Risk assets were once again beset with concerns on Thursday after Donald Trump’s late-evening press conference in the US failed to allay fears about the global spread of the coronavirus.

It didn’t help that the CDC confirmed the first US case of unknown origin literally while the president was responding to questions from reporters. Suffice to say nobody is particularly enamored with the idea of Mike Pence (who, last we checked, is not an infectious disease expert) leading the effort to combat the spread of infections.

European shares were sharply lower with US equity futures. 10-year yields in the US fell to a fresh all-time low and it looks as though bull steepening will continue in the near-term as market participants expect a Fed response. South Korean shares tumbled, down for a fifth day in six and nearing correction territory.

The Bank of Korea refrained from cutting rates, but did lower its growth forecast. Governor Lee is taking what, I suppose, is a prudent approach, eschewing a broad rate cut for targeted measures that might actually have some hope of making a difference where it matters.

“A health security crisis is the cause of the current economic difficulties”, Lee said Thursday. “In a situation like that, micro support for self-employed businesses and companies in trouble is more effective than an interest-rate cut”.

Fair enough. “Cutting rates to zero and printing electronic money… will be ineffective this time around, as coronavirus infects the cogs that make up supply chains and consumer consumption”, an analyst at Oanda Asia Pacific wrote after Lee’s remarks. South Korea reported more than 500 new infections.

Saudi Arabia suspended pilgrimages to Mecca, Israel asked citizens to reconsider travel abroad and Japan closed schools starting in March, as life grinds to a halt. The global death toll is now in excess of 2,800.

“Throughout the past several days the V-bottom seeking animal spirits have continued to persist [but] buyers [are] burned by weakness in the early hours of European trading”, JonesTrading’s Mike O’Rourke said Wednesday night, adding that “it’s beginning to appear as if China’s slowdown will be global slowdown with ramifications far and wide”.

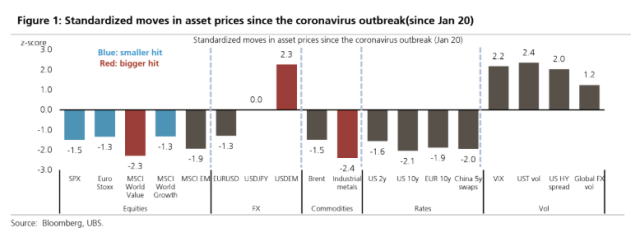

“There has been a wide dispersion on asset classes’ reactions to the virus risk, measured by their own volatility”, UBS said overnight, noting that “since the virus outbreak in China on January 20th, commodities and EM FX are most badly hit [while] value stocks and EM equities have also paid a big price”.

(UBS)

And yet, markets still haven’t really sold off in a manner consistent with “capitulation”.

“There’s no way you could possibly describe either the move higher in equity volatility, or the rise in high yield spreads, as anything more than a blip or a wobble”, SocGen’s Kit Juckes remarked on Thursday morning, on the way to asking this:

Is that right, when the press is full of talk of pandemics, and major global companies are talking of distortions to supply chains? Even if the threat from the virus passes relatively quickly and the human cost is relatively limited, the insouciance in credit markets is close to complacency surely?

Probably. And to be clear, Juckes isn’t alone in suggesting the market may still be underpricing the risk, even as the virus selloff is getting somewhat “real” in US equities, the sacred cow.

“If this virus spread intensifies stateside, it will most definitely be the straw that breaks the market’s back, which supports my cross-asset running super spreader narrative”, Stephen Innes, of AxiCorp remarked.

Once again, if you’re looking for upbeat headlines, this really isn’t the time. Fingers crossed that US equities manage some kind of rebound perhaps catalyzed by rebalancing flows and systematic re-leveraging.

Heisenberg, have you seen situations where the rebalancing flows are delayed for an extended period of time, or is it considered mandatory for fund managers to do this monthly ?

How ‘bout a “Making great progress with China on BIGLY agricultural purchases. MAGA!” tweet this morning, just for old times sake…? 😀

SP500 at 200d, RSI went <20, high vol – time to wet a couple toes

Good luck with the bounce! Set quick stops. I’m already envisioning a “US Case Count” bug in the bottom right corner of CNBC’s television broadcast. That’ll be good for “sentiment”…!!!

Rebalancing flows and gamma are irrelevant in this type of market- at least for now. It is emotion and headline driven market. A classical mean-variance model would suggest with outcomes widely disbursed (higher variance/standard deviation) with the same prospective returns, risk assets are worth less. Plus there are many known/unknowns and flat out unknowns right now with this virus. Hence a lot of street commentary which is trying to game this out at this point are not much better than guesses. Listening to the street about the virus is like consulting a tax attorney on a constitutional matter before the supreme court.

Even in 2008/09, stocks didn’t go straight down…