Barclays has seen enough on a number of fronts, apparently.

The bank on Tuesday adopted a no-deal Brexit as their base case scenario for the UK, noting that “the Johnson government is committed to delivering Brexit by the October deadline, and it has greater leeway to deliver, thereby making a no-deal outcome more likely than not”.

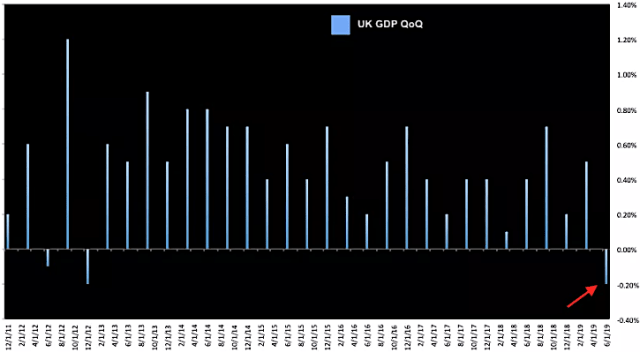

Needless to say, that wouldn’t be the best news in the world for the UK economy which, you’ll recall, contracted 0.2% in the second quarter, far worse than the stagnation consensus was looking for, and below the lowest estimate from more than three-dozen economists.

Barclays UK team says the no-deal scenario will likely “result in a disorderly withdrawal, but one that can play out gradually as policymakers engage in efforts to mitigate short-term disruptions, including through fiscal stimulus”.

All efforts to cushion the blow aside, the bank thinks a mild recession is likely. “We expect the country to enter a shallow recession in 2020 and the Bank of England to cut rates by 50bp by mid-2020, despite some initial jump in inflation on the back of the attendant currency depreciation”, the bank writes, cautioning that “the risks to our forecasts are tilted to the downside” where that means “a deeper recession could take hold should the expected disruption and confidence effects of a no-deal outturn be larger than expected”.

The UK curve inverted last week around the same time as the US 2s10s.

As ever, the financial conditions impact from that kind of shock, as well as the blow to sentiment, is impossible to measure accurately ahead of time. The pound managed to snap a 14-week losing streak last week thanks to “Remainer news flow” (I know, I know).

Barclays’ new Brexit baseline in turn prompted a change to the bank’s Fed call.

“A no-deal Brexit would take place against a backdrop of elevated uncertainty about trade policy and external demand”, the bank’s US econ team said, in a separate note, flagging decelerating European growth, “uncertainties related to the likelihood of snap elections in Italy” and “further evidence that growth momentum in China is ebbing”, on the way to calling for three additional Fed cuts in 2019, with 25bp reductions next month, in October and in December.

As far as the outlook for the US economy itself goes, that’s unchanged in the bank’s estimation.

“We think additional policy support from the Fed and from the recently passed Bipartisan Budget Act will be enough to keep the [US] expansion on track while manufacturing and trade adjust to weaker external growth”, the bank says. “Put another way, we believe that more insurance, in the form of federal funds rate cuts, is needed to deliver our previous baseline outlook for activity”.

Suffice to say the White House agrees.

We, the Brits, are screwed.