If you’re looking for reasons to stay bullish on U.S. stocks amid a deteriorating outlook for global trade and ongoing geopolitical tension between the Trump administration and, well, and damn near everybody, you can lean on two things:

- buybacks

- earnings

Both of those tailwinds are linked to the administration’s decision to pile fiscal stimulus atop a late-cycle economy, a move that will invariably produce a sugar high and help prolong what is already the second-longest expansion in U.S. history.

The question, as ever, is what the longer-term consequences of this are. More to the point, fiscal policy in the U.S. is an anomaly. We are, as Goldman put it earlier this year, heading into “uncharted territory“:

Larry Kudlow’s protestations (read: lies) aside, the deficit is widening at a time when the Fed is aggressively tightening policy. That, Jeff Gundlach recently suggested, is a “suicide mission“.

The irony here is that the reason the Fed is so keen on staying ahead of the (Phillips) curve is that piling fiscal stimulus atop an economy operating at or near full employment risks an inflationary outcome, purportedly “structural/endemic” deflationary forces notwithstanding.

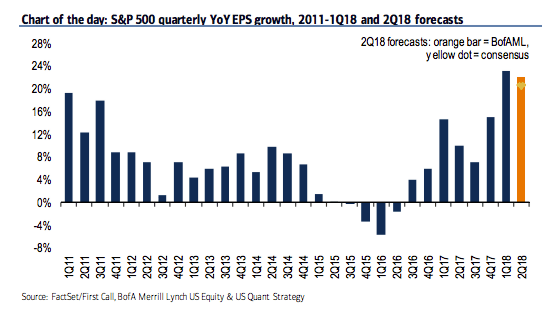

But sustainability be damned, we’re pushing ahead with this lunatic plunge into fiscal largesse (which, by the way, is completely anathema to the GOP’s traditional lip service to fiscal rectitude) and in the short-term, that’s likely to give corporate earnings a boost. We saw this in Q1 and BofAML expects Q2 to come in hot as well.

“We forecast EPS will come in modestly better than analysts expect, 22% YoY, supported by very strong results from early reporters, positive (though decelerating) US data surprises, better-than-expected US GDP growth (which is tracking 3.6% in 2Q vs 2.3% in 1Q), and strong ISM indices,” the bank’s Savita Subramanian writes, in a note dated Tuesday.

You’ll note that this comes just over a week after Goldman upped their 2018 EPS forecast for the S&P but not their price target. Factors limiting multiple expansion from here include margin pressure and of course, trade tensions.

On the former, Subramanian notes the obvious, which is that “companies who cannot pass through higher wages and/or input costs could be at risk.” Here’s more:

10% of companies cited higher labor costs in 1Q18 vs 8% in 4Q17 (the highest since we began tracking in 2015), and wage growth is at post-crisis highs (Chart 7). We have not seen a hit to margins yet, but operating margins have softened in Consumer Discretionary (the most labor-intensive sector) plus several others.

And what about guidance? After all, Daimler recently became the first major company to issue a profit warning citing trade jitters and we’ve seen a veritable chorus of other corporates cautioning that tariffs represent a threat to their business. On that score, BofAML says it’s “so far, so good”:

This quarter we will be paying close attention to management guidance and commentary for any deterioration in outlooks driven by uncertainty around growth or trade, which could halt the capex recovery and stall confidence. So far, so good — management has continued to guide above analysts’ upwardly revised earnings estimates (Chart 5), and has also continued to guide above analysts’ forecasts for capex (Chart 6), though the capex guidance ratio fell to slightly below average levels as of our latest update in June.

That’s all fine and good, but you needn’t be some kind of doomsayer or tinfoil hat enthusiast to observe the proverbial storm clouds gathering.

The irony of the administration’s trade policy is that it simultaneously threatens to derail growth and push up inflation. Here’s what Deutsche Bank’s Aleksandar Kocic wrote late last week:

This is exactly the territory where monetary policy response becomes ambiguous — whether to defend growth or fight inflation. However, before we see clarity regarding the tariffs in terms of their magnitude and economic impact, the Fed is unlikely to deviate from its current path.

In other words, they’re going to continue to effectively apply the brakes in the interest of warding off inflation and if they’re blindsided by a sudden hit to sentiment and/or growth, they risk exacerbating things. At that point, you can expect those guidance cuts that have so far been few and far between to start piling up.

You know something (probably not) fuck earnings season. Pay your workers a living wage so they can afford your very own product or get the hell out of the way. That is progressive and yes it keeps people out of your pocket later when you bitch and moan about having to pay more taxes. This is turning into a feudal system, just the way billionaire asshole like it, kiss my ass. Vote people vote.