“Bear” is an extremely relative term these days when it comes to equities.

To say harboring overtly dour notions about stocks has been painful in 2021 would be to materially understate the case.

To be sure, there were bumps in the road, although it may not have felt like it. September was a bit rough, for example, and there’s been no shortage of drama at the sector and style level. Indeed, the ebb and flow of the re-opening trade and the vagaries of the reflation narrative engendered notable factor volatility at fairly regular intervals, while the “frothiest” corners of the market suffered sizable drawdowns.

However, at the index level, 2021 has been a year of acronyms and superlatives. Notwithstanding episodic, under-the-hood turbulence, the benchmarks logged record after record. By late last week, the S&P was some 7% higher than the most bullish Wall Street year-end forecast, to say nothing of any remaining “bearish” targets.

Among analysts who maintained a somewhat skeptical view about the prospects for additional gains as summer melted into autumn were Morgan Stanley’s Mike Wilson (who suggested a 10% pullback might be in the cards) and BofA’s Savita Subramanian, who held onto a 3,800 target until the first week of September.

I should point out that Wilson was squarely on the right side of the post-pandemic trade in US equities. He was a self-described “steadfast bull” through year-end 2020 and generally stayed abreast of things this year until August, when he started to fret. Wilson marked his profit forecasts to market after Q2’s blockbuster results, but adopted a cautious approach. Subramanian (and colleague Jill Carey Hall) were somewhat incredulous by the time September’s mini-swoon rolled around. “What good news is left?”, they wondered, while begrudgingly raising their year-end target.

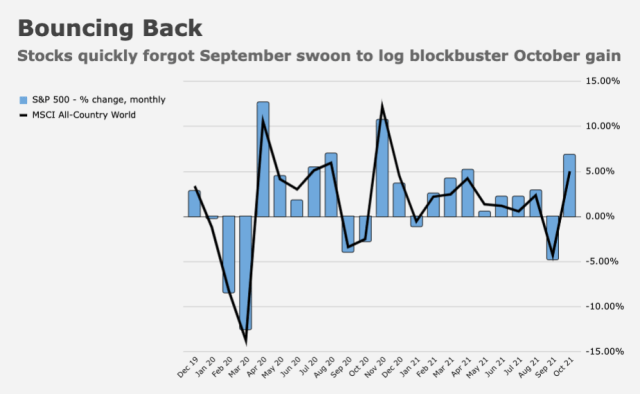

September did, in fact, deliver a long-awaited 5% pullback, but that was about it. Subsequently, equities (and not just US equities either) posted a blistering October (figure below) and Q3 earnings stateside surprised to the upside — again.

The rally continued into November, as key event risks came and went without upsetting any equities apple carts (for drama, you had to consult front-end rates).

Now, Subramanian is looking on the bright side (while maintaining a subdued outlook for 2022). And Wilson is rolling out the acronyms.

“During our more optimistic years, we explored what could go wrong for stocks in our ‘Exploring the Dark Side’ series, but with our now tepid outlook for flat returns through 2022, we take our cue from Monty Python and look on the bright side,” Subramanian wrote, in a recent update, adding that although record equity duration leaves stocks extremely vulnerable to a sharp rise in yields, the corollary is that lower rates could translate into lots of upside.

“A rising discount rate is more negative than ever — a 1ppt increase in the cost of equity could drive the S&P 500 to ~3600, but conversely, a 1ppt drop would push the S&P 500 to 6300,” Subramanian said, pointing out that “convexity matters here, as risks are asymmetric.” The table (below, from BofA) illustrates the point.

She went on to note surprisingly resilient margins thanks to pricing power and cost control. “The S&P is already 70% more labor-light than in the 80s,” Subramanian remarked.

It’s possible that employers will eventually tire of raising wages at a record clip, especially if workers continue to hold out. At that point, businesses might bring in the bots. “If wage pressure spurs automation, expect efficiency gains,” BofA said, noting that it’s “dangerous to underestimate Corporate America.”

And then there’s inflation. What do you buy to hedge inflation? US reals are still deeply negative. “Commodities offer inflation-protection, bonds offer income but neither offers both,” Subramanian wrote, in the same note. “Stocks sit in the sweet spot offering inflation protection (earnings are nominal) as well as yield (the S&P 500 dividend yield vs. 10-yr yields is still the 80th percentile.”

The “bottom line” for Subramanian is that folks should “remain invested” while being careful to “pick your spots.”

For Morgan’s Wilson, the ferocity of the rebound from the September pullback was a surprise. “Equity markets continue to ride the wave of retail flows, seasonal strength and institutional FOMO,” he wrote Monday. “While this is very much in line with our thinking over the past few weeks, we have been surprised once again at the magnitude and speed of the move higher.”

That “wave” served to help stocks re-rate after the S&P’s forward multiple dipped near 20 at the beginning of last month (simple figure below).

“Almost all of the rally since October 4th has been due to the 7.5% increase in the forward P/E,” Wilson said. “Animal spirits are alive and well.”

Indeed they are. A testament to “animal spirits” is Morgan’s retail client base, whose allocation to stocks sits at a record high, while cash is near record lows (on a five-year lookback). And it’s not just the “dumb” money. Data from Morgan’s prime desk shows the L/S crowd has gross leverage in the 100th%ile, and net leverage in the 95th.

Ultimately, Wilson adopted a similar cadence as that employed by Subramanian — a kind of begrudging fatalism towards the likelihood of a melt-up, but spiced with caution.

“Bottom line, the equity market is making a run at our bull case targets even faster than we expected as both retail and institutional participation follows the seasonal trends and fears of tax hikes and the oncoming Fed taper recede,” Wilson wrote. “We think this dynamic is very close to completing on price but acknowledge the seasonals remain supportive through Thanksgiving/early December.”