If you wanted to adopt Kuroda’s penchant for optimism (or, as he puts it, “positive attitude and conviction”), you could conceivably argue that the BoJ’s fourth straight cut to the inflation outlook is good news as it suggests a “hawkish” surprise is not in the cards, especially in light of the cloudy global growth outlook.

But that kind of begs the question – at this point, the bank’s “very powerful” characterization of its various easing measures has become a standing joke. If what you’re talking about is breaking the deflationary mindset and getting up to target, there’s not much that’s “very powerful” about the policies. The bank is so far away from target that you can’t even put the target on a chart because if you do, the actual lines look flat. This is clearly a hopeless endeavor:

(Bloomberg)

As alluded to above, a naive interpretation would be that it’s a positive for risk assets that the BoJ has missed its window and therefore can’t really fathom an exit strategy, let alone one aggressive enough to “surprise” the market. But then again, the fact that they’re not announcing anything new despite a clear reflationary predisposition seems to suggest that they know they’re out of options (i.e., reaching the limits of what monetary policy can do).

Of course Kuroda doesn’t see it that way. “Our policy options have neither disappeared nor narrowed”, he said Wednesday. On trade, Kuroda expressed optimism that a resolution to the Sino-US dispute is in the cards, but he joined everyone on the planet (well, everyone on the planet who isn’t a member of the Trump administration) in warning that “prolonged trade friction would deeply hit the global economy.”

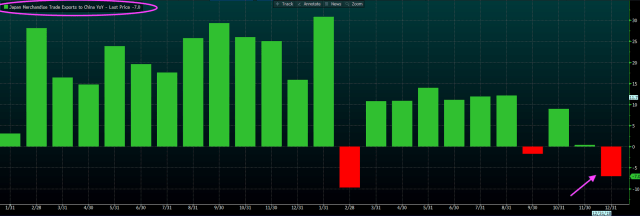

The BoJ cited oil prices in cutting the FY2019 inflation forecast and Kuroda reiterated the necessity of dragging inflation kicking and screaming back to target before normalizing policy. His comments came just hours after Japan reported the second drop in exports in four months.

(Bloomberg)

I’m no Japan specialist, but I’m going to go out on a limb and say the following visual bodes ill and speaks to a lot of the same dynamics that have the world on edge about the trade conflict and China’s sputtering economy.

(Bloomberg)

“For the time being, the BoJ probably has little choice but to retain current monetary easing, as it did at the today’s MPM”, Barclays writes on Wednesday, adding that over “the longer term, however, it faces a dilemma with sluggish CPI inflation on the one hand, but the mounting side-effects of its extraordinary easing, especially NIRP, on the other, forcing it to take a discretionary, pragmatic and opportunistic approach to managing monetary policy.”

The yen dropped following the cut to the inflation outlook.

Barclays is sticking with their call for the BoJ to try and exit NIRP in favor of ZIRP in July. If they (the BoJ) can’t manage that, here’s what happens next, according to the bank:

In terms of Japanese fiscal policy, it appears that tightening due to the October consumption tax hike (JPY5.7trn, or 1.0% of GDP) will be largely offset by a range of mitigating measures, including exemptions from the hike for certain necessities and a free education policy. Even so, we believe the economic cycle will show swings in H2 FY19 (October 2019 to March 2020) due to pre-hike frontloading of consumption and the subsequent payback, making it natural to expect the BoJ’s window of opportunity to close from the viewpoint of coordination with fiscal policy. If the BoJ foregoes its opportunity in Q3, we believe it could be forced to retain NIRP for an extended period out to 2020, when the prospect of recession will strengthen, in our view. This could lead to the accelerated accumulation of the policy’s side-effects such as profit deterioration at financial institutions.

I’m sorry, but this looks increasingly hopeless. As always, it’s complicated immeasurably by the yen’s safe haven status. Any flight to safety that ends up bolstering the yen undercuts the inflation targeting effort further and as we saw on multiple occasions in 2018, trying to tweak YCC and otherwise wake up the moribund JGB market has the potential to catalyze a lot of volatility and it wouldn’t take much to accidentally trigger a “tantrum” episode there given how thin the market is.

All of that is to say nothing of the ETF program, which nobody knows how the BoJ is going to unwind. You can’t classify a massive equity book “held to maturity” because stocks don’t “mature”, so presumably, they’ll want to dispose of those holdings at some point. Of course you don’t want to sell into a falling market (both for your own sake and for the sake of the market itself) and given the size of their holdings, it’s hard to imagine how disposing of them in a way that’s not destabilizing is possible (more on that here).

In any case, everyone has kind of learned to just dismiss these BoJ meetings because nothing ever happens, but that’s precisely why they shouldn’t be ignored. The fact that nothing is happening despite, on one hand, the longer-term necessity of rolling back accommodation and, on the other, the assumed short-term necessity of doing more considering inflation isn’t cooperating, suggests that policymakers are stuck. I realize that “boxed in” is a tired, old click-bait title for central bank posts, but the BoJ really is “boxed in” – there’s just no other way to describe this scenario.