I’ve said this a thousand times if I’d said it once: I am continually incredulous that everyone else is incredulous when it comes to what lengths Recep Tayyip Erdogan will go to in the pursuit of political expediency.

Take this quote from someone called Julian Rimmer, a trader at Investec Bank in London, who spoke to Bloomberg on Wednesday for (another) piece documenting Erdogan’s move to “trap” foreign investors in his beloved lira:

I’ve never seen a move like this in the 21 years I’ve been watching this market. This amounts to sacrificing long-term pragmatism for a short-term political expedient. Such tactics will make many traders question the investability of the lira.

That same sentiment has been echoed by innumerable strategists and market watchers this week amid a ridiculous surge in the overnight rate. If you’re wondering whether the following chart (which is all the rage on Wednesday) has become meaningless to anyone not actually involved in this market, the answer is “yes”.

“The implied yield of overnight Turkish lira swaps has been trading between 600% and 750% for the last two hours [and] I don’t recall seeing this happen to any liquid and freely tradable currency in the past 15 years”, Bloomberg’s Mark Cudmore marveled on Wednesday morning, adding that “for any fund that has any Turkey exposure, VAR levels will now have shifted significantly, mean[ing] such funds will be pressured to reduce risk elsewhere until any Turkey exposure is closed.”

That pseudo-lament came hours after Cudmore explained, via a hypothetical lira long position entered a week ago, why this situation is so vexing for everyone, including most lira bulls.

As you’re probably aware, JPMorgan recently made the “mistake” of suggesting folks should sell the lira on the assumption that it may fall after key local elections later this month. You’re reminded that analysts were at pains last week to square the proverbial circle after net international reserves dropped $6.3 billion in the two weeks ended March 15, a figure that didn’t line up with external debt payments in March estimated at just $3.8 billion. The lira dove on Friday amid the confusion.

Read more

Everything You Didn’t Want To Know About Friday’s Collapse In The Turkish Lira

Last summer, when the lira was in free fall, we habitually pounded the table on the idea that nobody should be in any way, shape or form surprised by anything that Erdogan does because, after all, Erdogan is Erdogan.

Still, folks were incredulous when he installed his son-in-law Berat Albayrakc as economic czar following the landmark “election” that consolidated more power in the presidency. People were equally surprised when, a couple of weeks later, CBT left rates unchanged despite the market pricing in ~100bp hike. Here’s what we wrote at the time:

Again, it’s not clear why anyone went into this policy meeting with high expectations for more hikes. Although the central bank deployed an emergency LLW hike, simplified monetary policy, delivered a hike to the one-week repo rate and continued to insist that they retained their independence, the writing has been on the wall for months: Erdogan would commandeer monetary policy once he emerged victorious from the (rigged) election.

And even if the writing wasn’t on the wall, Erdogan made sure that everyone knew what was going to happen. Days after calling interest rates “the mother and father of all evil†during a speech to the business community in Ankara, he delivered a truly hilarious deadpan interview with Bloomberg, during which he made it abundantly clear that while short-term measures might be necessary to shore up the flagging currency, after the elections he would lower rates.

With his son-in-law now in charge of the economy, and having altered some of the laws around central bank nominees, there was every reason to believe that Turkey would disappoint and sure enough, they did, leaving the one-week repo rate unchanged.

That was in July.

Eventually – and by “eventually”, we mean after the lira went into what looked like a death spiral in August – Erdogan allowed CBT to tighten and things calmed down. Critically, the geopolitical gods smiled on the Turkish autocrat in October when Saudi Crown Prince Mohammed Bin Salman’s ill-advised decision to chop up a journalist in the Kingdom’s Istanbul consulate gave Erdogan some leverage with Washington and the international community, leverage which he wielded deftly by juxtaposing his “benevolent” decision to free Pastor Andrew Brunson with bin Salman’s penchant for dismembering Washington Post columnists.

Recent “stability” notwithstanding, last summer provided a lifetime’s worth of evidence to support the contention that when it comes to Erdogan, it is a fool’s errand to assume that he will shy away from doing what appears politically expedient and/or what he believes is necessary to protect his reputation as the strongman who, come hell or high water, will triumph over “speculative” attacks on his economy and/or currency.

Well, what’s expedient right now is cracking down on lira shorts and making absolutely sure that last week’s steep slide in the currency doesn’t accelerate prior to key local elections, which are already playing out against a recessionary backdrop.

Read more about the elections

As Turkey Sees First Recession In A Decade, Let’s Get You Up To Speed On All The Latest

And here’s the other thing about Erdogan: He tries to warn you. Every, single time he’s about to do something like this, he tells you ahead of time. Here, for example, is what he said on Sunday in a televised rally in Istanbul about banks who recommend selling the lira:

I am calling on those who are engaging in such activities ahead of the elections. We know the identities of all of you. We know what you are doing.

With apologies to everyone who has spent the last 48 hours marveling at the extent to which Turkish banks have refused to provide liquidity thereby trapping everybody in the lira and facilitating the above-mentioned 40-fold increase in offshore rates: What, exactly, did you expect? Obviously not this, but why not?

The short answer is because Turkey needs foreign investment, and when it comes to instilling confidence just six months on from a currency rout, resorting to these kind of draconian measures for the sole purpose of guarding against depreciation ahead of municipal elections seems criminally insane to outside observers – even those who are perennial Turkey watchers.

“CBRT might have temporarily stabilized the lira before local elections, but at what cost? Jacking up offshore rates to 600% now just smacks of panic – and means foreigners will struggle to hedge TURKGBs”, BlueBay’s Tim Ash said Wednesday, noting that Turkey CDS has blown out to the widest since September.

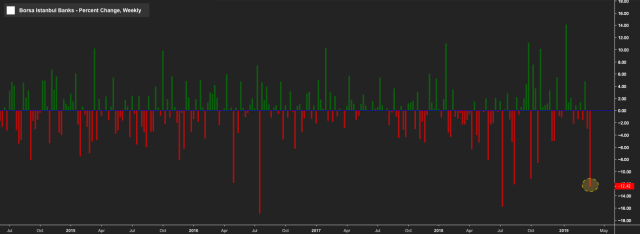

Meanwhile, Turkish stocks crashed the most since the coup. Have a look at this:

Wednesday’s near 7% plunge erased this year’s gains.

Turkish banks are down more than 12% this week.

“In the end, Turkey needs to work with foreign investors to cover its borrowing needs – that is the sad reality [and] fighting the market and investors will not end well”, Ash added.

That is unequivocally true. But again, this is Erdogan we’re talking about. The idea that he would risk a sudden drop in the lira leading to a poor showing for AKP this weekend just because a week-long crackdown might imperil future foreign investment is ludicrous. That’s like suggesting he would have risked losing last year’s landmark referendum on expanding the powers of the presidency just because not committing to a completely free and fair election risked undermining Turkey’s claims on democratic legitimacy.

The point is, Erdogan is an autocrat and he’s going to do whatever he wants to do whenever he wants to do it. If you put your money on the line without having a heart-to-heart with yourself during which you accept, without equivocation, that he (Erdogan) can and will occasionally do things that are completely out of bounds, then you have nobody but yourself to blame.

As for locals, it’s another story entirely. For them, the situation is just plain old sad. As the above-quoted Tim Ash goes on to say, “the problem is not foreigners, it’s locals selling TRY as reflected in marked pick up in dollarization [which] shows a fundamental lack of confidence at home in policy, the outlook for inflation and the fact TRY depo rates were manipulated too low by authorities.”

Right. But restoring confidence requires credible policy, and that’s arguably not in the cards, because there will never (ever) be a time when the central bank is truly independent. Erdogan isn’t going anywhere, which means that while CBT will be allowed to operate in a manner than projects credibility and independence when things are relatively stable, the specter of Erdogan-o-mics casts a constant pall over the institution.

Trump has brother, by another mother…

The Islamic dictator is on course taking the country down the economic and political crapper. The upcoming municipal elections will be rigged, again, and the demise of the country will continue until he is gone for good one way or another.

There are banks that loaned to Trump after multiple bankruptcies. There are traders who invested in Argentina’s Century bonds despite multiple defaults. There are investors who bought Greek and Puerto Rican debt well past sustainability. Plenty will plough into Turkish lira-denominated assets after this.

that’s not the part that’s absurd. carry is carry and there’s nothing wrong with gambling if the price/yield is right. the issue here is that every time this happens, EM watchers (and in some cases EM fund managers) act surprised that Erdogan is being Erdogan.