Well, suffice to say mainland shares are excited about Donald Trump’s decision to extend the deadline on trade talks with China.

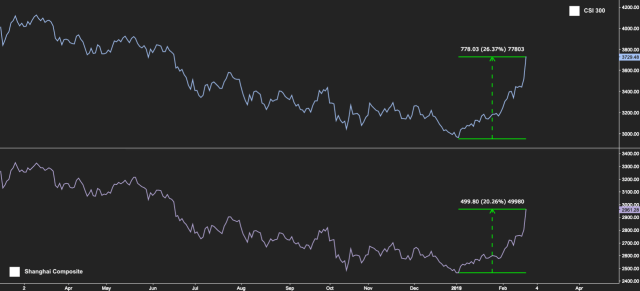

If you were quickly scanning your screens on Monday morning, you’d have been forgiven for thinking someone had made a mistake. Because it’s not often that you see the CSI 300 surge 6% in a single day. But that’s exactly what happened on Monday on the heels of Trump’s late Sunday tweet proclaiming “substantial progress” on a variety of issues, including key structural sticking points. This was the best session for the benchmark since the wild days of 2015 when mainland shares were in the midst of a historic, margin-fueled bubble (that ultimately burst, prompting the creation of the vaunted “national team”).

The SHCOMP had a similarly euphoric session. If it finishes this week higher (and after Monday, something would have to go horribly wrong for that not to be the case), this would be the eighth consecutive weekly gain.

Both benchmarks are now in bull markets off the January 3 lows. This is – umm – quite something to behold.

If you use a 9-day RSI (as opposed to the standard 14), this sucker is pushing the limits of what’s possible (h/t to Bloomberg’s Andrew Cinko).

Amusingly, every single stock with the word “securities” in its name rose by the 10% limit on Monday.

That’s thanks to Xi, who told a Politburo meeting that Beijing will be deepening finance sector reforms in the interest of further opening up the industry. Here’s an absurd visual that underscores the point:

Yeah, sure – why not?

Oh, and the ChiNext surged 5.5% on Monday too. It was already in a bull market as of Friday.

Obviously, all of the above is overtly silly. Sure, there was a strong argument to be made that mainland shares were oversold after last year and were thus due for a bounce on any concrete signs of trade progress, but what you see above is pretty clearly the result of a raft of efforts designed to roll back the deleveraging push in the interest of rescuing equities and resurrecting risk-taking.

I suppose if Beijing is hell-bent on turbocharging this, they’ll be some semblance of successful. After all, there’s more than a little room for margin debt to rise (it hit a four-year nadir late last month) and if January’s credit data was any indication, China is ok with shadow banking becoming “great again” in the interim if it means reinvigorating sentiment.

Still, you can’t help but get the feeling that caution is warranted considering the sheer ferocity of this move. For those interested, below is a snapshot of valuations for both the CSI 300 and the MXCN.

(Goldman)

Fake news. Chinese accounting, that is. In fact, and let me make this clear, you can’t trust ANYTHING the Chinesers say. For example, a billion? My big fat hairy orange ass. In reality, the population of their country is only 22 million, and a small dog called ‘Bowser’.

Need a border wall built for MXCN…national emergency.

Interesting how the VIX is responding to this “euphoric” news. Last time the SPY and VIX were positively correlated to the upside for multiple days: late Jan/early Feb 2018. And that was a fun ride.