Boy, I’ll tell you what, this week has provided stone, cold proof that this is a market which depends almost entirely on what’s been working (Growth/Tech) continuing to work.

If you read that first sentence and you’re inclined to accuse me of trafficking in tautologies, then perhaps you should think about whether the market has itself become tautological.

More simply, perhaps you should think about just how right Howard Marks was in July of 2017 when he described the current setup as a “perpetual motion machine.”

When Growth, Tech, Low Vol. and Momentum all become synonymous, and when those classifications are used to construct a multitude of factor-based products, what you end up with is factor crowding and a steady stream of money being channeled into the same names/sectors/styles. That creates a self-fulfilling prophecy that’s manifested itself in the multi-year outperformance of Growth that’s laid waste to the AUM of folks like David Einhorn.

“The more a stock is held in non-index passive vehicles receiving inflows (ceteris paribus, or everything else being equal), the more likely it is to appreciate relative to one that’s not”, the above-mentioned Howard Marks wrote in June, nearly a year after penning the memo that contained the “perpetual motion machine” characterization.

“And stocks like Amazon that are held in a large number of smart-beta funds of a variety of types are likely to appreciate relative to stocks that are held in none or just a few”, Marks continued, adding that “what all of this means is that for a stock to be added to index or smart-beta funds is an artificial form of increased popularity, and it’s relative popularity that determines the relative prices of stocks in the short run.”

Again: It’s a self-fulfilling prophecy.

Of course it’s also self-fulfilling in the other direction, something we saw play out earlier this month when bear steepening in the curve catalyzed a Growth-to-Value rotation that ended up triggering an egregious Momentum unwind on October 10. And it’s something that played out on Wednesday, when Growth underperformed Value by ~1.2%, one of only a handful of days this year when Growth suffered such dramatic underperformance. It’s of course no coincidence that the Nasdaq plunged the most since 2011 on Wednesday amid the Growth rout. When all your leadership is sitting on one side of the fence, a rotation to the other side (i.e., to Value) is a disaster for the entire market.

Read more

On Thursday, we got exactly the opposite. One day after collapsing, the Nasdaq had its second best session since 2015.

Given everything said above, it should come as no surprise that Growth had its third best day versus Value since April of 2009.

Simply put, the entire market hangs on Growth/Tech not underperforming. The Growth-to-Value rotation simply cannot be – it must not be. Because if that rotation materializes and proves some semblance of sustainable, this whole thing goes up in smoke, like it did on Wednesday.

That’s the setup for earnings reports from Amazon and Alphabet and unfortunately for everyone who’s long, they both disappointed – at least on an initial read.

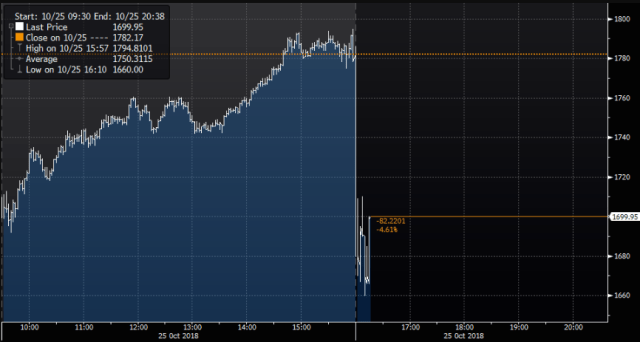

For Amazon, Q4 sales guidance came in below consensus at $66.5 billion to $72.5 billion, versus estimates of $73.78 billion. 3Q EPS was a huge beat, but this is Amazon we’re talking about, which means actual profits do not make up for disappointing top line guidance. The shares dove in AH trading after rallying a ridiculous 7% during the regular session:

(Bloomberg)

Meanwhile, Alphabet turned in a Q3 top line miss, which is also bad news. The shares responded accordingly, falling in late trading and erasing most of Thursday’s regular session gains.

(Bloomberg)

This immediately spilled over into Facebook and Netflix, with both falling 2% AH, underscoring how interdependent these heavyweights really are. And again, the problem with that interdependence is that the entire market lives and dies by Tech and Growth.

Of course the above are just the knee-jerk reactions and there’s always scope for the shares to recover once actual human beings have time to parse the results. But barring something unforeseen, the results from Amazon and Alphabet aren’t likely to inspire much in the way of confidence at a particularly delicate time for the market.

AMZN and GOOG getting taken to the woodshed after hours……

Psychometrics is certainly the tech ‘born’ into 2016 and of the future. FB, GOOG TWTR and AMZN are psyop leaders.

MSFT and IBM are ahead (in the US) on quantum computing competing with the state owned China industrials. All these business models are looking as strong as ever. Accenture ACN is also deeply in psychometrics and defense, but under the headline radar. These businesses, in an ETF or not will go still go head-to-head with China and ultimately Democracy itself, if they are in an ETF or not.

I encourage everyone I know to eschew FB and TWTR for anything but smileys on kid pics. I want rights on privacy similar to the EUs concerns. But until that regulatory threat has teeth in the US, these companies represent the wild west and the C-Suite cackle of greed which exploit privacy manipulation, judicial arbitrage and monetizing philosophical chimera of “Freewill.”

So in my mind the FAANG, by and large IS the future. The market is along for the ride as we finance Orwell’s warnings. Willingly.

Ben Hunt at Epsilon Theory has been posting interesting psychometric charts from NLP ai. Keep up on that.

PS: Theoretically, a quantum computer can crack a blockchain in a couple days (hours?), so even ‘decentralized’ crypto may be an illusion and just another node in the psychometric data grab.

There has been a bit more dispersion in the FAANGs lately which i think is interesting. AAPL and AMZN and NFLX have stayed in motion (until this month) while GOOG and FB have struggled. GOOG and FB have a lot of CF and dominant share as does AAPL while AMZN and NFLx derive more value in outer years. MSFT has also been perpetual motion but back by strong growth in CFs. There is more dispersion lately which I think is good. I may not agree with how the markets chooses them but maybe we get less of what Howard was saying going fwd. The economy and sectors are so growth deficient in many parts and growthy in so few so what we have seen makes some sense but it has seemed to have gone to extremes at times. This recent episode of indigestion has offered up some possible opportunities if one gets the future CFs right.