November scarcely needed another market milestone, having offered up a veritable cornucopia already, but I’ll toss another one out there anyway.

After a truly dramatic rally underwritten (literally) by the Fed, investment grade credit made history, as yields touched 1.82%. That tied a record-low set in August.

During the panic in March, yields hit 4.58% at the peak. Following the Fed’s historic intervention in corporate credit, borrowing costs collapsed and outflows turned to inflows in both investment grade and high yield bond funds.

Junk yields hit record lows earlier this month amid the pro-cyclical rotation that accompanied the initial readout on Pfizer’s COVID-19 vaccine.

You’d certainly be inclined to suggest that credit might be priced to perfection at this point, especially now that there are questions around the future of the Fed’s capacity to backstop the market.

But, as BofA’s Hans Mikkelsen noted earlier this month, the US high-grade market “pays out a record 40% of yield income” globally, despite comprising just 13% of the global IG fixed-income world. In simple terms: If you’re looking for high quality yield in a world where the total stock of negative-yielding debt sits at more than $17 trillion, you don’t have many options outside of USD IG.

“[Our] spread targets for DM and EM credit show the customary tightening of spreads and flattening of curves that occurs in a young expansion, with magnitudes of 10-15bp on US and Europe high-grade,” JPMorgan said last week.

“The usual drivers are in play: improving credit metrics and declining default rates as growth and earnings revive; declining net issuance and stable-ish government bond yields due to low inflation and loose monetary policy,” the bank added, noting that even so, “total return prospects across credit should be below their long-run average given near record-low starting yields and a modest backup in government rates.”

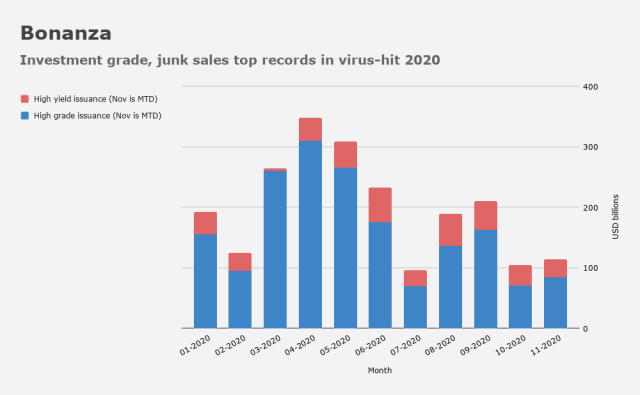

Issuance is likely to slow down in 2021, or so you’d think. The following visual is updated through last week. It’s been a blockbuster year.

Finally, I’d note that in the week through November 25, investment grade funds took in another $5.94 billion on Lipper’s data.

There has been just one week of outflows since April.

High yield inflows doubled in the week leading up to Thanksgiving, coming in at $1.2 billion.

Cuomo is threatening to shut down NYS if testing rates and hospitalizations continue to increase. Watch out for a bond rally if that happens.