Needless to say, Apple’s “shock” guidance cut has prompted a wave of price target rethinks across Wall Street as analysts ponder the end of the company’s growth run.

As noted here just after the news crossed on Wednesday afternoon, Apple has become synonymous with the macro narrative, which means the guide down has the potential to undercut confidence at a broader level in addition to the technical damage incurred by suppliers and the mechanical index-level damage dictated by the company’s weight. Apple not only sets the macro narrative, in many ways it is the macro narrative.

Read more

As for the Street, folks aren’t generally amused, although the extent to which they’re “surprised” varies.

“Apple’s guidance cut confirms our negative view on demand in China that we have been flagging since late September [and] we are reducing our FY19 revenue estimate by 6% to $253bn and FY19 EPS By ~10% to $11.66”, Goldman writes, on the way to cutting their 12-month price target to $140. That’s predicated on a 12x P/E multiple (ex. cash ~10x).

“We see the potential for further downside to FY19 numbers depending on the trajectory of Chinese demand in early 2019”, the bank cautions. Here’s a table that summarizes Goldman’s take:

(Goldman)

In addition to Goldman, Piper is slashing their target to $187 (from $222), Nomura takes their target to $175 from $185, BMO’s target goes to $153 from $213 and Morgan is cutting their target to $211 from $236. I’m sure there are more and this will keep coming all day – you can count on it.

Meanwhile, suppliers including Hon Hai Precision, Taiwan Semi, Luxshare Precision and LG Innotek all dove in Asian trading, although some names pared losses a bit.

(Bloomberg)

In Europe, suppliers are similarly beset, as is tech more generally. Here’s a snapshot of some notable names:

(Bloomberg)

And here’s the SX8P, which is down nearly 4% on the session, although it’s still early.

(Bloomberg)

Clearly, Wall Street is going to feel the heat from this at the open. Whether things can turn around as the cash session plays out is anyone’s guess, but as noted on Wednesday evening in the linked post above, this is a decidedly bad omen at just the wrong time.

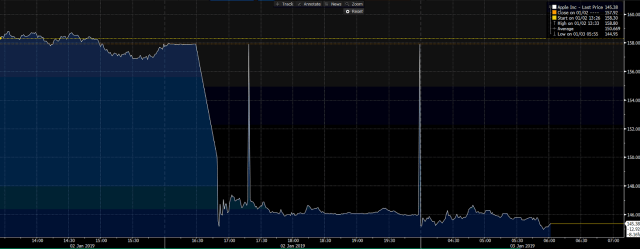

Apple itself is obviously down sharply in the pre-market, in accordance with after hours trading from Wednesday.

(Bloomberg)

Or Apple will reach oversold status and the BTFDippers will snatch up shares with a new 2% dividend yield, the price will revert within weeks, and none of this matters. We’ll see.