“While I have a deep and abiding faith in the United States of America and its extraordinary resiliency and capabilities, we do not have a divine right to success,” Jamie Dimon wrote, in his longest letter yet as CEO.

The financial universe was “disappointed” last month in Warren Buffett’s purportedly “tone deaf” annual letter, which the media mercilessly criticized for being devoid of insight into the human suffering caused by the pandemic. Market participants also decried Buffett’s letter for being similarly bereft regarding America’s reckoning with two centuries of racial injustice.

I called it unfortunate that so many people seemed to be operating in a very narrow cognitive frame of reference. Why, I wondered, would anyone look to Buffett for solace or any real insight into the world? To speak frankly, Buffett is just a man who made some money. He’s not Marcus Aurelius.

Dimon is no Marcus Aurelius either, and if he wrote a book of philosophy I certainly wouldn’t read it. But unlike Buffett, he doesn’t generally shy away from politics or otherwise avoid addressing any elephants loitering in the room. His annual letters are overtly prescriptive, and the latest installment is no different. The word “needs” is used 22 times. “Should” 98 times.

Clearly, Dimon penned his latest tome well in advance of Mitch McConnell’s hypocritical admonishing of corporate America on Monday, but it’s safe to say McConnell’s exhortations for business leaders to stop championing social causes that run counter to the GOP agenda wouldn’t have made a difference — bashful Jamie isn’t.

“Businesses must earn the trust of their customers and communities by acting ethically and morally,” he said. He detailed the bank’s efforts to spend $30 billion over the next half-decade “to address the key drivers of the racial wealth divide [and] reduce systemic racism against Black and Latinx people.”

On climate change, Dimon said that although “coal, oil and natural gas have powered the world’s energy economy for many decades, advancing significant economic growth and social development for billions around the world, our reliance on these resources now threatens the very growth they have enabled.” He suggested that everyone “can agree on the need to make our energy system much less carbon intensive,” but said it’s foolish to abandon traditional resources and companies that produce and consume fossil fuels. Instead, they need to be partners in a transition. “We will measure our clients’ carbon performance against sector-based GHG reduction targets that we’re setting for 2030,” Dimon remarked. He also touted “an opportunity to make the world a better place” not just for “our children and grandchildren,” but also “for all living things that share this planet with us.”

Dimon spent quite a bit of time on the pandemic and outlined all the steps JPMorgan took to help mitigate the economic strain for businesses and individuals. I won’t trouble myself with attempts to nitpick. There are clearly lines of criticism to pursue, but Dimon offers a deluge of data, numbers and statistics. It’s impossible to challenge the contention that the bank spent a lot of money on initiatives aimed at making a difference. A more plausible line of reasoning starts with aggregates and profits and asks not whether the bank did anything (or even whether the bank did a lot), but rather, whether the bank did enough. When it comes to juxtaposing windfall trading and investment banking revenues against the economic malaise playing out simultaneously on Main Street, that’s a topic I’ve spilled gallons of digital ink documenting.

He addresses fiscal stimulus, direct checks and the prospects for inflation. “The fiscal deficit is, pure and simple, giving various individuals and institutions money to spend – which they will spend over time,” Dimon wrote, adding that,

All things being equal, this is, and always has been, inflationary. Of course, in a recessionary environment with low inflation, like after the Great Recession, this might be precisely what is needed without causing overheating or excessive inflation. My own view: The anemic growth in the decade after the Great Recession was due [in part] to public policy failures.

Dimon also detailed why the post-pandemic stimulus effort is likely to bring about wholly different economic outcomes versus the crisis-fighting measures adopted during and after the financial crisis.

“Circumstances and starting points matter,” Dimon wrote. “Before the Great Recession, you had an overleveraged financial system and overleveraged consumers. Today, this is not the case.”

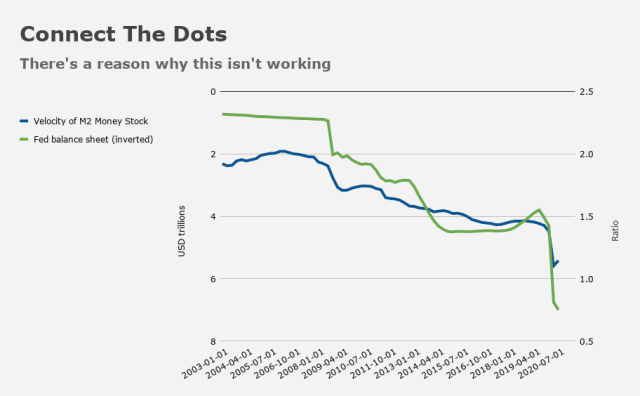

For Dimon, regulations that forced the financial system to adopt more conservative leverage requirements means banks have “very little need to de-leverage.” That, in turn, means “the QE in this go-around will have created more than $3 trillion in deposits at US banks, and, unlike the QE after the Great Recession, a portion of this can be lent out.” That’s important. Dimon is suggesting that the dynamic shown in the figure (below) will not persist — that banks as middlemen in the QE transaction won’t impair the monetary policy transmission channel going forward.

If Dimon is correct, that’s good news. But I, for one, have my doubts.

After a dozen years of QE doing (far) more to inflate financial assets than to effectuate change in the real economy, I’d argue it’s time to try something else. People decry overt monetary financing of government deficits — as though having JPMorgan (or any other bank) between the Fed and Treasury somehow makes the transaction less amenable to charges that the central bank is monetizing government spending. That’s clearly absurd. The middlemen are superfluous, I’ve argued. And while I hope Dimon is correct in his assessment, the figure (below) makes me dubious.

For Dimon, the coming US boom could last at least two years. “I have little doubt that with excess savings, new stimulus savings, huge deficit spending, more QE, a new potential infrastructure bill, a successful vaccine and euphoria around the end of the pandemic, the US economy will likely boom,” he wrote, adding that “this boom could easily run into 2023 because all the spending could extend well into 2023.” (You could joke that the boom will be abating just as the Fed begins to ponder tightening if you go by the dot plot, leaving the FOMC to tighten into a decelerating economy.)

Amusingly, Dimon quips that there’s nothing surprising about froth and speculation in capital markets. “Equity markets look ahead, and they may very well be pricing in not only a booming economy but also the technical factor that lots of the excess liquidity will find its way into stocks,” he said. “As Captain Louis Renault said in Casablanca, ‘I’m shocked, shocked to find that gambling is going on in here!'”

Not surprisingly, he had some suggestions (several pages of them) on how to properly regulate banks, which I’ll skip because… well, because while Dimon is most assuredly an expert on such matters, he’s not exactly a neutral party.

Notably (and coming full circle), Dimon dedicated nearly 20 pages (so, around a third of the letter) to public policy. He addressed everything from healthcare to foreign policy to immigration to trade to manufacturing to infrastructure to taxes to bureaucracy to the budget to social safety nets to job opportunities for people with criminal records to wage growth. It’s a sweeping assessment. “Black adults are over five times more likely to be incarcerated than white adults,” Dimon lamented, calling that statistic “institutional racism in its clearest form.”

Dimon called for a “comprehensive, multi-year national Marshall Plan,” which starts from the following considerations:

We need a coherent, consistent national strategy to match the severity of the existing structural challenges that are driving our country’s racial and economic crises. Just as careful planning and analysis would have prepared us for the current pandemic, careful planning and analysis can address many of the challenges we face. These plans need to be comprehensive, integrated, sustainable and regularly reported on. If we throw a lot of money at infrastructure without fixing the regulations that cripple it, it won’t work. If we throw a lot of money at education but don’t report on the outcome (i.e., good jobs), we will lose credibility. Lurching from policy to policy and having boondoggles and special interest groups abound will make things worse. We need to do the right things and the hard things very competently.

We need to recognize the essential and irreplaceable importance of healthy growth and our global competitiveness. The best way to address our problems, and perhaps the only way to solve them without accelerating inequality further, is to promote healthy economic growth. A healthy growth strategy should be the primary economic policy of both political parties. Healthy growth may be the only way out of our current situation (slow income growth and rapidly increasing debt). We must unleash the extraordinary vibrancy of the American economy. Economic growth will give us the wherewithal to deal with the issues stemming from inequality in ways that are sustainable. It is the engine that will drive and secure America’s global leadership.

Among the most notable passages from the letter come from Dimon’s discussion of hyper-partisanship.

“Democrats and Republicans often seem to be ships passing in the night – with both parties talking at cross purposes even when they may share the same goals,” he wrote.

His advice to Democrats was relatively boilerplate: “Democrats should acknowledge Republicans’ legitimate concerns that money sent to Washington often ends up in large wasteful programs, ultimately offering little value to local communities.”

His counsel for the GOP, on the other hand, was somewhat pointed. “Republicans need to acknowledge that America can and should afford to provide a proper safety net for our elderly, our sick and our poor, as well as help create an environment that generates more opportunities and more income for more Americans,” Dimon chided.

He continued. “Republicans could acknowledge that if the government can demonstrate that it is spending money wisely, we should spend more,” he wrote. “And that may very well mean higher taxes for the wealthy.”

Haven’t read it (yet), but H’s very nice summary makes it sound like a campaign document.

I think the statement on helping the poor the young the people who can make a difference in our country:s productivity is welcome and long overdue. However that statement runs counter to his call for more QE or as I call it socialism for the already wealthy. The first stated tenant is within the thesis of Jesus Christ, the policy prescription of more QV is antithetical to Jesus Christ. It is possible that if big business were to deepen their opposition to McConnell’s call for subservience, did it may Force the Republican party to abandon their Antichrist stance for one that is consistent with Jesus Christ. Of course this would abandon the trumpsters from the dumpster.

But this sort of public discourse can lead to nothing but good for our country. As it is squarely taking on the debates that we need to have with a logical and a well thought out framework, even if there are some self-serving elements. We can hope is that more people bring out more philosophical discussions. So I challenge you Walt why would you not read a philosophical book by Jamie dimon? Written philosophy can be parsed examined and the gems exposed elevated. I for one believe the dumbest person in the United States has something to offer us, I would not put Jamie in the category of the dumbass so I’d say he’s got maybe three somethings to offer us.

A decade or two, or three, late.

This is obviously wishful thinking on my part…I hope Mr. Dimon has been having these conversations in private with other elites for a while now. Obviously, if he has, it hasn’t changed any minds. Most assuredly because they don’t care or recognize the need for them to change.

Too late to matter but I guess it’s better than nothing.