The red-hot US housing market (the “giant flaming marshmallow,” as I’ve called it), may be poised for a kind of double whammy.

Prices have, of course, surged over the course of the pandemic. Demand is strong due to a number of factors, not least of which is the much ballyhooed (and possibly exaggerated) de-urbanization dynamic. The proliferation of work-from-home arrangements further reduced the appeal of dense urban environments just as virus containment protocols sapped city dwellers’ joie de vivre.

Initially, demand was so voracious that cost seemingly wasn’t much of a deterrent, but as supply dwindled and prices continued to surge, some warned that prospective buyers might get priced out of the market. Indeed, signs of ebbing demand began to emerge earlier this year as price pressures continued to build.

As prices rose, one mitigating factor was the ongoing decline in mortgage rates, helped along by Fed largesse.

That pillar of support is showing the first signs of wobbling.

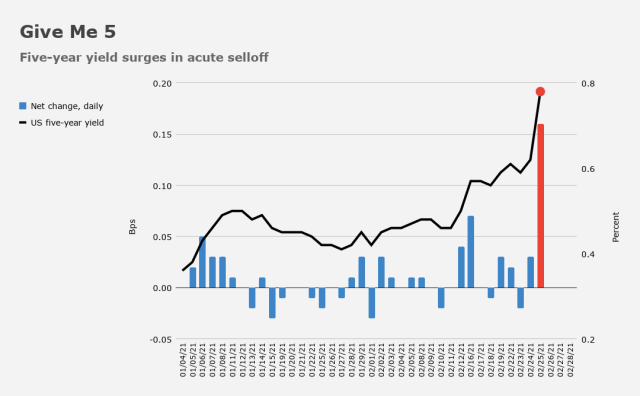

At the risk of making mountains of molehills (and the rise denoted by the red dot in the figure below certainly does look like a molehill staring backwards up at a mountain, especially on a longer-term chart), mortgage rates hit a six-month high this week, after touching a record low of 2.65% in January.

To be sure, that’s still very (very) low, but if financing costs rise at a time when prices are perched at or near record highs, the affordability calculus could become challenging.

Mortgage applications fell last week, in part due to rising prices. Pending home sales dropped 2.8% in January the NAR said Thursday. The problem there wasn’t prices, though. Or at least not according to NAR’s chief economist Lawrence Yun. “There are simply not enough homes,” he remarked, flatly, on the way to saying that a seasonal rise in inventory should help. “An anticipated ramp-up in home construction will provide for much-needed supply.”

Meanwhile (and apropos) some are beginning to point the finger at convexity hedging for exacerbating the recent Treasury selloff, even as most of the chatter indicated it had already run its course. The Fed’s ongoing MBS purchases (and resultant enormous holdings) mitigates the potential scope of any self-feeding spiral, but that doesn’t mean you can’t get forced selling if yields spike dramatically. As JPMorgan’s Josh Younger told Bloomberg Thursday, “everyone is a convexity hedger at some point because as your portfolio keeps getting longer… it will become increasingly painful.” Well, everyone but the Fed, that is.

The linked Bloomberg piece now carries the headline “American Homeowners Are Adding Fuel to Bond Market Sell-Off,” but the URL suggests it was initially called “Convexity Hedging Haunts Markets Already Reeling From Bond Rout.” I guess they couldn’t decide which click bait to go with — fear of the esoteric (i.e., convexity hedging) always works, especially when you pair it with a ghost (i.e., “haunt”), but then again, you can’t go wrong putting “American Homeowners” in a headline. It must have been a tough choice.

Amid the chatter, Harley Bassman had a message. And when it comes to this particular subject, Bassman is a guy who would know, by the way.

“I sure hate to be a bother, and push back on a great headline, but just to be clear, the notion of MBS convexity hedging being relevant to the recent back up in rates it totally bogus,” he said, in emailed comments, adding that,

The Fed owns one third of the market, and they don’t hedge. Then there are the Index funds, but they don’t hedge because the Index extends with the market, so they have no mismatch. This leaves the REITs, who do hedge, but they are tadpoles relative the the size of the market.

To the extent convexity flows were contributing, it’s “ebbing now [and] the last few days have been CTAs and asset managers adjusting,” one rates strategist said, adding that “today’s probably not MBS — it may be just other folks tweaking their duration.”

In any event, MBS hedging wouldn’t be “driving it,” per se. It would be an amplifier. The main driver is just the market starting to reprice the Fed. Five-year yields surged on Thursday. What you see in the visual (below) is a truly dramatic move.

That flattened the 5s30s. The curve is “no longer directional,” TD’s rates team said. “The recent selloff hints at taper fears and that risks the front-end as well, since QE and rates are inherently linked,” the bank’s Priya Misra remarked.

In short, the market looks to be pulling forward Fed expectations. Eurodollar volumes were multiples of their 20-day averages.

All of this as Fed officials continue to push back on the notion that a taper is in cards. Indeed, Jerome Powell went out of his way this week to communicate just the opposite, and his colleagues have generally parroted the same message. A rate hike is years away. Or so we’re told.

Maybe that’s no longer good enough. Reassurances and reiterations of forward guidance have a way of becoming “stale” for spoiled markets, especially when they (markets) know they can extract what they want from the Fed simply by forcing the issue, in true “hall of mirrors” fashion.

Assurances that a rate hike remains at least a good couple of years into the future might not be enough, perhaps the market is trying to force the Fed into hinting YCC is in our proximate horizon, as you have eloquently indicated, the market can force the issue, it wants it’s cake and it wants to eat it too.

Seems to me that if they have to go full BOJ in order to keep rates from getting out of hand (and killing the recovery before it’s barely out of the starting blocks), they will.

All J-Pow has to do is tweet “WAM”, and the belly and back-end will reverse course. Everyone riding the steepener trade for the last 6 months will go screaming for the exits. And negative convexity/gamma cuts both ways, of course.

Will be interesting!