Even if central banks stumble into a policy mistake and it all comes crashing down as a result, it’s been a good run.

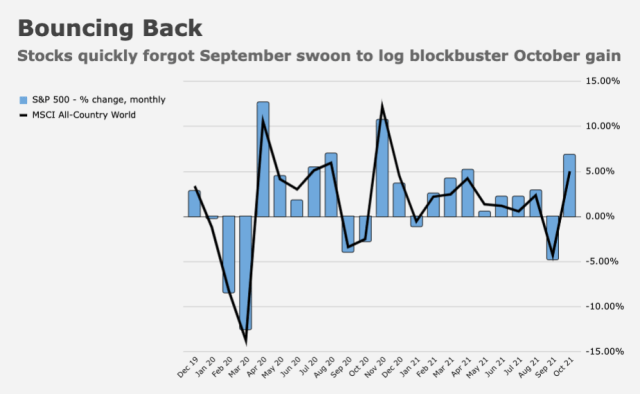

US equities entered November coming off their best monthly performance since the election (simple figure below).

October’s rally relegated September’s swoon to the dustbin of history. The S&P is up some 105% since the pandemic panic lows.

Global stocks were similarly buoyant. October was the best month of the year for the MSCI gauge.

On the line is a four-week win streak and there’s no shortage of tradable of events. Most obviously, the Fed is poised to formally unveil plans to taper monthly asset purchases, likely at a $15 billion per month pace, ending in June.

Meanwhile, the RBA’s credibility is on the line after the bank declined to defend yield-curve control, while the BoE is set to hike rates as inflation concerns override elevated virus cases, a simmering Brexit dispute with France and a yield curve that’s virtually screaming “policy mistake!”

Read more:

Stocks are unbothered by the rate hike ruckus and accompanying front-end fracas, helped along as they are by earnings, inflows and, of course, systematic re-allocation, as declining realized volatility helped restart various virtuous loops.

“Vol reset over the past few weeks, with hedge monetization and vol shorts back in force and lagged ‘buy’ flows from systematic, vol-allocation strats accelerating with realized and implied collapsing,” Nomura’s Charlie McElligott said, flagging more than $37 billion of vol control rebalancing over just two sessions and nearly $46 billion over a week.

In the US, Democrats came into November as close to cementing a deal on Joe Biden’s economic agenda as they’ve ever been, but Joe Manchin and Kyrsten Sinema have demonstrated a willingness to stand in the way of transformational change.

It’s far from clear what principles Manchin and Sinema think they’re defending, but their recalcitrance “succeeded” in cutting the price tag on The White House’s social spending plan in half, which meant stripping away a number of key programs.

Although the framework unveiled last week includes some unpalatable tax proposals for corporates and their shareholders, Goldman’s David Kostin said “the new tax plan appears to pose less of a risk to equities than what we had been assuming.”

He went on to note that the bank’s baseline 2022 S&P 500 EPS estimate of $202 “included an $11 (5%) reduction from corporate tax reform, about half of which was attributable to an increase in the domestic statutory tax rate [but] after [last] week’s developments, prediction markets are pricing a 93% chance that the domestic statutory rate will not rise.”

Extrapolating from the new framework, Goldman said 2022 EPS growth could be 5%, more than double their previous forecast.

“The 1% surtax on executed buybacks could affect both equity demand and EPS growth, although its impact would likely be modest,” Kostin went on to write.

Note that inflows to global equities were $28.1 billion over the latest weekly reporting period (figure below).

That brought the four-week average back up to $19 billion and the YTD haul to a truly astounding $839 billion.

In addition to the Fed, the RBA, the BoE and any accompanying dramatics, markets will get a fresh read on the world’s most important macro data point.

The October jobs report out of the US is expected to show the world’s largest economy added 450,000 positions last month (figure below).

NFP has disappointed investors for two consecutive months and there’s little indication that the myriad distortions holding back the labor market (including and especially a paucity of workers) have disappeared or even dissipated.

“The expiration of unemployment benefits hasn’t been accompanied by workers rushing back to the labor market, enticed by higher wages or simply the absence of the pandemic-inspired support,” BMO’s Ian Lyngen and Ben Jeffery wrote. “On one hand, this has resulted in more subdued payrolls growth than might have otherwise been anticipated [but] the flipside is that if, in fact, 61.6% is the new norm for participation, then rising wages will presumably follow.”

Also on deck stateside: ISM manufacturing and ISM services.

Commenting late last week, BofA’s Michael Hartnett wrote that with “$8.4 trillion in emergency stimulus by Fed and Treasury ending, a fiscal flop [would] tighten ‘peak stimulus’ and ‘peak growth’ narratives.”

The “Investment Clock” is “moving into a bear flattening defensive phase,” he warned.

I just sold a piece of real estate which was a significant chunk of my net worth. The market will not come crashing down tomorrow (or even soon) so that I can re-deploy those funds into the market at a good price. I have never been that lucky!

Put it all into Gamestop!!