I regret to inform you that according to anecdotal desk chatter from at least two large banks, Tuesday’s manic action on Wall Street wouldn’t have been possible without the participation of algos.

But not everyone wholly agrees with that assessment. So let’s take a trip down the rabbit hole.

“Nonsense” is among the descriptors being bandied about with regard to algo trading around the yield curve inversion story. And I mean that in the sense that at least one person we spoke to believes some of the price action was not indicative of carbon-based lifeforms making informed decisions about the bond story, but rather was the result of automated non-thinking by market participants who do not blink, bleed or breathe.

And when it comes to the read-through for liquidity when electronic market making meets systematic trading meets Fed communications missteps meets unpredictable economic/foreign policy (as communicated via Twitter), one adjective we heard on Tuesday afternoon was “sad”.

Rolling it all up then, I suppose it’s fair to characterize Tuesday as “sad nonsense.”

Read more

Due to Wednesday being a national day of mourning for President Bush, everyone will have some time to reflect on yesterday’s “sad nonsense”.

When it comes to the “Whodunit?”, we covered a lot of ground in the “post-mortem” linked above and also in “On Wall Street: Midday Massacre”. Unfortunately, though, nobody has been able to offer a definitive “Colonel Mustard in the Library with the Candlestick!” take.

“On days like [Tuesday] the question is always ‘why?’ Headlines get thrown around, rumors of ‘algos’ circulate”, Wells Fargo’s Pravit Chintawongvanich wrote on Tuesday afternoon, before reminding everyone that “finding a ‘reason’ isn’t the most productive exercise [because] after all, there doesn’t have to be a reason, and knowing that reason won’t necessarily help going forward.”

That’s true, but it won’t stop everyone from trying to assign blame. Realizing that, Chintawongvanich runs through a list of the usual suspects – some are exonerated, some are not. Or at least not entirely.

As we mentioned late Tuesday, it doesn’t seem like trade jitters were the proximate cause, at least not if what you’re looking to explain is the sudden lunchtime plunge in ES and massive rally in the long end. A simple look at the relative performance of the China and EM ETFs shows they actually outperformed the S&P (right-most bars on top and bottom pane).

(Bloomberg)

What about short gamma? Remember, Chintawongvanich and others (where “others” includes us), variously suggested that lots of open interest around key options strikes tied to calls might turn dealers into forced buyers on a gap higher. That, Chintawongvanich contends, is what played out last week when the S&P logged its best weekly performance since 2011 on the heels of Powell’s dovish relent.

The short gamma effect “exacerbated the market reaction to Powell and [the] G-20 but on Monday, people were very quick to sell their in-the-money Dec7th call spreads out of the gate, creating delta to sell which pressured the market lower”, Chintawongvanich says, adding that although a lot of the December 7th trades were probably unwound on Monday, “there [was still] big open interest in Dec 7th options, especially at the 2750 strike, and if dealers were short that strike, it could have created some unpleasant short gamma effects with dealers getting increasingly long on the way down and having to sell.”

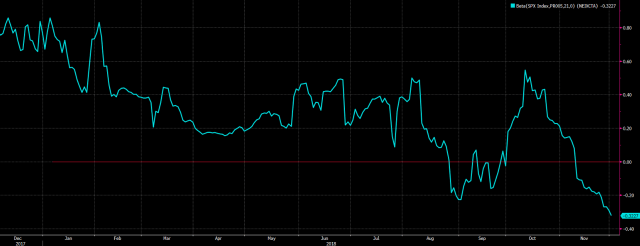

As far as positioning goes, it’s going to be pretty hard to argue that everyone was long and was thus overextended headed into Tuesday. We’ve been over this a hundred times if we’ve been over it once. Here’s the moving beta of the S&P to the HRFX equity hedge index, for instance:

(Bloomberg)

That’s just a proxy for the Long/Short crowd’s exposure to U.S. equities. The annotations speak for themselves and the purple circle is current.

That ~$900 billion universe is hardly “overextended” and as Chintawongvanich notes, that means “the selloff may be welcomed by some who missed out on the rally last week”. That is, thanks to the massive de-leveraging/de-beta’ing in October, that crowd effectively gets “shorter” when the market gaps higher, so they would probably be fine with it not doing that lest the active community’s YTD underperformance should get even worse.

As far as retail investors go, recall that Schwab’s clients raised cash (i.e., ran screaming to the sidelines) at the fastest pace since 2015 in October, when cash as a % of assets jumped to 11.1% from a record low of 10.3% in September.

Read more on recent hedge fund, retail de-leveraging

Exodus: Retail Investors Run Screaming To Cash As Hedge Fund Exposure Plunges To 2017 Lows

Further, the recent collapse of the put/call open interest ratio was pretty clearly the result of everyone who pared their exposure in October/November hedging on the upside (as call open interest jumped more than put open interest). You don’t need downside hedges against something you no longer own, but you do need upside hedges for right-tail risk. Hence more demand for calls than puts and the collapse you see in the put/call open interest ratio.

(Bloomberg)

Chintawongvanich underscores this. “The fact that everyone wanted to hedge upside probably means people aren’t long enough”, he said on Tuesday, adding that “sentiment certainly improved immediately post G-20, but positioning doesn’t flip that quickly.”

As far as CTAs go, we covered this pretty extensively on Tuesday. There’s rampant speculation that trend followers exacerbated the decline, and at least one desk blamed CTAs, which have become the market’s bogeyman par excellence.

Chintawongvanich isn’t buying that. “We are happy to report that the ‘bogeymen’ had nothing to do with the selloff in equities [Tuesday],” he says, before reiterating that on Wells’ models, “CTAs [are] moderately short in global equities and close to flat in S&P 500.” Here’s the chart we used on Tuesday which is just the moving beta of the SG CTA index to SPX:

(Bloomberg)

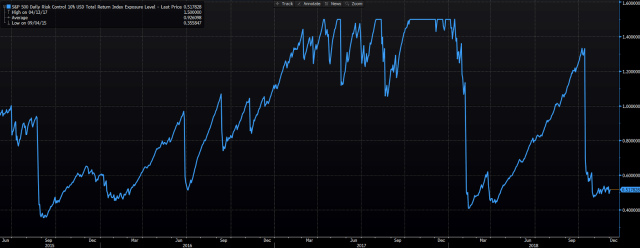

Just so we’re sure to check all the quant boxes, Chintawongvanich also says the vol.-targeters’ allocations are “still very low” after coming in substantially during the October rout. The same goes for risk parity, he says.

A quick check of the S&P Daily Risk Control 10% index (a decent benchmark for vol.-control) shows that crowd’s exposure being pared materially in October. Have a look:

(Bloomberg)

In short, volatility has not come down enough for long enough to prompt a meaningful rebuilding of that exposure.

The bottom line, for Chintawongvanich, is that “if you’re worried about robots blindly selling spooz, ‘these aren’t the droids you’re looking for.'”

So, again: “Whodunit?” If it’s not the robots, who was responsible for Tuesday’s “sad nonsense”?

Well, we would reiterate what we said in our post-mortem about the insane rally in the long-end. We’ll just quote that post as follows:

What’s not debatable is that the massive rally in the long end had a part to play. This is extraordinary:

(Bloomberg)

That was actually even more extreme at the lows — 30Y yields were down by more than 12bps at one point.

Needless to say, shorts in the long end and all the unfortunate souls who were inexplicably still sticking around in steepeners (which they’ll describe in retrospect as “tactical” in order to save themselves some embarrassment) said “to hell with this” and threw in the towel.

A massive stop out in a major asset class doesn’t just happen in a vacuum. One person we spoke to noted that the bond rally seems to have caught everyone off guard.

For his part, Chintawongvanich says it is indeed possible that steepeners being stopped out en masse might have tipped dominos, feeding through to equity vol. In addition to sending a generalized risk-off signal (what would you “think” if you were an algo and 30-year yields suddenly dove by 12bps out of the clear blue sky?) the flattening pressure wreaked havoc on financials, which could have in turn spooked the rest of the market.

It would be difficult to put it any more succinctly than Chintawongvanich puts it:

It’s not inconceivable that the volatility stemming from big players getting stopped out of one thing (rates) ends up rippling through to another thing (equities).

No, it is not inconceivable at all, and in fact it seems likely given the fact that everything started moving at once around lunchtime.

At the end of the day, it’s not possible to point the finger at one person or one strat or one shady Sophia with her dead robot eyes and creepily humanoid mannerisms. About the best we can hope for is that the frequency of these types of events doesn’t continue to increase.

That seems like wishful thinking, though. Especially in an environment where geopolitical tape bombs are becoming more and more prevalent and against a backdrop where U.S. monetary and foreign policy is made in real-time on Twitter.

USA is maybe at 1.75% GDP growth soon? Where would you price the 10s in the context of Medicare entitlement needs etc.?

A famous anecdote about AI:

Evolved player makes invalid moves far away in the board, causing opponent players to run out of memory and crash.

Let’s rephrase it

Evolved player makes sudden unexpected move far away in the market (chart), causing opponent players to run out of cash.