With just grocers and pharmacies open to consumers, retail sales in the UK plunged in April.

This isn’t surprising, of course. But, it’s yet another example of a print so egregious that it bears mentioning even as the conditions made it inevitable.

Last month, retail sales fell by nearly a fifth. The headline MoM read is an 18.1% decline.

I think I should emphasize (especially for new readers), that the point of presenting these figures isn’t really to parse whether a given print is a six-sigma event, or a 10-standard deviation anomaly or a 25-standard deviation dinosaur comet strike.

Rather, the point is to emphasize that these numbers represent a wipeout of years worth of economic progress in the space of just a few weeks. The chart below shows the overall index behind the visual above.

As ING points out, “in level-terms it means sales were below where they were back in 2008/9”.

The bank emphasizes the point made here at the outset. “We may be in an era where financial markets have become desensitized to big percentages, but April’s decline in UK retail sales is nevertheless shocking”, they write.

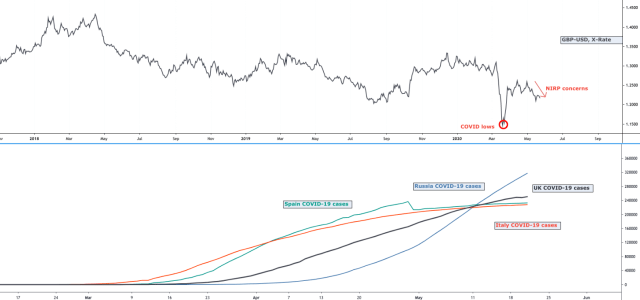

Indeed it is. And it speaks to why the BoE is now pondering negative rates in a bid to shore up the economy following the epidemic which, as you’re probably aware, hit the UK particularly hard.

Both Andrew Bailey and, as of Friday, deputy Dave Ramsden, have said they’re open to taking rates negative, which means the pound may have a date with a fresh 35-year low.

Meanwhile, Britain’s budget deficit hit a record in April, ONS said Friday.

“The coronavirus pandemic has had an unprecedented impact on borrowing, with the £62.1 billion borrowed in April 2020 being the highest in any month on record”, the government said.

The BOE is soaking up quite a bit of this. Between QE and the negative rates discussion, gilt yields are pressing to record lows.

“I’ve written a lot about what a bad idea even talking about negative rates is when the Bank

of England has a massive task ahead of it”, SocGen’s Kit Juckes wrote Friday. “This morning’s retail sales were as bad as expected, and the public sector finances are even worse than expected”, he added, noting that “the bank has a lot of bonds to buy and talking about negative rates just piles pressure on the pound, as does the commitment to finish filming ‘Carry On Brexit'”.

The outlook is obviously bleak for the economy. Data out last week showed the UK has plunged into recession. GDP contracted 2% in Q1 and 5.8% in March, sequentially. We already know Q2 will be a disaster.

That’s but a preview of the malaise. The UK’s lockdown was in place all of last month, and won’t be totally lifted for quite a while. The economy will likely shrink more than 20% in Q2.

“The sharp fall in the value of the pound and a prolonged period of subdued consumer confidence following the 2016 referendum had hit demand over recent years, while retailers were contending with the combined cost pressures of consecutive increases in the minimum wage, and more recently, inventory building around Brexit deadlines”, ING went on to write Friday, commenting further on the retail sales figures.

Needless to say, if the UK decides to pivot back to austerity at any point (déjà vu all over again), the government would risk short-circuiting any recovery officials manage to engineer.

The Brits are in a world of hurt. Brexit was conceived in ignorance and lead directly to ignorant leadership which lead to an ignorant response to a pandemic (ignorant in these cases meaning decision making without facts and logic). I’m not sure whether the US is leading or following in ignorant leadership, but we are walking the same path. Denying reality (such as wearing masks and holding no large gatherings during a highly transmissible virus pandemic) ultimately costs one big time. Our big time may not be that far off if there isn’t some radical change. Unfortunately well established power structures are hard to dislodge peacefully.

Peter Ziehan, late in his recent book, discusses one possible, future the role of the US in the UK’s future. Let’s just say that there is no interest in ongress for a 51st state quite yet. Puerto Rico and DC are ahead of the line at any rate.

“Vassal state” is too strong a phrase to characterize the potential relationship that the UK could have with the US in the future. Rather, there could be a possibility that the UK is dominated by US business interests while the UK is provided a market to sell their good into. …and, a market to buy food from.

Zeihan , a self-described geopolitical strategist, is a one trick pony.

His analysis is at times interesting and pertinent. However, most of his conclusions are flawed and are presented with the intent to provide proof for American exceptionalism.

He has turned his prognostication of America as a permanently preeminent global polity into large appearance fees. If you have seen one of Zeihan’s presentations you have seen them all. Given the research that he presents in his books, I suspect that Zeihan shills the exceptional nature of American greatness not because he believes the United States to be immune to the rise and fall of empires but because doing so has made him into a celebrity prognosticator in the time of Trump.

Worth remember that the GBPUSD has declined in the month of May for 10 straight years. 2020 is no different