Equity futures rose Wednesday, as markets look to rebound from heinous losses incurred on the heels of the Fed’s widely-panned “emergency” rate cut.

Helping to buoy sentiment is Joe Biden’s “miracle” comeback in the Democratic primaries. Investors are hoping for a “status quo” nominee and they’d certainly have it in the former vice president.

Betting markets are rapidly adjusting to the new realities of the race which, just a month ago, seemed all but lost for Biden. The PredictIt chart for Joe looks like Tesla from earlier this year.

Bond yields are still falling, even as equities look to rally. Tuesday was a historic day for US rates and the flight-to-safety bid from the virus isn’t likely to abate.

Global COVID-19 cases topped 93,000 and the death toll rose to 3,200. Iran reported 586 new cases, taking the total to nearly 3,000. Hassan Rouhani said almost all provinces have infections. Israel is instituting a one-week quarantine for school children after one tested positive. The ECB restricted non-essential travel until April and an official in the European Defense Agency in Brussels tested positive. Italy closed schools and universities.

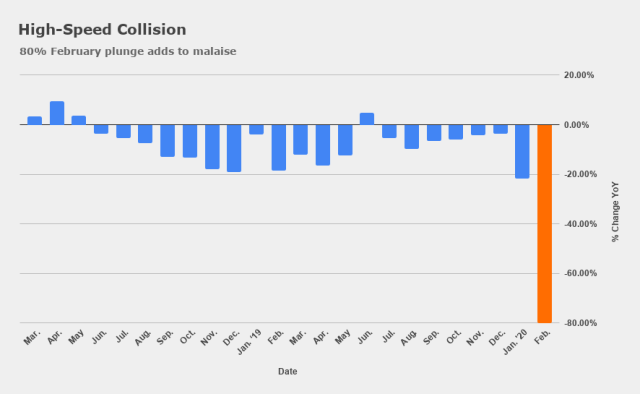

If you’re looking for more evidence of the destructive impact COVID-19 is having across economies, there’s now a preliminary print available for full-month February auto sales in China.

Car sales collapsed 80% for the month, better than the 90%+ plunge during the first two weeks, but still a shocking figure that’s just insult to injury amid what was already the country’s worst ever auto market slump.

Meanwhile, Hong Kong’s PMI plunged to 33.1 in February. That’s a record low, “beating” (if that’s the right word) the previous all-time nadir touched in April of 2003.

“The latest PMI flashed red warning lights on the dire private sector conditions across Hong Kong SAR in February amid the coronavirus outbreak, with the headline index plunging to an unprecedented level since the survey started in July 1998”, Bernard Aw, Principal Economist at IHS Markit said. “Measures taken in response to the Covid-19 situation and general fear of being infected saw business activity and new sales sinking at a record pace in an economy that has been beset earlier by political protests and US-China trade war tensions”.

This comes just days after the city reported another 20%+ plunge in retail sales. Hong Kong has resorted to cash handouts and other stimulus measures as part of the new budget but, as detailed here late last week, it likely won’t be enough.

Traders are now watching for an emergency BOE cut on the heels of the Fed’s move, and the BOC is on deck. You can be sure policymakers the world over are now pondering what – if anything – they can do to help insulate their economies.

Maybe Joe Biden has some answers.

Mother nature has spoken

yep, you could say that mother nature is expressing her view on trumpism and its populist relatives around the world. A year from now, we’ll all have a new-found appreciation of how much we depend on each other globally and how little sense the “countryX-firsters” make – anywhere.

Meanwhile, I wish some analysts would look at the China data a bit more closely and extrapolate it to other economies, with a focus on the timing of recovery after the virus has been contained. We know that China’s return to work, car sales and a variety of other metrics ranging from power to transport have all been slow to improve. How that translates in the US and elsewhere is likely to be an “even slower” recovery (I think), because we can’t react as quickly as an authoritarian regime can and because we are unlikely to use extensive quarantines to halt the virus in the first place, meaning the economic hits will likely drag on longer before the recovery really begins.

Which dynamic will kick in first? – markets having enough economic data to really repair (“ok, slower but we can see the end of it now”), or economies shifting from “pothole slowdown” to “real structural damage happening” as small businesses start giving up and debt-impaired companies start running out of time.

Italy is an example – they are letting the red zone/yellow zone experiment run its course before trying anything tougher. I think countries need to realize that Covid will kill you with your own political expediency, and the US with our decentralized health system will pay double for it.