The following short bit will come as no surprise to regular readers, and as such, I hesitated to give it separate treatment.

But, I decided to go ahead with it as a kind of “quick hitter,” mostly because it serves as a useful addendum to last week’s piece documenting outflows from junk funds amid the worst stretch for US equities since the March panic.

As a quick reminder, Lipper data showed investors pulled more than $2.5 billion from high yield funds in the week through October 28, while EPFR’s data showed outflows accelerating to $3.4 billion over the same period.

Read more: Stocks’ Worst Week Since March Spills Over Into Junk

Those outflows came against a backdrop that saw junk spreads balloon nearly 50bps wider on the week.

Well, for those wondering what the granular picture looked like for popular high yield products, the answer is that HYG bled some $3.7 billion from Monday through Friday. It was the single worst weekly outflow since junk cracked during the initial stages of the pandemic.

It goes without saying (or at least it should) that oil’s trials and tribulations aren’t helping matters.

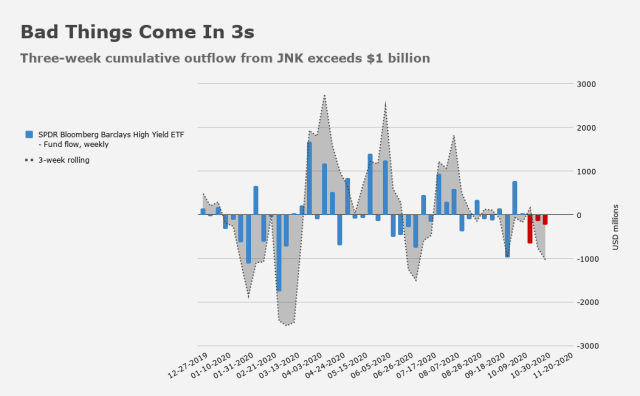

And it’s not just HYG. JNK, another popular junk product, lost in excess of $1 billion across three consecutive weeks of outflows, the worst streak since June.

Crucially, this isn’t just about pre-election jitters. Junk is highly levered (figuratively and literally) to the recovery, so any signs of waning economic momentum or news of additional lockdowns in large economies will be incrementally negative.

It helps immensely that central banks are supporting credit markets both directly and indirectly, buying IG and fallen angels, and working to sustain the kind of environment that forces investors out the risk curve and down the quality ladder.

That said, it’ll be tough sledding (or at least tougher sledding) going forward for junk if the macro backdrop doesn’t take the kind of pro-cyclical turn that many assume will accompany a new fiscal package stateside and the widespread rollout of a vaccine.

None of this is “new” (or “news”) per se, but it’s worth staying apprised. Especially for those holding these retail junk products. Despite having proven (time and again) to be far more resilient than critics perhaps thought, these vehicles still suffer from an inherent liquidity mismatch which, in theory, could be problematic at some point.

Do note: We’re nowhere near that hypothetical danger zone at present, and despite folks like myself consistently warning about the perils of liquidity transformation (which is basically the selling point for junk ETFs, even if most investors don’t realize it) there’s scant evidence to support the notion that they’ll ever truly “break.” I’ve been wrong on that warning so many times over the past decade that I’ve lost count.

Notwithstanding our collective “it’s the end of the world,” the bond market a truth machine compared to equities. I’ll take this data point as being coincident with a recognition of future prospects looking out to the period January through July.

Junk spreads will follow the direction of the economy, especially energy related which is a large share of the market. In my view, a likely outcome of all this a year or two from now is increased earnings and tepid stock market performance- P/E compression in other words. It won’t be headline grabbing, but that is probably the way market valuations come back into line. A P/E compression market probably helps high yield bond performance relative to other markets.