It’s fair to say 2020 has been a disastrous year for Exxon.

The company, once the world’s largest, is the poster child for legacy energy’s fall from grace. The short-lived crude price war between Riyadh and Moscow and the subsequent collapse in oil demand that accompanied the pandemic, were hard on producers across the board. But Exxon arguably fared worst. It was ejected from the Dow in August, adding insult to injury.

On Friday, the company reported another quarterly loss, the third in a row. Exxon lost $680 million in Q3. For the first nine months of 2020, the cumulative loss is $2.37 billion.

As a reminder, this is totally unprecedented. You can take the figure (above) back as far as you want – you will not find a comparable stretch. Recall that Exxon reported zero cash from operating activities in the second quarter.

The company’s Q3 results are worth your attention, even if this isn’t your space. Note that Chevron managed to swing back into the black with a surprise (adjusted) profit of $201 million for Q3. That compares to a $3 billion loss in the second quarter. Of course, things are far from rosy, something CEO Mike Wirth made clear, but if the outlook is poor for the industry, it’s downright bleak for Exxon.

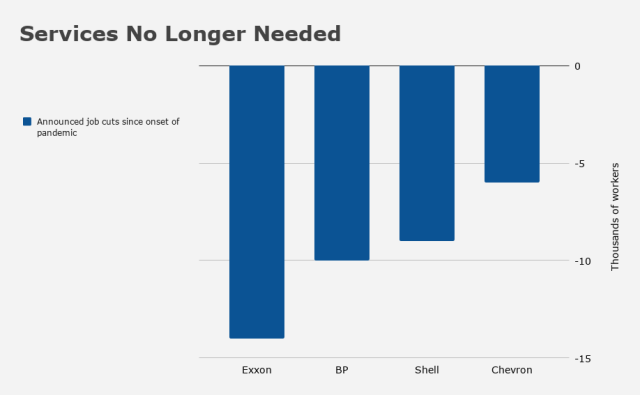

On Thursday, Exxon said it will cut 1,900 US jobs as part of its “extensive global review.” “The impact of COVID-19 on the demand for ExxonMobil’s products has increased the urgency of the ongoing efficiency work,” a statement reads.

That’s quite the euphemism: “Efficiency work.”

Compared to Q4 2019 levels, Exxon’s workforce is poised to fall by 14,000. They aren’t alone in this “efficiency work,” that’s for sure.

More cost cutting is expected in 2021. The company said Friday that spending next year will be between $16 billion and $19 billion, down markedly from the $23 billion 2020 target set in April. That figure was itself a $10 billion reduction from the original capital spending plan for this year.

As Bloomberg notes, a prospective $30 billion writedown on natural gas fields, if taken in full, “will be the industry’s worst [impairment charge] in more than a decade.”

All of this comes as “old” economy names (like Exxon) face an existential crisis as the “new normal” threatens to exacerbate already unfavorable trends. NextEra Energy overtook Chevron’s market cap this year, for example.

“We remain confident in our long-term strategy and the fundamentals of our business, and are taking the necessary actions to preserve value while protecting the balance sheet and dividend,” Exxon CEO Darren Woods said Friday, adding that the company is “on pace to achieve… cost-reduction targets.”

Everything (and everyone) is expendable. Except for the dividend. That’s sacrosanct.

A potential Biden presidency wouldn’t have to do anything to oil. No further leasing of federal lands to fracking is not regulatory. No one is talking a carbon tax. A Biden presidency would luck out by not having to get in fights with with oil and their interests; oil’s piece of pie of the global energy market is not growing as fast as the pie.

This all said, I give to local clean water and nature non-profits blah blah, but still look forward to the next oil bull market. There will probably be one if not two more bull markets in oil while I’m alive. It’s an essential commodity and there is nothing like it as a transportation fuel. In the post-COVID world, demand will perk up.

I was one of the Homers who didn’t have stops on the oil majors I held earlier this year. It was one space that seemed indispensable and capital-loss risk free to me…until it wasn’t. Took a bath.

Out of curiosity, I just went over to SA to see what they are saying about Exxon…same ole same ole (like with another debt titan, T).

As far as petro engineering goes, Exxon is the best at what they do. Exxon will probably be around for as long as we need oil. And they’ll stay that way. It’s almost inconceivable that they will attempt a transition the likes of which BP and RDS are now attempting.

Yikes, and a $30 billion write down is coming. Lights out.

I’ve had XOM for decades at a basis under $30. After watching nearly half my hard-earned profits go away, I gave it all to my favorite charities (all but 50 shares saved for old times sake). My only energy related holding is now ENB (oil and gas will be used and transported, even if the suppliers don’t make any money on it). Like it or not there are still 1.3 bil ICE vehicles running around our planet and that number is not likely to fall much in the next decade or two.

Honestly I own Exxon. I mean, it’s hard not to buy this thing with that dividend and where it’s trading, unless you think it’s just going to go away overnight. Obviously, that is NOT a recommendation of any kind, and it’s certainly not one of my favorite positions. But then again, it’s not a position I hate either. I don’t have enough tied up in to really care, and I accept that the downside can be roughly described as “existential.” But I don’t see these majors just disappearing tomorrow. They’re too powerful from a lobbying perspective and there’s still a lot of aversion to phasing out fossil fuels. (I separate my investment decisions from my personal political beliefs, btw. I hate fossil fuels.)

Those last few decades may not be very pleasant, though. A diehard income guy, I still have my ENB but sold out BP early this year. You can add up XOM, RDS, and BP market caps today and it comes to about the same as TSLA’s – and I expect that correlation to only worsen at a rate that oil dividends won’t come close to offsetting. Even assuming TSLA “pops” in some unfortunate whim of market sanity, oil’s Humpty D. will never climb back up on the wall.

Yeah, don’t get me wrong. I don’t doubt at all that I might regret holding onto XOM. It’s just that where I bought it means that even in the absolute worst case scenario, I’m not going to be terribly disappointed if it just slowly grinds to zero. What I hope is that sometime between now and a better future that is devoid of nasty fossil fuels, there will be a pro-cyclical rally that will help legacy energy recover a bit from the pandemic swoon. All I need to log a solid gain on that position is good little bump. If it never comes, well, then so be it. But I have a feeling these “dead” dinosaurs have a couple of rallies left in them.

Clearly those dinosaurs have some rally left in them. Oil well production always goes down therefore investment is need just to stay flat, no matter where you are in the world. Low prices have created a worldwide incentive to under-invest in new production. Electric vehicles, while they will take over the world, are still a minority of autos in the world. The worldwide under-investment is therefore likely to create an all time high spike in prices.

Until battery technology gets a lot better you will see quite a bit of demand for oil and natural gas. Renewables are where we eventually will get to, but not so soon- unless of course we get some real energy storage option breakthroughs and build out robust infrastructure. In the case of natural gas, that might even be longer since it will likely be a fuel for generating baseload and peaking electricity supply for quite some time. Battery tech is the key to making the electric grid reliable and for extending the range of electric vehicles if/when we enter a renewable age. It is a good and important goal for the planet’s future. But it is not going to happen overnight.

Some great comments above.

One of the few cases I recall from business school was about buggy whip manufacturers when cars started prowling the landscape. Their business did not disappear overnight but the writing was on the wall.

Should they have veered into making autoparts? Our conclusion was no – they should have just reduced capex and paid out all of their income as dividends. Why waste money battling with better equipped and more knowledgeable automakers?

BP & RDS are trying to pivot while XOM is following the “buggy whip maker” strategy.

(Over the years my partners & I occasionally cite the buggy whip case. For example when looking at Japanese or Chinese companies lurching into totally unrelated businesses, like property companies trying to manufacture computer peripherals. Most of the new ventures do not succeed.)

BP & RDS are large companies. Imagine buggy whip manufacturer which uses his wealth to buy Ford and add it to his buggy empire.

If there are some cash flowing times ahead for oil either strategy can work.