded.

Trump advised the nation to avoid travel, restaurants and schools, and said the effort to keep the virus from spreading could last through July or August. “It’s bad”, he said, flatly.

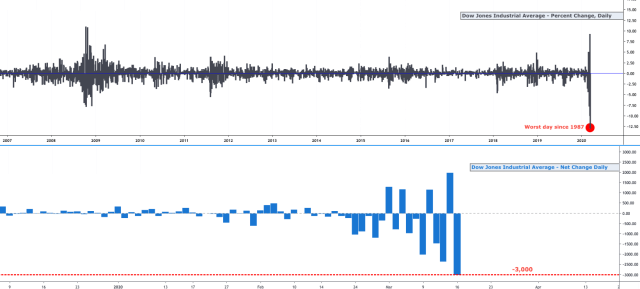

It’s bad, alright. The Dow suffered its worst day since 1987 on Monday, and just two sessions removed from Thursday’s historic selloff.

In other words, we now have a new “worst day since 1987” just two sessions after the last such epic rout. The Dow fell 13% or, for those who can still find humor in this epic debacle, 3,000 points.

The White House advised the public to avoid gatherings of 10 people or more. The best thing for the stock market, Trump said, is to get through this crisis.

It’s hard to argue with that latter assessment. US equities have moved 4% in either direction in each of the last six sessions, swings the likes of which are astounding for any era.

At one point Monday, 8 of 11 S&P groups were down 10% or more. The Russell 2000 dropped more than 14%.

If you’re wondering when the last time the S&P posted moves of 9% or more in three consecutive sessions was, the answer is 1929.

“We continue to exist in a rolling ‘VaR-down’ / ‘de-grossing into cash’ state, which means further knock-on deterioration in market depth and liquidity from MM’s as well, going hand-in-hand with gappier price-action as bid-ask dramatically widens on much smaller size”, Nomura’s Charlie McElligott wrote Monday.

Brent fell below $30 for the first time since 2016 as the market braces for demand destruction on a global scale. The losses for US energy shares in 2020 are quite simply catastrophic.

The VIX rose 25 points. Let that marinate on your frazzled brain for a moment. It’s at 83.

The high yield ETF sank 5.5% Monday, a horrific one-day slide.

Meanwhile, gold plunged again, in what one can safely assume is a continuation of the recent trend, wherein investors are forced to liquidate positions to meet margin calls and cover losses in risk assets.

So much for the whole “safe haven” label.

It’s all moving together now, as things tend to do in these types of environments.

(Morgan Stanley)

As noted here first thing Monday morning, central banks will not be able to avert a recession in the world’s major economies, and that includes the US.

The longest expansion in American history is now over. That can be stated as fact at this juncture. Write the obituary. It’s done. It’s the famous Dead Parrot Sketch. Like the “Norwegian Blue”, the expansion has “expired and gone to meet ‘is maker”.

Even some GOP lawmakers are now in favor of helicopter money. Mitt Romney on Monday suggested sending every American adult $1,000 immediately. Republican Senator Tom Cotton is drawing up cash stipend legislation.

The government will almost surely need to bail out the airlines, which are asking for some $50 billion, despite having plowed 96% of their free cash flow into buybacks over the last nine years.

Amusingly, you can expect more lawmakers to back bailouts for those corporate management teams than to back small checks sent to regular people.

Asked how he’d rate the government’s response to the virus, the president said he’d give it “a ten”.

Once the virus has passed, “you’re going to have a stock market like no one’s ever seen before”, Trump promised.

As of Monday’s close, the Dow is up a mere 11% since the election. In other words, one more day like this one, and US equities will be in negative territory since Trump won the presidency.

Everywhere and always, Pride goeth before destruction, and an haughty spirit before a fall.

“Everywhere and always, Pride goeth before destruction, and an haughty spirit before a fall.”

Truer words have never been spoken.

“Mitt Romney on Monday suggested sending every American adult $1,000 immediately. ”

He can start by personally handing out some of the funds he gained by destroying companies when at Bain capital. Mr. Rommney is very comfortable handing out other people’s money.

It appears that Trump has finally accepted his new reality……this was the best presser he has had and I was pleasantly surprised that he is finally acting like a President…..or as good a version as he is likely to be capable of.

Agreed.

Asked how he’d rate the government’s response to the virus, the president said he’d give it “a ten”.

This is Donald Trump. He’s absolutely telling the truth — notice he didn’t specify whether it’s a forward or reverse scale. Big brain genius, if you asl me.

It’s like an inverse neutron bomb. Most of the people survive but the infrastructure is obliterated

When we do we start talking about chained derivatives, opacity, and a complete absence of accountability on the part of our financial institutions and shadow banking system?

@mfn – accountability? That might hurt profits! You should consider writing for the Onion!

H-Man, The CAT5 is landing on all shores and unlike other storms, landfall is not slowing down the storm.