Stimulus bets and a lack of overtly bad news looks set to buoy sentiment in a week that won’t be defined until Friday, when Jerome Powell speaks in Jackson Hole.

The Hang Seng and mainland China shares surged on Monday after peaceful protests in Hong Kong revived hopes that the violent clashes which threaten to undercut the city’s economy may ultimately abate or otherwise give way to a brand of civil unrest that doesn’t prompt an intervention by the PLA.

Still, the impact of the protests is likely to be felt for months. Hong Kong’s jobless rate ticked higher for the first time since 2017 last month, data out Monday showed. Unsurprisingly, weakness was observed in the retail and restaurant industries.

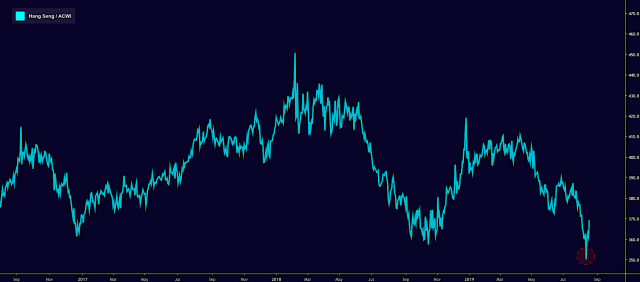

“Bargains” are likely enticing buyers in Hong Kong, and today’s gains capped off a four-day win streak. The Hang Seng is the “cheapest” it’s been relative global equities in 13 years.

Volatility on Hong Kong shares dropped the most since August 6.

It’s possible traders are also optimistic about the introduction of the improved Loan Prime Rate on the mainland Tuesday. We detailed this last week. Essentially, it’s a rate cut, but it also markets the last leg of a push by the PBoC to overhaul China’s two-track rates regime.

Read more: China Moves Ahead With Key Interest Rate Reform In Push To Lower Borrowing Costs

Additionally, Beijing is reportedly set to offer Shenzhen “favorable” policies as part of an effort to support innovation and facilitate openness to Hong Kong and Macau. State media said the central government intends to make Shenzhen City “a pioneering area of socialism with Chinese characteristics”.

Now, let’s see how long it takes President Trump to break the back of this fledging bounce with an adversarial trade tweet – or five.