Well, predictably, Friday turned into another sour day on Wall Street.

If you came in thinking the Fed was the only thing markets are concerned about, you’re probably disabused of that notion now. John Williams did an admirable job of “clarifying” the Fed’s position in an interview with CNBC on Friday morning and that was good for a fleeting bounce in equities.

Read more

CNBC Gives Fed A Mulligan As John Williams Explains What Powell Actually Meant

But it was quickly (and predictably) faded amid a flurry of bombastic tweets about border security and clear indications from Chuck Schumer that the wall (or the “slats” or whatever you want to call the monument to xenophobia the President wants to construct along the southern border) will forever be a figment of Trump’s imagination.

(Bloomberg)

Also weighing on sentiment Friday was the Thursday evening resignation of Defense Secretary Jim Mattis, whose letter to the President was remarkable for what it said about the Pentagon’s reservations about the relative merits of the White House’s foreign policy.

Read more

Jim Mattis Resigns – The Last Adult In The Trump Administration Is Gone

Trump spoke to reporters at a signing ceremony for criminal justice reform, and the specter of a Christmas shutdown cast a pall over the event. Trump made a series of characteristically absurd remarks.

At one point, the President actually said the wall would pay for itself in monthly installments.

He also claimed that the internet is causing “human trafficking to be at the all time worst”, a non-factoid that in his mind, justifies spending $5 billion of your taxpayer dollars on “well designed steel slats”.

This is all too much for markets. It’s just that simple. Normally, government shutdowns don’t have that much of an impact, but in addition to underscoring the contention that America’s elected representatives are simply incapable of doing what they were elected to do (i.e., legislate), the current situation lends credence to the notion that the President isn’t well. No malice intended (for once). Trump clearly isn’t in full possession of his faculties. The Mattis resignation letter essentially confirms that assessment.

This will go down as one of the worst weeks for U.S. equities since the crisis.

(Bloomberg)

It’s the worst week for crude since 2014.

(Bloomberg)

Both the Nasdaq and the Nasdaq 100 are in a bear market. The QTD rout in FAANG+BAT is simply astonishing. But hey, not everything in the FANG+ index is red this quarter.

(Bloomberg)

Just a couple of additional quick notes on credit. I realize I’m beating a dead horse at this point considering how much attention we’ve devoted to it this week, but humor me for a few additional visuals, starting with CDX IG and HY spreads widening again a bit — here’s the look since Powell:

(Bloomberg)

The CDX high yield index is now sitting at its lowest since June of 2016.

(Bloomberg)

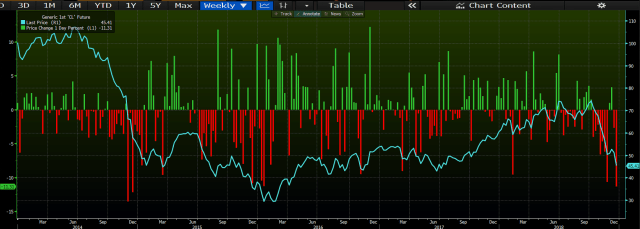

Outflows from mom and pop’s favorite liquidity-mismatched junk ETFs are piling up, with Thursday marking one of the largest outflows on record for HYG.

(Bloomberg)

The weekly look is particularly flagrant.

(Bloomberg)

We documented the latest news on outflows from leveraged loan funds early Friday morning, but we wanted to make one last point on that. BKLN is now trading at its largest discount to NAV since 2011.

(Bloomberg)

Finally, do note that there is no liquidity. The following are updated visuals from Goldman’s Rocky Fishman which show that bid/ask depth and top-of-book depth are actually worse than they were in February.

(Goldman)

Oh, one more thing. It won’t be long now…

(Bloomberg)

Read an interesting article on Quora by someone reputed to know T Rump and stated he was an Adderall snorter….now that makes perfect sense.

His brain certainly seems ‘fried.’

The fact that this Country was able to Elect an idiot as Chief Executive says very little for the Political system..The fact that an Economy that can’t sustain 3% interest rates is called robust is not a testimonial to our strength and stability. The fact that John Williams was trotted out to sacrifice for the diminished credibility of the corrupted Fiscal/Monetary regime is also no surprise. The only surprise in fact was that it has taken this long to arrive at this juncture.

It will be fun to see what mechanisms/rabbits are pulled out of the proverbial Hat to gloss over this Christmas present. Ahh, to be as eloquent as H….would top my year off…Practice makes perfect (better will do).

g………

Who do I have to bribe to get you to come back to Seeking Alpha, Heis? Your insights would have been greatly appreciated this month. I’ve been short HYG since December last year when I first read one of your posts about liquidity and credit spreads…it’s finally panning out!

Touche, great post

The saying “The market can remain irrational longer than you can remain solvent.” is stupid. You just have to plan. I was super close to taking my profits yesterday.

Yellen already publicly called stock market valuations rich near the end of her term, indicating to take profits (i.e., the Fed put strike would not be raised). You got burned, you don’t have Powell to blame for it folks.

And then we have the shit-for-brains WSJ:

“Mr. Trump entered the Presidency as a disrupter of the status quo, for which he has many fans,” the editorial board wrote. “We include ourselves among those who believe the political status quo–here and abroad–was overdue for challenge. He has provided that with a sharp cut in the U.S. corporate tax rate, economy-wide deregulation and U.S. withdrawal from the Obama Iran nuclear deal and the Paris climate accord. “

Then came the “but…”.

Butt me in and butt me out for as much as I can get….WSJ