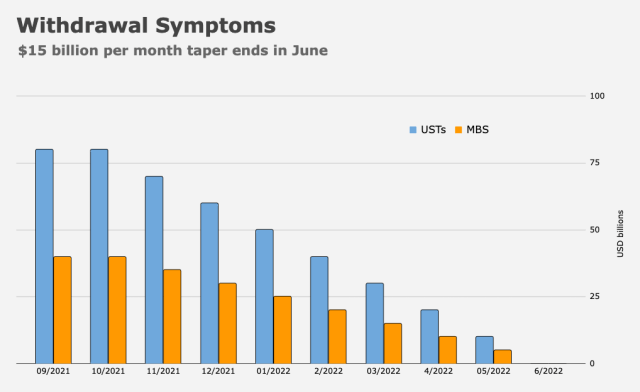

The Fed will formally unveil plans to taper monthly bond-buying this week, with designs on completing the exercise by July.

By most accounts, the pace of asset purchases will decrease by $15 billion per month (figure below), reaching zero in June.

The decision comes a week after data betrayed a sharp deceleration in US economic momentum, and just days before the October jobs report is expected to show the economy added 400,000 positions last month.

“We expect the process of tapering to commence with the monthly purchase calendar that begins in mid-November,” Goldman said. “Because the December purchase calendar will be published before the December FOMC meeting, unless Fed officials change the calendar schedule, the FOMC could announce reductions for both November and December next week [or] announce that reductions will continue at the same pace each month unless economic developments deviate substantially from its expectations, effectively putting the taper on autopilot.”

In other words, the Fed may decide to announce the pace of reductions for November and December only, or simply say the reductions will commence at $15 billion and continue at that pace each month unless events conspire to force a slower or faster taper.

Remember, the read-through for asset prices from reduced bond-buying isn’t straightforward. Well, it is for equities. As Harley Bassman put it, “clever quants will say that a statistically significant mathematical correlation doesn’t exist between money creation and financial asset prices, but who are you going to believe, them or your lying eyes?” Liquidity provision absolutely matters (figure below).

You don’t have to be good with numbers to know that when a price insensitive buyer is always in the market, it’s bullish one way or the other. Either there’s a direct connection (e.g., the BoJ buying equity ETFs on days when Japanese stocks fall “too” much) or an indirect one (e.g., the extent to which pushing yields on safe assets to zero and below shoves investors out the risk curve and down the quality ladder until the only places to go are high yield and equities).

From a common sense perspective, trillions upon trillions in liquidity doesn’t just get absorbed with no impact. As Bassman put it, “perhaps on a week-to-week basis asset prices don’t move synchronously with the production of fiat currency, but $20 trillion of money must reside someplace, and with the magic of financial leverage it is quite clear where.”

By now, the figure (above) is such a cliché that I hesitate to use it, but it retains its poignancy.

When it comes to bonds, the debate is a bit more nuanced. Fed tapering can bring about counterintuitive price action. If the idea behind monthly bond-buying is to stimulate and otherwise reflate, then tapering is best conceptualized as the abatement of a stimulative, reflationary impulse, not as the removal of demand for the US long-end, which will always find sponsorship from someone, somewhere, especially in the event a hawkish Fed creates market volatility and stokes policy error fears.

That is a crucial point. One shouldn’t necessarily assume that tapering will lead to upward pressure on yields, especially if economic momentum continues to wane, the long-end continues to rebel against rising rate hike odds and supply (issuance) slows.

“While not holding the same weight as the FOMC’s policy decision, Wednesday is made even more consequential by the refunding announcement and the latest update from Treasury on the shape of issuance over the coming quarter,” BMO’s Ian Lyngen and Ben Jeffery remarked, noting that we’ve now “reached the point in the cycle when the unprecedented amount of fiscal stimulus (and accompanying governmental borrowing), is in the rearview mirror and as such the release will likely reveal the first coupon auction size cuts of the cycle.”

“The market is currently pricing [a higher] probability of a rate hike at the June meeting, so a faster pace of tapering is not out of the realm of reason,” SocGen’s Subadra Rajappa remarked, before noting that “even in such a scenario, the Fed’s Treasury holdings will increase” over the course of the taper, and when considered in conjunction with “a sharp decline in coupon supply over the coming quarters, we expect little impact on the demand dynamic for Treasurys as the Fed steps away from the market.”

The November Fed meeting comes as policymakers around the world pivot decisively hawkish. The past two weeks were defined by fireworks at the front-end. The Fed is obviously cognizant of that.

“The most market moving aspect of the Fed communication will be on the timing of the hiking cycle,” TD strategists including Jim O’Sullivan, Priya Misra and Gennadiy Goldberg wrote, noting that “the market has sharply pulled forward rate hike expectations since the September FOMC meeting and is now pricing in 57bps of hikes in 2022 and 75% odds of a hike as early as June 2022.”

Goldman on Friday pulled their forecast for liftoff forward by a full year to July, roughly in line with market pricing. Although Jerome Powell has stuck assiduously to the script vis-à-vis de-linking the first rate hike from the end of the taper, the problem with insisting that the conditions for one are quantitatively and qualitatively different from the other, is that it opens the door for the market to simply goal-seek those conditions on the way to determining that they’ll be met around the same time the taper ends.

“At the same time, markets have sharply lowered the terminal Fed funds rate to just 1.50% from 1.85% suggest[ing] investors expect the Fed to be forced to tighten to control inflation, which results in a more aggressive start to hikes but a shallower hiking cycle,” TD went on to say, noting that “there is an underlying assumption of low potential growth and this dynamic is likely behind the enormous flattening of the curve in recent weeks.”

That gets to the heart of the problem. The narrative in rates headed into the November FOMC meeting centered almost entirely around the notion that preemptive rate hikes to control inflation will be detrimental to growth. It’s unclear how rate hikes can solve the issues pushing up prices (e.g., supply chain disruptions) absent policymakers engineering outright, across-the-board demand destruction, something one assumes they’re not keen to do.

The Fed is doubtlessly pondering the read-through of ECI data out late last week. Wages and salaries grew at the swiftest pace on record during the third quarter.

A $15 billion per month taper “is largely priced in and the more relevant question is the extent to which the Fed will signal inflation skittishness even beyond that which is underlying the decision to wind down bond-buying,” BMO’s Lyngen and Jeffery went on to say. “Friday’s ECI showed an impressive +1.5% Q3 gain in wages and salaries, the highest since Q1 1984 and what many believe is the missing component for inflation to become self-perpetuating.”

With the taper priced in and markets leaning into rate hike bets, you could argue that Powell has ample scope to convey a dovish tilt even as he’ll obviously be compelled to acknowledge the persistence of inflation. As was the case in September, it could be the BoE decision (on Thursday) that proves more consequential for markets.

As this article suggests, supply-side inflation is transitory. The stuff has been produced and shipped — it’s just stuck in and around Long Beach. Anyone know how to drive an 18-wheeler?

https://finance.yahoo.com/news/la-long-beach-target-ugly-hazard-of-containers-near-ports-amid-supply-crisis-131248353.html