To say Monday was a rough day for Chinese stocks would be to grossly understate the case.

As US equity futures dove and the yuan slumped following Donald Trump’s trade broadside, it was clear that Mainland shares were going to come under immense pressure following the holiday. But by the end of the session, it was an outright bloodbath.

The ChiNext dove an astounding 8% on the session, for instance, a rout reminiscent of the worst days in 2015 and early 2016. The CSI 300, meanwhile, closed 5.8% lower, for the worst session in more than 3 years.

It was obviously the same story for the Shanghai Composite.

The SHCOMP has now fallen nearly 12% from its April highs, as Monday’s turmoil came hot on the heels of a pullback catalyzed by worries that a stabilization in the domestic economy could prompt Beijing to adopt a more measured approach to stimulus.

State funds stepped in to try and arrest the slide, according to the ubiquitous “people familiar with the matter”. State buying could be seen in, for instance, PetroChina and Industrial and Commercial Bank of China.

Meanwhile, at least one large bank was seen selling the dollar in a bid to stabilize the yuan, as it dove to 6.80. For a moment, the offshore yuan was down the most in a single session since the 2015 devaluation.

Read more: China Considers Canceling Trade Talks, Yuan Dives, PBoC Announces Targeted RRR Cut

H-shares fell nearly 3% on the day, in the worst rout since October.

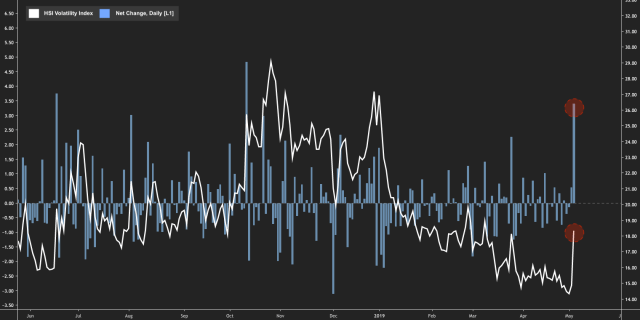

Monday marked the largest spike in the Hang Seng volatility index in nearly seven months.

You get the idea. Trump’s tweet came out of left field and while Beijing says a delegation is still planning to travel to Washington, it’s now unclear when and it’s also not certain that it will be led by Vice Premier Liu He.

If this gets devolved back down below principal-level talks, it could conceivably delay the proceedings even further. It’s also likely that Xi (and Liu) are embarrassed and/or feel betrayed by Trump. If that’s the case, Beijing could dig its heels in.

In any event, the focus is now squarely back on market volatility and away from any stabilization in China’s economy. It’s worth noting that the announcement of targeted RRR cuts did nothing to stop the slide on Monday.

Why can’t US markets have down days like that?

The PPT, market manipulation, the Fed? Yes, yes & definitely YES

No, no and definitely no.

Literally none of what you said there is true. If you know anything about Mainland Chinese markets, you know exactly why it has down days like that.

You’re trafficking in conspiracy theories.

This is no big deal…. The “Orange One ” just yelled fire in a crowded theater after the media had spun this trade deal as a sure thing after month of positive spin. Everyone is on the same side of the boat and now will come the False Alarm signal….Will take about three trading days to settle down but systemic issues remain …Be warned..!!

I disagree that it came of left field…Pyongyang is stepping out of its box again and the Orangeman doesn’t have any other levers to pull…expect a cyber event in the near future…