One small step for the PBoC, one giant leap for everyone else’s sanity.

China is moving ahead with efforts to simplify its two-track rate regime on Friday, as the State Council issued a decree aimed at improving the Loan Prime Rate via “market-based” reforms.

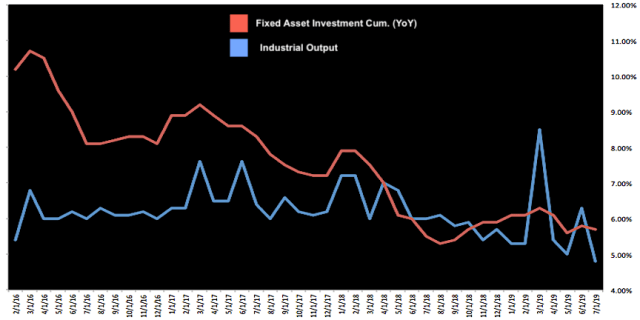

Apparently, banks will submit the prices they charge to their most credit-worthy clients in terms of basis points over OMO rates. That, in turn, will bring down the LPR as it will be effectively priced off a lower base as opposed to off the benchmark 1-year lending rate, which is generally seen as antiquated and increasingly ineffective. Colloquially speaking, Beijing wants to bring down the dark blue, squiggly line in the following chart:

The reforms will also see the addition of a five-year tenor.

The effort will “significantly lower real interest rates and resolve difficulties in financing and high financing costs”, official media quoted the State Council as saying. The rate charged to small businesses should drop by at least 1%, the government added.

Read more on the evolution of Chinese monetary policy

To be sure, this is a crucial moment for Chinese monetary policy. Analysts have variously insisted that the PBoC needs to resort to headline easing (as distinct from more targeted RRR cuts and TMLF) in order to resurrect the flagging economy.

Recent data have underwhelmed. July’s activity numbers were abysmal and featured the slowest pace of industrial output growth in 17 years.

That shocker came hot on the heels of data showing PPI deflation arriving in China for the first time since 2016. Meanwhile, credit growth data out Monday came up woefully short too.

Generally speaking, the decision to let the yuan weaken past the psychologically important (but objectively arbitrary) 7 threshold gives the PBoC scope to ease, as Beijing no longer has to worry about whether cutting rates would make that threshold harder to defend.

“We maintain our call that the PBoC will start cutting interest rates on its open market instruments in 2H19, including reverse repos, SLFs and MLFs”, SocGen said this week, adding that “it will be a good opportunity for the PBoC to announce a new policy rate and to introduce a new mechanism for banks to price lending”.

The “new mechanism” is what Friday’s news, as detailed above, is all about.