Market participants have been keen to compare 2019 to 2017, and with good reason.

2017 was defined by subdued volatility, as central banks were successful in protecting markets and underwriting the viability of a dip-buying strategy.

The macro environment that year was characterized by synchronous global growth and subdued inflation, the vaunted “Goldilocks” backdrop, which made it possible for market participants to adopt an upbeat take on the global economy, while maintaining the view that monetary policy would remain accommodative on the excuse that low inflation argued for the persistence of low rates, asset purchases and dovish forward guidance.

2019 has been a bit different. Central banks were forced to redouble their efforts after 2018’s attempt at normalization went awry, leading directly to one of the worst years for risk assets since the crisis. Growth slowed thanks in no small part to the trade war, uncertainty proliferated and the disinflationary overhang (blame whatever you will, be it demographics, automation or some combination of other “structural” factors) remained.

The plunge back down the easy money rabbit hole has been remarkable. Through late November, there were 68 rate cuts from global central banks, versus just 20 hikes, for a net 48-cut easing bias, the most in years.

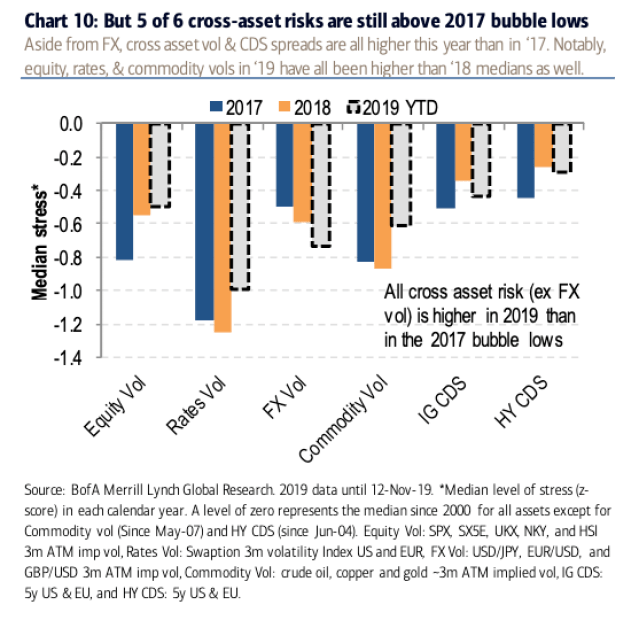

And yet, 2019 is not 2017, something BofA’s equities derivatives team points out in their year-ahead outlook.

“Global cross-asset volatility is higher in 2019 vs. 2017 for equities, rates, and commodities, and both IG and HY CDS spreads are wider as well”, the bank writes. FX vol. stands as the only cross-asset risk barometer that’s more somnolent this year than in 2017.

(BofA)

Indeed, the bank notes that “global equities, rates, and commodity vol are all higher in 2019 vs. 2018”, based on each calendar year’s median z-score versus the median since 2000. “[This] further illustrates the inability for CBs’ 2019 dove-fest to push volatility back to the extreme bubble lows”, BofA says.

This is particularly vexing considering that in addition to gradually losing their power to suppress volatility, policymakers have not generally succeeded in bringing inflation up to target.

“It’s obvious why both the ECB and the Fed are calling for fiscal stimulus to support monetary, as despite 10 years of experimental monetary policy, they have not managed to stop inflation expectations from falling”, BofA goes on to remark, adding that “both the US and EU markets [are] steadily converging towards Japan, which, outside of Abenomics, has been pinned near zero”.

(BofA)

Paradoxically, it is that generalized failure to generate inflation (and remember, it’s not so much that central banks cannot generate inflation, it’s that generating the “right” amount of inflation is tricky – bringing inflation to 20% is a much simpler task than getting it to 2% and keeping it anchored right there), that gives policymakers the plausible deniability they need to persist in the very same policies that are gradually losing the ability to suppress cross-asset volatility.

Still, given enough time, 2019’s epochal dovish pivot will likely succeed in flat-lining (and that’s both an adjective and a verb in this case) cross-asset vol.

“Volatility is nothing more than a risky form of yield, and as markets are starved for safe yield (as rates are lowered), investors are forced to sell volatility for yield — not just in the form of options, but any relative value strategy is inherently short-volatility, and lower rates make taking on this risk more attractive”, BofA goes on to say, before noting that “this effect doesn’t happen overnight [but rather] through feedback loops over time”.

Looking back at history, it generally takes around two years for those feedback loops to fully manifest themselves in markets.

The read-through, from BofA’s perspective, anyway, is this: “The policy U-turn and lower rates should eventually reverse the upward pressure on volatility that began in 2018, however, not perhaps until closer to 2021, given this historical lagged relationship”.

In the meantime, nobody is going to complain about cross-asset returns in 2019.