It is difficult for the BOJ to achieve everything, such as monetary expansion guideline, steepen yield curve, boost yield levels and keep the 10-year range. At some point, the BOJ will have to give up something.

That’s from Takafumi Yamawaki, head of local rates and FX research at JPMorgan in Tokyo, who Bloomberg quotes on Friday in the course of documenting the BoJ’s exceedingly precarious juggling act that became even more challenging this week as 10-year JGB yields pushed well below the lower-end of the central bank’s target range.

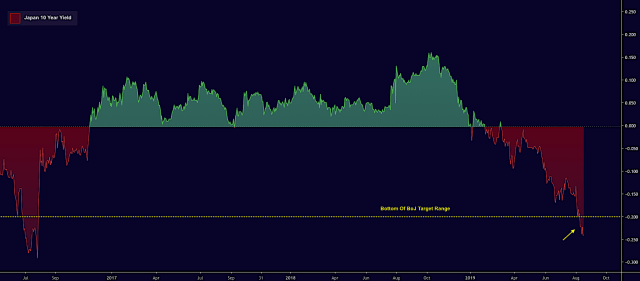

Amid an extension of the global bond rally that found New Zealand’s 10-year yield dropping below 1% for the first time ever following a contractionary PMI print on Friday, 10-year JGB yields dropped to -0.255%.

That was the lowest since 2016 and puts Kuroda and co. in a tough spot. If they act to push yields higher, they risk catalyzing a tantrum scenario (although in the current environment, it seems unlikely that any effort to relieve downward pressure on yields would be that “successful”). If, however, the bank countenances further undershoots of the lower-end of the range, it’s a sign of policy impotence.

On Friday, the bank slashed purchases in the five-to-10 year bucket by JPY30 billion, the first cut in nearly nine months. YCC has entailed what, in market parlance, is known as a “stealth taper”, as a “happy” side effect of the focus on controlling the shape of the curve.

The cut to purchases was expected given the renewed plunge in yields. JGB futures pulled back from record highs, but you can expect the market to keep testing Kuroda until he delivers a more forceful message.

At the same time, the surging yen has weighed on Japanese equities. The Topix this week wiped out its 2019 gain (it’s since turned marginally positive) as the yen pushed to its strongest since March of 2018 (excluding the January flash event) amid incessant safe-haven flows.

Meanwhile, Japanese added $104 billion in US Treasury exposure in the eight months through June, the latest TIC data showed Thursday. That is the most voracious pace of buying in half a decade and underscores the extent to which negative yields in other locales are likely turbocharging the rally in US Treasurys by creating foreign demand.

Japan overtook China as America’s largest creditor in June for the first time since May of 2017. Japan’s pile of US bonds, bills and notes rose to $1.12 trillion. China’s holdings did rise in June for the first time in four months, though, to $1.11 trillion.