As expected, the Fed formally unveiled plans to trim the pace of monthly bond-buying on Wednesday.

The decision marked the beginning of what, in theory anyway, will be a slow unwind of emergency measures adopted in the wake of the pandemic. (Never mind that the emergency measures adopted following the financial crisis were never entirely unwound.)

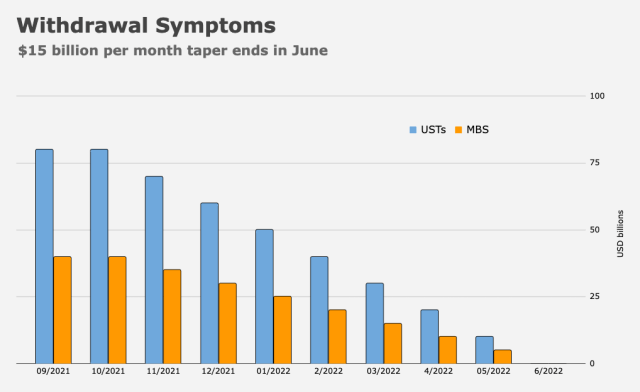

Starting this month, the Fed will reduce purchases of Treasurys and MBS by $15 billion, in line with market expectations. Assuming no changes along the way, the taper will be complete by July (figure below).

“In light of the substantial further progress the economy has made toward the Committee’s goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities,” the November statement read, adding that, for now, “the Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook.”

The plan was well telegraphed. Officials spent the better part of six months openly deliberating the proper timing and pace. Nobody was surprised by the specifics of Wednesday’s announcement.

Arguably, markets priced in the taper months ago. Or at least tried to price it in. It’s not straightforward. For one thing, issuance is set to slow. Wednesday’s refunding announcement was largely as expected. Treasury will cut coupon auction sizes starting this month.

Additionally (and I repeat this at regular intervals), there’s quite a bit of nuance to be had when it comes to debating the likely impact of smaller monthly Fed purchases. If the idea behind monthly bond-buying is to stimulate and otherwise reflate, then tapering is best conceptualized as the abatement of a stimulative, reflationary impulse, not as the removal of demand for the US long-end, which will always find sponsorship from someone, somewhere, especially in the event a hawkish Fed creates market volatility and stokes policy error fears. Put differently: Fed tapering can bring about counterintuitive price action.

In any case, traders have moved on to debating the timing of liftoff in the context of price pressures which have proven more stubborn than policymakers anticipated. Recent fireworks catalyzed by expectations of preemptive hikes from the BoE, a hawkish turn from the BoC, the likelihood of more hikes from RBNZ and the RBA’s abandonment of yield-curve control, all contributed to a fairly dramatic repricing in front-end rates.

The RBA did its best to reverse some of that by pairing dovish language on the timeline for rate hikes with confirmation that the target on the April 2024 YCC bond had indeed been jettisoned. On Wednesday, Christine Lagarde said the ECB has “clearly articulated the three conditions that need to be satisfied before rates will start to rise.” Those conditions “are very unlikely to be satisfied next year,” she emphasized.

The Fed statement gave no indication that the Committee is considering any kind of dramatic pivot that would bring forward liftoff into the taper window. It was left to Jerome Powell to spar with the inquisitive and otherwise parry implicit criticism in the press conference.

The November statement described inflation as “elevated, largely reflecting factors that are expected to be transitory,” and noted that “supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors.” The September statement, by contrast, said simply “inflation is elevated, largely reflecting transitory factors.”

It’s not just traders anticipating “early” rate hikes. Analysts are similarly compelled to bring forward the timeline on liftoff. Goldman, for example, now sees the Fed hiking in July, just a month after the taper ends.

Fed doves cite five million “missing” jobs while insisting the threshold for hiking rates is still some ways off. But it’s no longer clear (at all) that “slack” is the appropriate term for the labor market shortfall versus pre-pandemic levels of employment.

Jobs are plentiful. Workers are scarce (familiar figure below). “The sectors most adversely affected by the pandemic have improved in recent months, but the summer’s rise in COVID-19 cases has slowed their recovery,” the new statement said of the labor market.

The quits rate hit a record over the summer and labor scarcity has compelled employers to offer higher wages, better benefits and incentives to coax workers from the sidelines.

Wages and salaries increased at the fastest pace ever in the third quarter, ECI data out last week showed. That, in turn, raises the specter of an inflationary spiral, even as it suggests labor has the most leverage vis-à-vis capital in decades.

19 months on from the pandemic lockdowns, manufacturers are bedeviled by surging input costs, seemingly intractable supply chain bottlenecks and any number of associated disruptions which, together, make it difficult for factories to meet surging demand. Anecdotes from manufacturing PMIs are a broken record — a “compendium of complaints,” as I put it Monday.

In the services sector, businesses are still struggling to fill open positions and adjust to the post-pandemic reality of wary consumers who, while eager to spend, may still be reluctant to engage regularly with high-contact businesses like restaurants and theaters.

It’s likely that many consumers aren’t even aware their psychology has changed. For some, reluctance to dine out or go see a movie may be subconscious. For others, fear may not be a factor at all. Rather, some behaviors initially adopted to contain the spread of the virus are now viewed as convenience perks. As it turns out, it’s just easier to have someone do your grocery shopping for you. Who wants to go back into the store when you can just pull up to the curb? Some folks, maybe. But rest assured, virus measures-turned timesavers have likely made permanent converts of many Americans.

Monetary policy can’t answer most of the questions tacitly posed above. And rate hikes, to the extent they are employed preemptively to beat back inflation, could do more harm than good if the problems remain concentrated in supply chains.

When it comes to the taper and the notion that it’s on something like auto-pilot, I’d be remiss not to note that the last time Powell tried auto-pilot while tightening, things didn’t turn out particularly well. (And, yes, tapering is tightening, by the way.)

Of course, in 2018, the Fed was running down the balance sheet, as opposed to simply growing it at a slower pace. But that’s the thing about addiction — it generally becomes more acute over time, raising the stakes and reducing the margin for error in the event of withdrawal.

November FOMC statement

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months, but the summer’s rise in COVID-19 cases has slowed their recovery. Inflation is elevated, largely reflecting factors that are expected to be transitory. Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In light of the substantial further progress the economy has made toward the Committee’s goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities. Beginning later this month, the Committee will increase its holdings of Treasury securities by at least $70 billion per month and of agency mortgage-backed securities by at least $35 billion per month. Beginning in December, the Committee will increase its holdings of Treasury securities by at least $60 billion per month and of agency mortgage-backed securities by at least $30 billion per month. The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook. The Federal Reserve’s ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

Interesting that FOMC committed to $30B of reduction — $15B now and $15B in Dec. (when messaging gets a little complicated b/c of the holiday). Powell also made it clear that optionality is one of the committee’s watchwords heading into 2022, as it should be. I think, and market participants seem to agree, that the FOMC is where it should be and has a plan going forward.

If I may, please allow me to present a thought.

I had Bloomberg TV chattering in the background while encouraging the dog to stop barking at a squirrel on an outbuilding roof. Did I hear someone say that the Fed also said they would not replace the mortgage back securities in their portfolios as they mature?

If that is correct, is it their way of trying to cool off the housing market a little without having to nuke the whole economy via higher rates? If so it’s great and about time.

Backdoor targeted policy making!

“Rather, some behaviors initially adopted to contain the spread of the virus are now viewed as convenience perks. As it turns out, it’s just easier to have someone do your grocery shopping for you. Who wants to go back into the store when you can just pull up to the curb? Some folks, maybe. But rest assured, virus measures-turned timesavers have likely made permanent converts of many Americans.”

Great point ! Things change.

There is the way that people think the world should work.

There is the manner in which the world used to work.

There is the way the world actually works.

And finally, there is the way that the world will function “tomorrow”.

Sorting all of that out is a brain teaser that is fun to play.

Yep!

Fed has been in a sweet spot lately in terms of market communication on taper. When they announce each incremental thing, market reacts +ve because already mostly discounted.

As we’ve discussed before, Treasury issuance will taper with and maybe faster than Fed buying. Rate hike expectations already where taper pace might suggest.