I suppose it’s wholly asinine to reiterate that last week was turbulent for markets.

You rarely overhear “regular” people talking about stocks in random settings, but I’ve heard a good bit of that over the past three days down at the small cluster of shops and restaurants near one of the two piers here on the island I call home. It’s spring break, which means things are more “alive” than usual, and even some of the younger visitors seem cognizant that something notable happened this week. Or at least they pretend to be cognizant, which is about all you can ask of a twentysomething.

That’s all based on a small sample from a very small place, but this is one case when you can probably generalize. After all, if people are talking about stocks while standing around waiting to board a $150/hour dolphin watching expedition, I can only imagine what the conversation must be like in Manhattan bars.

Thanks in no small part to the role dealer hedging, systematic flows and an acute lack of market depth played in accelerating directional moves, these last several weeks have been one of the wildest rollercoaster rides in history.

“We have been living in a black swan scenario recently”, SocGen’s equity strategists remarked on Wednesday.

As Deutsche Bank points out, the S&P moved by more than 3% in either direction 10 times in three weeks. There have only been two other periods in history characterized by those kinds of wild swings: The financial crisis and the Great Depression.

(Deutsche Bank)

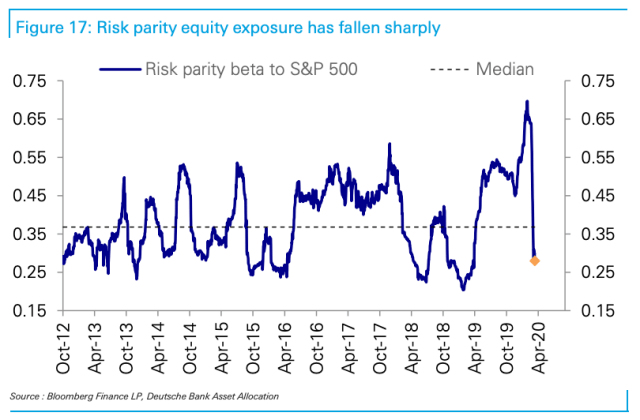

Late last week, risk parity took the deleveraging baton after CTAs took their turn and vol.-control (as a general category) simply ran out of exposure to pare.

A simple look at the combined performance of the S&P and the long bond ETF shows that simultaneous declines in bonds and stocks on Wednesday, and only meager gains for bonds during Thursday’s equity rout, led to two consecutive sessions of massive losses for a simple portfolio holding stocks and bonds. On Friday, mammoth gains for stocks offset losses in bonds. Here’s the visual:

I spilled quite a bit of digital ink on Thursday and Friday documenting the risk parity rout, both in “The Treasury Market Is Broken. ETFs Are Cracking. Risk Parity’s ‘Footprints’ Have Been Spotted” and “QE Has Returned. And The Risk Parity Kraken Has Been Unleashed“. Nomura’s model estimates aggregated risk parity gross exposure was cut from 450% (61st %ile since ’11) down to 305% (2.9%ile) on Thursday.

“Late February’s rise in equity volatility was partially offset by negative correlation in bond-equity returns along with relatively moderate bond volatility”, Deutsche Bank writes, in a Friday note, adding that “last week played out the worst case scenario from fear selling with almost all assets down, in addition to soaring asset volatilities across the board”.

A consolidated gauge of volatility across US equities, rates and G10 FX is the highest ever, outside of the GFC and 1987.

(Deutsche Bank)

Needless to say, simultaneous selloffs across assets and a sharp, across-the-board spike in volatility is a nightmare scenario.

“Elevated risk and lack of diversification likely prompted RP funds to bring down their total portfolio exposure to the lowest level since mid-2016”, Deutsche goes on to say, before noting that “the cuts to equity exposure have not translated to gains in exposure to other asset classes [and] our model RP portfolio bond exposure is sitting at the 40th percentile since 2005, while equity exposure is near historic lows last seen in 2008”.

(Deutsche Bank)

Nomura’s model has risk parity’s equity allocation in just the 0.3%ile. The bond allocation sits in the 32.2%ile, while credit has been pared down to the 3.8%ile.

As mentioned here earlier in the week, the vol.-targeting crowd simply doesn’t have much left to purge. By Wednesday, after some $130 billion in pared exposure over the space of a month, this universe’s allocation was in the 1st %ile going back a decade on Nomura’s model.

By Friday, Deutsche’s model showed $150 billion in deleveraging from vol.-control over the past month.

The good news is that “this record drop in equities has left very little downside selling pressure from VCs even for a 3% spot down move” which would only entail another ~$1 billion in de-risking. The bad news, Deutsche goes on to say, is that “all components (realized vol, implied vol, time weighted vol) that feed into the aggregate volatility metric tracked by VCs are at post GFC peaks”. That means it’s going to be a while before this universe begins to add back equity exposure.

Finally, if you’re wondering whether a lack of market depth contributed to this week’s dramatics, you shouldn’t be – wondering that is. As I’ve noted repeatedly here, market depth never recovered from “Vol-pocalypse”. The visual in the left pane below underscores that.

(Deutsche Bank)

Liquidity in equities is now the worst ever. That’s not an exaggeration – or at least not on simple measures of market depth.

As far as what stocks were telegraphing prior to Friday’s absurd late-session surge, Deutsche notes that the S&P was effectively pricing in “an ISM of 35 and earnings growth of -25%, both commensurate with severe recessions”.

Of course, there will be a recession in the US – that is (almost) a guarantee considering the containment measures put in place to stop the spread of the coronavirus. Whether or not it ends up being “severe” is up for debate.

Below, for those who might have missed it, is a breakdown by state (current through Saturday morning’s government data) of COVID-19 cases and deaths.

Donald Trump may be willing to go out on a limb by autographing Dow charts after Friday’s stick save into the closing bell, but I would generally caution that even if we’ve seen the worst of the selling, there’s more volatility to come.

The next few big data releases out of the US will only partially reflect the impact of the anti-epidemic measures. The bottom line is that we are going to be talking about this right up through the election.

As for overall equity positioning after this week, it’s at financial crisis lows.

(Deutsche Bank)

“The current late stage of the economic cycle is making it harder for global economies to ‘stomach’ unexpected black swan scenarios, and we are seeing a push for policymakers to intervene more intensively than before”, SocGen’s Sophie Huynh wrote this week.

“We expect a V-shaped recovery but recommend investors put hedges in place and be patient for now [as] we cannot rule out further downside… should COVID-19 spread rapidly in the US with limited reaction from the authorities”, she added.

Suffice to say that so far, markets have not been impressed with the reaction from “the authorities”.

A “a V-shaped recovery?”

In stocks — I mean… I don’t disagree necessarily. People are going to be just as crazy once this virus passes as they are when it’s proliferating. It’s not like retail has fallen out of love with “BTFD”… they’re just too busy buying hand sanitizer and bottled water at Sam’s to care right now. But by God once the virus is gone, you can probably expect everyone to see what they at least think are “bargains’ everywhere. And remember, re-leveraging from systematic strats is model-driven. It’s not based on some fundamental assessment… or at least most of it’s not. When volatility subsides, those strats will re-leverage. It’s programmatic. And you know corporates won’t stop buying. I’m not saying I totally agree with any “V-shaped” recovery thesis, I’m just saying that you can make the argument.

You understand this more than I do, but I would assume that many of the users of these “strats” have had their head handed to them, even if their bodies are still barely solvent. So I think we might see more of a cup and handle pattern before FOMO and TINA take over again.

H-Man, I guess it is how wide you define the “V”. Yes there will be bargains when the virus passes, but you then deal with the carnage and then price the market. Right now this market can’t price the carnage. If the carnage is substantial, it my make that “V” a very wide “U”.

A lot depends on your definition of V-Shaped recovery, and on your timeframe. For example, we had a V-shaped recovery on friday. If you consider only two days, it’s a perfect V. If you consider the entire week, than it’s an asysmmetric V, with the right side shorter than the left side (half size, actually). When the market hit the final bottom, there will be a sharp, V-shaped recovery, but it will simply recover part of the losses. The V started with SP500 at circa 3400, the bottom could be at any level, the recovery will not reach 3400. Not in a V shape.

This week will be a good test of the V-shaped recovery theory. If we have a strong bounce into Fri, March 20, we’ll have direct evidence that those expensive puts mentioned by Nomura’s Charlie M are being monetized instead of rolled for the apocalypse. If we hit new lows this week, then the v-shaped recovery will have less ground to stand on. Evidence based trading, is good trading.

H — can you comment on the risks of a ban on shorting specifically on inverse ETFs, leveraged or otherwise? If I knew SQQQ was going to possibly leave me stranded, I would have liquidated more of my longs … TY.

He NEVER answers these sorts of questions being that that answer is for you to find out. You are asking him to figure something out for you. Not his thang. I’ve never once here read a recommendation.

OK — but he was one of the first people (at least that I read) to focus on the market mechanics implications of the high-yield ETF/underlying bond liquidity mismatch, and this seems similar to me. Not asking for a recommendation, just some insight as to the mechanics.

Equity goldfish has left the bowl and is in for some tile dancing, I’m preoccupied with what leads to (forces) bond selling and sans a “pure” rotation (lowercase v at best) what that scenario looks like? Or maybe I just need to take a walk…

I suspect that Trump won’t be autographing Monday’s chart.

I’m partial to the V shaped recovery, too. But, let’s play safe.

Several short duration funds have interesting ways of leveraging up. One CEF shorted 35% of their own shares. Another took a huge short on LIBOR. The latter should be worth a short term bounce but the former means there is a buyer on any dip.

H-Man, the virus bombs are hitting the US but no one knows the extent of any direct hits to our economy. Methinks if Asia and Europe are precursors of how the bombs land, there will be more direct hits than we are expecting.

The coronavirus is the biggest factor, but not the only factor, affecting markets. The oil price wars, bond market dislocations, liquidity issues, supply chain worries, consumer confidence, etc. will not dissolve with a resolution to the virus. Prior to the virus, Heisenberg covered these topics constantly. So, I’m with the other posters who don’t expect a V recovery to the stock market.

Buybacks financed mostly by taking on debt has been a big factor in the bubble. Wondering if that will happen again (now would have been the right time not at ATH”s) or the greedy CEO’s got burned so much that they will not touch that for a while.

If the crisis is indeed followed by a V-shaped recovery you can rest assured that share buybacks will be a ubiquitous part of the upward surge.

He gets exclusive rights.

US President Donald Trump is attempting to entice a German lab to develop a vaccine exclusively for the US, a German newspaper reported. Berlin health authorities are in intensive talks with the company.

https://www.dw.com/en/germany-and-us-wrestle-over-coronavirus-vaccine-report/a-52777990

Contacted by Reuters, a spokeswoman for the German Health Ministry said: “We confirm the report in the Welt am Sonntag.”

https://www.cnbc.com/2020/03/15/coronavirus-germany-tries-to-stop-us-luring-away-firm-seeking-vaccine.html