You could easily attribute it to generalized growth concerns and/or to Donald Trump’s ill-advised decision to pick another fight with Brussels, but it might be better to simply say that after eight days of gains, US equities finally decided to take a breather.

Whatever you want to blame, the streak is no more – the S&P fell the most in two weeks on Tuesday, snapping an eight-session string of gains amid a somewhat dour prognosis on the global economy from the IMF and worries that the Trump administration’s move to publish a list in conjunction with proposed tariffs on EU products ranging from helicopters to “uncooked crustaceans” bodes ill for already strained relations between Washington and Brussels.

Transports were hit particularly hard, falling more than 1% on the session. It was another crap day for Boeing, which is on track for a rough April after suffering through the worst month since January 2016 in March. 10Y yields stateside fell back below 2.50 as Treasurys clung to gains amid Saudi Aramco’s $12 billion offering. This isn’t exactly a picture of “inspired” action:

It’s entirely possible that risk appetite was tempered ahead of the ECB and the March Fed minutes, both of which have the potential to move markets if they go too far in the direction of underscoring growth concerns just as market participants appear willing to take ostensible “green shoots” seriously. Remember, when it comes to central banks, you want dovishness predicated on “patience” and an abundance of caution in the face of downside risks. What you don’t want, though, is dovishness predicated on panic. And there’s a fine line between those two flavors of dovish policy leans.

In any case, we don’t need to conjure an explanation every time stocks fall. But it would be interesting if things roll over from here, considering this is still generally thought of as a rally that “nobody owns” (see chart on the left below), so to speak. If things go south, it would presumably mean the hoped-for “force-ins” never materialized.

(Goldman)

With sentiment and optimism around central banks’ ability to engineer a rally having driven most of 2019’s mammoth gains (see chart on the right above), it will fall to the data to “prove” the optimists right. “From here we think risk appetite can pick-up further but only alongside better growth data, which our economists expect in the second half of the year”, Goldman said on Monday evening, adding that while they “remain constructive in our asset allocation, we would add protection hedges as risky assets continue to outperform and volatility resets lower.”

And that pretty much captures it – everybody is “constructive” in light of green shoots and central banks reverting to vol.-suppression mode, but there’s a lingering sense of dread that’s keeping folks cautious at best, and sidelined entirely at worst.

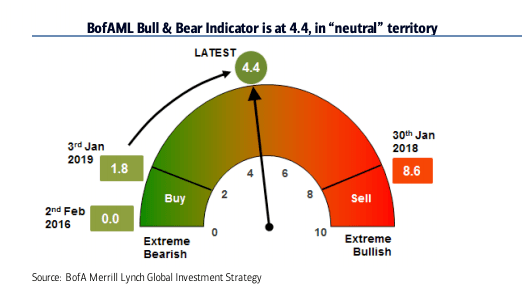

You’re feeling a lot better about things if you were lucky/prescient enough to dive in after the December rout, but even still, you’re facing a quandary. “It’s the best year ever [with] commodities annualizing a price return of 84.8% YTD [and] global stocks annualizing 67.9%”, BofAML’s Michael Hartnett wrote late last week, before noting that despite the gains, his famous Bull & Bear Indicator says “it’s too early to sell.”

(BofAML)

“We see SPX >3000 driven by oil and banks [and] expect a ‘top’ in Q2”, he wrote, in the same note.

Perhaps SocGen’s Kit Juckes summed things up best prior to the US session on Tuesday. “There’s no new progress on US/Chinese trade talks, and I’m doubtful today’s data will do anything at all to answer questions about the state of the US economy”, he wrote, before flatly observing that “slowing slowly with a patient central bank is a recipe for volatility to stay low and for cash to flow towards yield, oil and Chinese stability.”

Generally speaking, that’s bullish, but every now and then, folks will sell – if for no other reason than because they don’t have anything else to do.

I’m not sure “inspired” action, or lack thereof, does today’s trading enough justice. NDX volume was nearly 80% off its average.

My sense is that the bulk of market participants don’ t want to see an end to this free lunch any more than they ever do..But end it will in a time of no ones choosing. One can find an infinite (literally) amount of explanations for each and every 1/2% move and reality is that talk is a lot of wishful thinking. Even Charlie can be off now and again(amazingly so it seems). Boat is stacked heavy to one side (look out) Actually I think that is what H….is saying as well

Today’s commodities gains are tomorrow’s inflation. 5-8% up from here even with minimal inflows before

meaningful pullback. Watching transports the next few weeks for indications of momentum going into historically weak late April/Early May time frame aka the time of year for short term peaks.