Right up until Wednesday at lunchtime, when Jerome Powell saved the world from himself, there was a lot of fear out there.

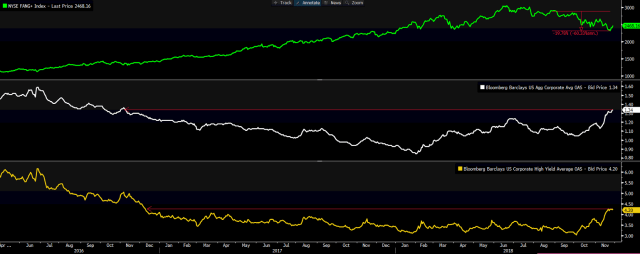

Equities were in a tailspin prompting Donald Trump to cast Powell as the Skeletor to his He-Man, credit spreads were blowing out and leveraged loans, one of 2018’s only winners, were starting to look shaky as well.

Read more

The $1 Trillion Leveraged Loan Bubble Looks Like It’s Popping — Here’s Some Deadpan Color

Jeff Gundlach Is ‘Amazed’ At How ‘Copacetic’ Markets Are About Coming Credit Apocalypse

Perhaps most disconcerting of all (at least for the retail crowd and also for hedge funds whose “VIP” lists are littered with the same names that have driven benchmarks inexorably higher), FANG+ and Tech/Growth more generally were in what counts as free fall for a group of stocks that, until this year anyway, were basically bulletproof if you could stomach some post-earnings turmoil on occasion.

(Bloomberg)

But for all the hand-wringing, options tipped a market that was complacent or, to quote Jeff Gundlach who likes to prove he knows big words, “copacetic”. For instance, the Credit Suisse Fear Barometer (a gauge of the cost of downside protection versus upside options), dove to a fresh five-year low last week.

(Bloomberg)

The same dearth of demand for downside hedges is readily observable across similar metrics (you can read more on this from Bloomberg here, but not until you’ve finished reading this post, ok?)

“The S&P 500 put/call open interest ratio recently plunged to multi-year lows [and] a few clients have been asking how this should be interpreted”, JPMorgan’s Bram Kaplan and Marko Kolanovic write, in a note dated Monday.

I’ll save you some suspense: the ostensible lack of interest in downside hedges is due to the fact that everybody already de-leveraged, de-grossed, de-netted, de-beta’d or otherwise vomited and you don’t need to hedge against further declines in something you don’t own anymore. That’s the simple version.

If you check out the chart below, what sticks out (and even if it didn’t stick out, there are big red circles which help you focus) is that over the past 13 or so years, there’s a fleeting spike in the put/call ratio when things start looking tenuous and then a collapse during the ensuing corrections.

(JPMorgan)

Again, the explanation for that is both intuitive and straightforward.

“This happens for several reasons”, Kaplan and Kolanovic write, before listing those reasons as follows:

- investors sell much of their cash equities, which reduces put demand (since you don’t need to hedge what you’re not long to begin with);

- options become expensive as volatility spikes, leading some investors to short futures rather than buy puts to hedge further downside;

- call demand increases as investors buy calls or call spreads to hedge right tail risk from being underweight or short equities; and

- investors monetize some of their hedges (reducing put OI)

I suppose you can take some measure of comfort in all of that, assuming there’s solace to be had in knowing that the reason upside hedges are in demand more than downside protection is because everybody already sold everything and the only thing left to do now is buy some calls on the off chance Jerome Powell stops being “loco” and catalyzes a rally. Like he did on Wednesday.

I usually check SKEWX It was giving me more or less the same explanation. The market bought protection the whole summer, and during the fall protection was not in high demand, with skewx enigmatically low. The only explanation was that the market was already well loaded with puts, accumulated during the summer rally. Maybe the hedge funds haven’t been very smart with their momentum trades/longs but other market participants have been on alert and acted, with likely nice profits in October https://invst.ly/9d1gh

This week demonstrated once again that when you miss days like Monday and Wednesday the performance sucks. Many studies show that if you are not invested and you miss strong days, you can forget the average 8% yearly performance, it’s enough to miss some days and you are at 4%, miss more and you are close to 0%.

On the other hand just see how the mood was last week. With this week full with events (macrodata, Fed, G20). It wasn’t easy to remain long 100%, everything turned out fine but it could also turn out bad. I risked 30% long.

Really difficult weeks to trade. Really difficult 2018 in general. Still having a positive performance, but I have the feeling I never sweated so much.