Bitcoin looked poised to hit $50,000 on Sunday because… well, to tell you truth, nobody really knew the “because” part.

There’s ostensibly positive news flow. For example, one of Morgan Stanley’s investment arms is considering whether to allocate to Bitcoin. The fund, Counterpoint Global, is actively managed and “seeks to make long-term investments in unique companies whose market value can increase significantly for underlying fundamental reasons.”

In reporting Counterpoint’s internal deliberations, Bloomberg said crypto “enthusiasts would argue that approach fits well with Bitcoin.” I’d argue it doesn’t, mostly because Bitcoin isn’t a “company” and while it has shown it can “increase significantly,” there are no “underlying fundamental reasons.”

In fact, it’s usually just news flow about acceptance and adoption that pushes it higher, which means investors like Counterpoint risk slipping into a kind of reality distortion loop: News of their own interest pushes it up, and the rally then makes it appear more amenable to the fund’s approach. That’s self-referential.

Of course, it’s not just the Counterpoint rumor. BNY Mellon is all set to provide custody services through a new “Digital Assets” unit and Mastercard released what, to me anyway, was a comically convoluted press release explaining its “strategy” going forward vis-à-vis crypto.

As ever, it’s not my intent to be derisive. You can (and probably already have) perused the linked press releases. BNY Mellon’s is coherent. Mastercard’s reads like precisely what I’d imagine it is: A company with a massive global payments network and limitless resources attempting to map out a plan to do the impossible. Namely, onboard crypto.

Mastercard’s release was littered with caveats and nebulous language. That’s a bad combination. Generally speaking, you want a corporate press release to be unambiguous and you want it to provide clarity. So, caveats and ambiguity are the natural enemies of a good corporate press release. (Unless you’re involved in some kind of scandal or coverup, but that’s a separate area of public relations and you can outsource those services.)

But, bless their hearts, Mastercard tried. “This is a big change that will require a lot of work,” the company said, in an early candidate for understatement of the year.

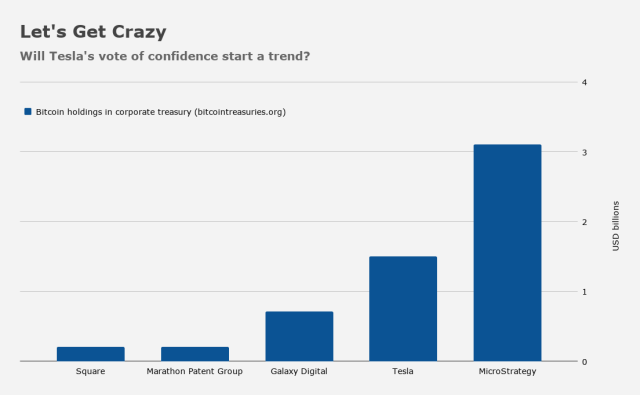

This all comes after Tesla added Bitcoin to the balance sheet and amid a veritable cacophony of speculation about which blue chip US corporates will be next. So far, adoption by corporate treasurers is scant.

The irony will continue to be that the higher Bitcoin goes, the more perilous it will seem, not just in some of the stodgy, staid corners of the investment universe that advocates are hoping to penetrate, but also to anyone who still sees it as a currency.

On Friday, Nassim Taleb said he’s been “getting rid” of his Bitcoin. “A currency is never supposed to be more volatile than what you buy and sell with it,” he remarked, adding that “you can’t price goods in Bitcoin [and] in that respect, it’s a failure.”

I agree. And he’d probably say that the weekend rally further supports his argument. But I’m not a fan of Taleb’s. And unlike most of his fans and critics, I’ve actually read all of his books. As I’m fond of putting it, two of them would be good required reading for undergraduate probability and statistics courses. But classics they are not.

H, I agree with Taleb that BTC has a number of deplorable advocates. But I disagree with the take that these deplorables invalidate BTC and blockchain’s utility entirely.

Blockchain is unique in that it is entirely democratic and meritocratic; it compensates individuals for advancing its network through the disbursement of tokens. Blockchains may compensate individuals for verifying the legitimacy of transactions (Bitcoin), providing computational resources (Ethereum), or enhancing security (certain altcoins). The economic value generated by blockchains occurs via cost reduction. Widespread adoption of blockchain would be devastating to bureaucratic entities that exist in the current configuration of financial networks — tremendous overhead is required to ensure things are running smoothly. A well constructed blockchain theoretically eliminates these supplementary entities via cryptography/computation to ensure legitimacy, fungibility (uniqueness), and security.

Consequently, the value of the tokens on a respective blockchain are a referendum on the value of the blockchain’s network. Since network effects are subject to winner take all effects, the bigger the network, the more valuable it is and the more likely it is to remain the largest network. This positive feedback loop plays into the exponential rise in BTC’s price.

This is all one large experiment, of course. Implicit assumptions are made around the legitimacy of BTC transactions, specifically with respect to Tether (re: NYAG’s investigation into Binance, currently ongoing). Since Tether is assumed to trade at a 1:1 parity with USD, any violation of this assumption will lead to a significant hiccup in the widespread adoption of crypto. It could even serve to invalidate this experiment entirely. We also have security/integrity risks of the blockchain itself. In effect, there is a significant probability BTC and its kin are worthless.

But this notion that BTC’s volatility invalidates its function as a currency is a poor argument, in my opinion. Allen Farrington’s essay Wittgenstein’s Money does a fantastic job of explaining why this is a poor argument — if you have some time, I’d recommend giving it a read. But to borrow from Farrington: “Ludwig Wittgenstein once asked a friend, ‘tell me, why do people say it is more natural to think that the sun rotates around the earth than that the earth is rotating?’ The friend said, ‘well, obviously, because it just seems like the sun is going around the earth.’ Wittgenstein replied, ‘well, what would it seem like if it did seem like the earth were rotating?'”

Consequently. we must ask, “What would it seem like if it did seem like a global, digital, sound, open source, programmable money was monetizing from absolute zero?” And I think we conclude that it is awfully similar to the price action we currently see.

To be clear — any “investment” in these assets is completely speculative, and consequently does not warrant a large allocation of one’s portfolio (Bjarne likens owning BTC to being short gamma, which is absolutely correct given the fat left tail alluded to above). But I am of the opinion that it warrants >>an<< allocation, because there is similarly a probability things manage to go according to plan.

Bingo, it takes some insight and a lot of gambling to see the potential value in a newly formed network. Blockbuster couldn’t conceive of Netflix’s value proposition, Kodak couldn’t see digital photography… I won’t argue any specific blockchain will exist in 100 years but I strongly suspect some will and they will be integral parts of infrastructure in various ways including functional global currency. Will governments ban them? Some will for a time. Will governments adopt them? Some might for a while. Ultimately though crypto no more deprives countries of sovereign currency than does other countries printing currency. The US doesn’t control how much money Mexico prints and it really doesn’t care. Coexistence is the lowest energy response with the highest payoff.

According to plan?

“A currency is never supposed to be more volatile than what you buy and sell with it,”

“you can’t price goods in Bitcoin [and] in that respect, it’s a failure.”

This.

In its current state, of course

Yes.

And? Not all Bitcoin advocates, even maximalists, believe that the purpose of BTC is to be a currency. Technically, it sucks at this. The volatility certainly doesn’t help.

The main thesis is and remain liquid gold/store of value. Not medium of exchange or unit of account. “Store of value” requires adoption. That’s it. As long as everyone agrees it’s a store of value then it’s a store of value.

@H speaking of books, I would love to know which books you would most recommend to someone with an “advanced beginner” level on stocks/finance/economics?

Read a number of those already, including of course the classics (intelligent investor, common stocks and uncommon profits, irrational exuberance etc).

Read Piketty first and everything else later.

Won’t help you with trading, but it will help you understand the world. I actually like Capital And Ideology better than Capital itself.

But I mean, these aren’t exactly weekend reads.

Thanks for the suggestions. I read Picketty’s Capital in the 21st Century. Quite enlightening in terms of how we got here and the inevitable outcome inherent in our current version of capitalism.

I’ll check out the other one.

Definitely agree and I’d add Francis Fukuyama – The origins of political order and David Graeber – Debt the first 5000 years.

Thanks – I’ll read this as well.

Taleb says he is selling his BTC (presumably around its current highs), then says it is a magnet for idiots. Nothing like leaving a **** in the pool after you’ve had your swim. What an asshole. Also, the other side of the coin (sorry) to BTC volatility is USD volatility. If dollars were as stable a measure of value as many claim they are, why are they yanked hither and yon by something as fugitive and ephemeral as crypto?

Sir, kudos to you, “nothing like leaving a **** in the pool after you’ve had your swim” is a graphic and somewhat vulgar metaphor but it is also a very appropriate way to describe Taleb’s actions and statements.

Read this, would love comment from someone who knows a lot more than I do but its sounded both informed and possibly fatal to the bullish case for BTC–“Bitcoin is going up due to Unbacked/fraudulent Tethers being printed en mass to buy bitcoin on margin via Binance. It’s a massive scam which the big banks are falling for.”

another great article, thanks!

While I would not claim to have profound knowledge of the crypto universe, one point does stick out to me (which has also been re-iterated in this forum):

In it’s current form BTC is nothing more than an object of speculation. Mastercards press release sums it up quite well:

“We are also seeing users increasingly take advantage of crypto cards to access these assets and convert them to traditional currencies for spending.”

That’s it in a nutshell.

Personally, I do not see a way forward to change that, given that the current “exchange rate” oscillates betweeen 30,000 and 50,000.

These things will never be used as a currency, in case an outright ban can be avoided BTC et. al. will either

a) continue their somewhat absurd trajectory or

b) revert to their intrinsical value of 0 or near 0, in which case most people, especially those who bought at the top, will not want to have anything to do with them. Which is counterproductive to a use as currency

I wonder if the BTC mania is like the craze in early 20th C for steam cars? Or Zeppelins? The underlying idea of flying and cars was probably correct but not those iterations. The ‘third generation ‘ type of coins (BTC/Ethereum/3rd gen) such as NEM actually have a lot of practical use cases and are more advanced than the preceding coin types and do/ would leverage the blockchain to be potentially very fertile and profitable as regards smashing costs and disintermediating complex interactions as raised above by ‘identity element’. The blockchain is a lot more than BTC.

True.

And it’s easy to imagine a future (or maybe already existing) company using blockchain to provide useful services to customers and turn a profit doing so. Think about all kinds of proof-of-transaction services that now require lawyers/notaries.

OTOH blockchain enables users to do just these kind of transactions without any additional intermediary, so then again the services provided by said companies would not be necessary.

For the time being I cannot discern any wide-spread application of the blockchain technology other than crypto coins, which imo constitute a dead-end iteration of the underlying idea.

What might be a major impediment to the future use of blockchain technology outside of crypto “currencies” is too many people getting burned speculating in BTC now leaving little to no trust or interest to engage with other applications in the future.

I am fully aware that as of this typing, speculators in BTC are not getting burned, but sooner ort later they probably will.

My understanding is that mining of bitcoin continually becomes more difficult and expensive. So previous miners are sitting on a lot of “profit”. They may be happy to sit while the value constantly rises, but what might be the catalyst to prompt them to monetize their profit?

I mean a global ban on mining or crypto could. Otherwise a miner has little incentive to sell off everything. I mean titans of industry rarely cash out and I suspect we’ll end up with a few new Bezos out of this whole thing.

Tesla having a bad quarter and having to sell some of their position in BTC in order to offset the losses from the operational side…

😉

As pointed out by another commenter on the Tesla-related article, they have to sell to realize gains from their crypto position.

sorry, that was sloppy wording.

I meant they have to sell BTC to mark their gains. Realization always requires selling, of course.