Everything’s a bubble.

That’s a refrain you’ve probably heard quite a bit lately.

Admittedly, it’s difficult to argue with the proposition that some manner of “reckoning” may be close at hand, at least for some assets which have pretty clearly overshot to the upside.

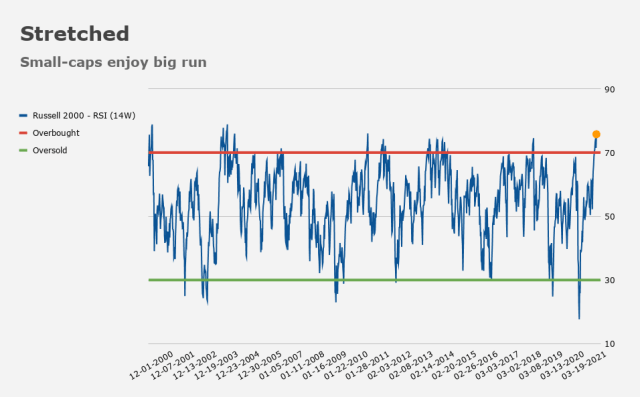

The Russell 2000, for example, is near the most overbought in more than 15 years on at least one measure, although as regular readers know, I don’t generally assign much in the way of predictive power to anything that can be even loosely be described as a “technical” indicator.

The problem, of course, is that calling the top is difficult. They don’t, in fact, “ring any bells” when the elevator is about to go down, and as much as this will rankle readers who trade professionally or semi-professionally, market timing is one of the surest ways to underperform benchmarks, historically speaking.

Sure, some people can outperform. But most can’t. Everyone knows that intuitively. And it’s especially true in a world where benchmarks are driven inexorably higher by the dynamics associated with central bank accommodation. How many traders do you imagine managed to beat the S&P’s return since the lows in early 2009?

In any case, the futility of calling tops doesn’t mean we shouldn’t at least attempt to identify warning signs or potential tipping points. And in that regard, BofA’s Michael Hartnett, who has consistently suggested that caution may be warranted around what he describes as “peak positioning, policy, and profits,” has some ideas.

In a note out this week, Hartnett alluded to higher rates causing indigestion for risk assets. He pointed to six possible “early warning signs,” including a break below $133 in the investment grade credit ETF (i.e., LQD) and a “surprise” rally in the dollar.

Remember: Nothing would choke off the reflation trade faster than a sustained dollar rally and/or a surge in US real yields, which the Fed has succeeded in pushing to record lows. For what it’s worth, JPMorgan on Friday wrote that “the clock is at least ticking on dollar debasement as a viable contributor to the dollar-bearish narrative.”

“We are wary of definitively calling the end of the dollar downtrend, but at the same time, the direction of travel in real yields” could lend support, JPMorgan went on to say. 10-year reals posted their first weekly gain since October this week.

BofA’s Hartnett also listed the possibility of upside inflation prints “spooking the Fed.” He flagged a six-year high in food prices.

Regular readers might recall that late last month, I mentioned a gauge published by The Food and Agriculture Organization, which tracks monthly changes in cereals, oilseeds, dairy products, meat and sugar. It rose again in December, marking the seventh consecutive monthly increase.

The last time global food prices surged, some blamed Fed policy, opening the door to the suggestion that the FOMC was indirectly contributing to unrest in developing nations.

Finally, Hartnett said market participants may want to look out for signs that higher yields are undermining assets that have gone parabolic recently, including (obviously) Bitcoin and Tesla.

So, if you’re looking for proverbial coal mine canaries, those are some candidates.

The underlying risk is simply that with assets of all sorts priced off of record-low yields and deeply negative real rates stateside, even a seemingly pedestrian backup could upset more than a few applecarts.

The USD looks to have turned up last week…..1st sign of Risk Off.

I’ve got my finger on the Sell Everything key.