A few days back, while commenting on an article that documented Elon Musks’s increasingly outlandish social media posts about Dogecoin, I mentioned that, in my opinion, it would be foolhardy for corporates to put Bitcoin on their balance sheets.

While I recognize that not everyone who trades for fun (or even professionally) went to business school, and while acknowledging that many popular online commentators are similarly bereft when it comes to the kind of post-graduate studies which, while totally useless in most respects, do at least provide you with formal training in basic corporate accounting and public relations, you don’t need a graduate degree to understand why it might be a bad idea to put a large amount of cryptocurrency on the balance sheet of a publicly traded entity.

I’m going to quote myself on this point. If there’s one thing Musk and I have in common, it’s an inflated sense of self-importance. Of course, he actually is important, whereas my claim on that is tenuous, at best. But Musk is living proof that even the most important people in the world can, against the odds, harbor delusions of grandeur despite how objectively grandiose they in fact are.

“This idea of corporate management teams putting Bitcoin on the balance sheet is ludicrous,” I wrote, in a comment on “Elon, Dogecoin And Markets Gone Mad.” I added the following:

It would be like Berkshire’s quarterly results, only instead of the stock swings, you’d have Bitcoin swings. Can you imagine the chaos? Something like: “In the third quarter, our core business performed well and we were able to pass along rising costs to consumers despite a challenging economic environment. However, due to a 46% decline in the value of our cash on hand which, as shareholders might recall, was partially converted to a combination of Bitcoin and Ether last year….”

Fast forward less than 48 hours, and Tesla’s 10-K revealed that Musk decided to put $1.5 billion in Bitcoin on the balance sheet.

“In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity,” Tesla said, adding that,

As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.

Let’s just dispense with the obvious: There are too many jokes to fit into one day, and maybe too many to fit into one lifetime. Some write themselves. Others require a bit more creativity in order to convey all of the overlapping narratives to folks who might not be familiar with Tesla’s (or, more aptly, Musk’s) somewhat fraught relationship with analysts and the SEC.

Suffice to say that not everyone will be totally enamored with the idea of Tesla introducing something that has the potential to materially increase balance sheet volatility.

Cash and equivalents stood at $19.38 billion at the end of last quarter, up more than 200% YoY. I suppose it’s up to Tesla what to do with that, but as the company itself makes clear, the optics could be bad during some quarters.

“Digital assets are currently considered indefinite-lived intangible assets under applicable accounting rules, meaning that any decrease in their fair values below our carrying values for such assets at any time subsequent to their acquisition will require us to recognize impairment charges, whereas we may make no upward revisions for any market price increases until a sale, which may adversely affect our operating results in any period in which such impairment occurs,” the filing noted. “Moreover, there is no guarantee that future changes in GAAP will not require us to change the way we account for digital assets held by us.”

That’s a lot to unpack, but it’s actually not complicated. It’s a formalized version of what I said colloquially last week. This move could mean that Tesla will be compelled to “explain” what will seem like anomalous swings in some performance metrics by way of reference to volatility in Bitcoin. If Tesla begins to take in additional Bitcoin as payment for its vehicles and doesn’t immediately convert that to a more stable store of value, the potential for such quarterly balance sheet volatility would presumably increase commensurate with the percentage of sales made in Bitcoin.

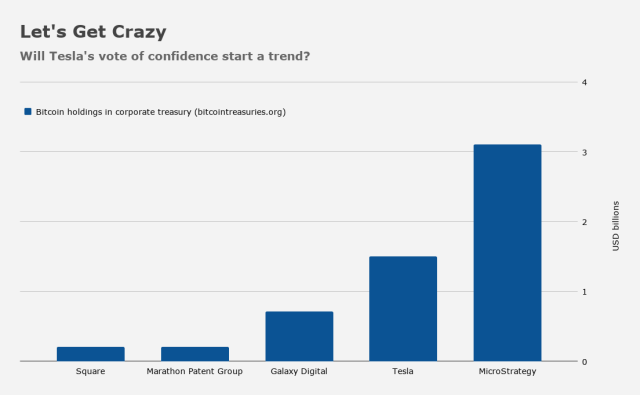

“[Tesla] trails only Michael Saylor’s MicroStrategy with its $3.1 billion hoard of Bitcoin,” Bloomberg wrote, adding that “Saylor, who has been an outspoken proselytizer for Bitcoin, held a webinar earlier this month in which he said over 1,400 firms signed up for the session on legal considerations of holding the digital currency.”

This is all just as funny as it sounds. One of the many concerns that I would have, as a Tesla shareholder (and don’t forget, it’s an S&P 500 constituent now), is that Musk has demonstrated not just the capacity to influence the price of Bitcoin with his tweets, but also what some might construe as the intention to do so.

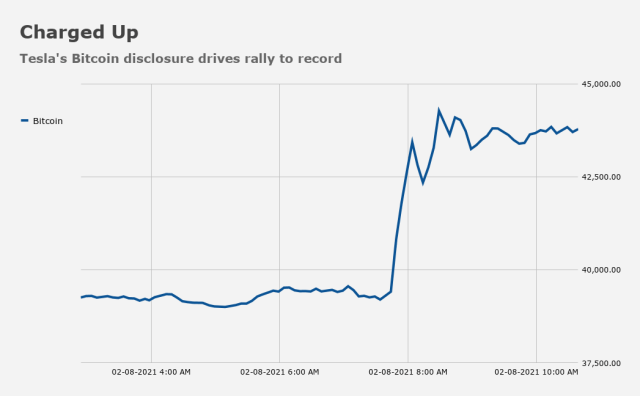

Just last month, for example, Musk reignited a faltering rally in Bitcoin by appending its symbol to his Twitter feed. As the figure (below) shows, Tesla’s filing Monday sparked another big rally, this time to a new record.

The implication is that Musk can (and perhaps already has) tweeted up the value of Tesla’s “cash.” He can, effectively, “improve” (and the scare quotes are there for a reason) Tesla’s balance sheet at will, simply by tweeting about Bitcoin or, as last month showed, putting a Bitcoin symbol on his Twitter bio.

This raises uncomfortable questions about the extent to which Musk could, for instance, theoretically offset lackluster sales by juicing the price of a portion of the company’s cash. If he accepts Bitcoin as payment and then proceeds to talk up the price of Bitcoin, he would effectively be able to raise selling prices after the fact. By the same token (Get it? “The same ‘token‘”), a hypothetical 50% plunge in the price of Bitcoin, would effectively mean that the price of any vehicles sold for Bitcoin would be half what it was when they were sold. How do you account for that in your margins? And does any of this mean that Tesla will have to hire traders to trade Bitcoin futures in order to hedge this exposure?

There are any number of other absurd outcomes that one can conjure, running the gamut from silly to potentially worrisome.

The crypto crowd is understandably excited, but if I had a large sum tied up in Bitcoin I would be asking myself what happens in the event the stash of crypto on Tesla’s balance sheet grows over time, and then the company were to experience some kind of operational snafu or a series of bad quarters. It seems likely that in such a scenario, the company would sell Bitcoin to raise dollars. Would that not weigh on Bitcoin?

As noted above, one could spend all day (and night) documenting the possible pitfalls of this decision. Another concern is that, in the event of a regulatory crackdown on crypto in the US, a portion of Tesla’s cash would be vulnerable. It seems unlikely to me that regulators would take Tesla’s balance sheet into consideration when making such a decision.

In closing, I should note the obvious, which is just that if this becomes a trend, and Bitcoin does take over the world, then Musk will be remembered as a pioneering genius.

But considering he’s already a pioneering genius, and that Tesla is a publicly traded company, I worry the risk/reward profile from this move might be asymmetrically skewed to the downside.

So Janet, Jerome and Congress are ok with US corporations dumping “excess” USD and buying Bitcoin?

GME could do a secondary (their stock price is still 3x over what it was in January, 2021) and hold proceeds in Doge! Why not?

Of course Musk tweeted after he took the position…

““Digital assets are currently considered indefinite-lived intangible assets under applicable accounting rules, meaning that any decrease in their fair values below our carrying values for such assets at any time subsequent to their acquisition will require us to recognize impairment charges, whereas we may make no upward revisions for any market price increases until a sale…”

The rule cited by TSLA suggests that if they drive up Bitcoin, they could not mark up the value on their balance sheet or operating results. The only way to “recognize” the gain would be to sell it.

That’s an interesting conundrum for crypto bulls, aint it?

I just think it’s a little hilarious that whatever market deities exist, they have clearly decided to single out H for personal torment by forcing him to write more and more Bitcoin articles. What cosmic sin must H have committed to deserve such a fate? 😉

Of course, if Bitcoin is the joke with no punchline, and the Fed/Congress are busily turning USD into a Hollywood horror test tube baby nursed in a vat of debt, that we all call “cute” only because all the other central bank babies are uglier, perhaps this all makes sense somehow. Can you hedge horror with humor, or vice versa?

I actually didn’t mind writing this one. This one was fun. 🙂

I love the side note about elevated self-importance. However this does in my mind increase the likelihood I might short Tesla one day.

3sts is the ticker, fortunately I have a very small position and yet the position is somewhat smaller now than it was a week ago. Musk seems particularly adept at crushing shorts and boosting his NW. I would be deeply concerned as an institutional investor being long TSLA

I’d love to know what the large institutional shareholders think about getting potentially some unwanted bitcoin exposure. I wouldn’t be happy about it, if I was a PM. It will be interesting to see if he publishes a price list in Bitcoin!

I love the irony of this, making every one who holds SPY in their portfolios indirect holders of Tesla and therefore BTC, most investors are now exposed to a degree. I think the flood gates could open into a real mania, Musk and Tesla have been such a “success” story in the markets that others might seek to emulate his move. If you think retail FOMO was fun to witness in 2017 wait for institutional FOMO later in 2021. I’ll continue to take profits in crypto as the dollar value climbs, but news like this make it hard to dampen my bullish view of the space, long BTC is becoming the best way to express a bearish view on humanity and I am most certainly bearish on the human race…

“It seems unlikely to me that regulators would take Tesla’s balance sheet into consideration when making such a decision.”

I think this touches on one of the most fascinating aspects of Bitcoin. I completely agree, but it seems if the US is going to outlaw or heavily regulate it, they need to do so sooner rather than later. BTC is quickly becoming entwined with some large public companies, institutional investors, and members of congress. How long before it is “too big to squash” because harsh regulation would damage some high profile balance sheets and crash the stock price of some big companies or funds in a fragile market?

Yep. You’re exactly right.

And that will be the irony of Bitcoin. It could in fact get some immunity from overzealous regulators by virtue of adoption by the very same system it’s supposed to supplant.

Maybe that was part of the “master plan,” but somehow I doubt it.

Either way, as I mentioned in the Apple piece (linked below), once it gets embedded into these balance sheets, it will be harder to regulate.

https://heisenbergreport.com/2021/02/08/iexchange-one-banks-plan-for-apples-crypto-future/

The Gold Reserve Act of 1934 made it illegal to own gold- history could repeat itself and there could be an orderly process established for turning in cryptos to the US government in exchange for USD- at a rate established by the government.

I have noticed that starting from early January TSLA behaves similarly to BTC (or HBTC) and very differently from other big tech.

Now it is official: first of all Tesla is not a car manufacturer and even not a technology company, but some sort of cryptocurrency fund.

Invest accordingly.

Brilliant headline. The Onion would be proud.

Considering Bitcoin mining consumes the equivalent electrical output of Switzerland, putting $1.5 Billion into bitcoin is not consistent with Tesla’s mission. Whatever happened to saving the planet?

The printing press at the US Treasury consumes far less electricity. Gives a new meaning to going green.

Tesla shareholders should be able to vote on whether or not Tesla company should hold worthless Bitcoin.

Historically, Tesla’s net profits came from selling tax credits. Prospectively, appears Tesla’s net profits might be attributable to Bitcoin. Last I looked, the actual car business did not make money.

How desperate is he to hold up Tesla’s stock price?