2021 began promisingly enough with the dollar down and global equities bid, but by the end of the US cash session, optimism turned to pessimism amid virus concerns and the prospect of more political strife in the US.

The UK headed back into full lockdown starting pretty much immediately, and lasting until mid-February. In a national address, Boris Johnson said people must remain in their homes, leaving only for work (assuming working from home isn’t possible), exercise, necessities, medical treatment, or to assist the “vulnerable.”

Primary and secondary schools will be shuttered, as will colleges. The only exceptions are for vulnerable children and the children of essential workers. It’s no secret why this is necessary. Cases in the UK have spiraled out of control thanks in part to an aggressive new variant of the virus. The numbers have recalibrated the y-axis and threaten to overwhelm the National Health Service.

Note that the initial wave in the UK (from March and April) barely even shows up on the chart anymore. The situation is totally out of control, for lack of a more formalized, less colloquial way to put it.

Johnson said that “with each jab that goes into an arm,” the country is tilting the odds against COVID. That may well be the case, but until more arms are jabbed, COVID has the upper hand.

Obviously, the concern for risk assets is that new lockdowns will ultimately mean a double-dip downturn for multiple western economies, even as vaccine rollout proceeds apace. Remember, if you can “see the light at the end of the tunnel,” it means you’re still in that damn tunnel.

With that as the context, US stocks were down the most since October 28. At one point, the VIX rose the most since September, before coming off a bit.

Unfortunately, bonds weren’t much help. Although Treasurys reversed early losses in what Bloomberg’s Edward Bolingbroke described as a “flurry” of futures buying that sent 10-year notes to session highs, yields were essentially flat, and even a touch cheaper at the long-end.

But there was more nuance on Monday than the simple observation that bonds “weren’t your hedge,” so to speak.

10-year real yields fell to a record low -1.124%, which in turn helped push breakevens beyond 2% for the first time since 2018.

That came as Democrats’ odds of prevailing in the Georgia runoffs on Tuesday hit 47%, according to PredictIt.

“The most pressing question at the moment is what happens to financial markets in the event the Democrats manage to secure the two Senate seats currently in contention,” BMO’s Ian Lyngen and Ben Jeffery wrote, in a Monday afternoon note.

“Using the Monday overnight session as a rough approximation, the initial response will be upside for risk assets as additional stimulus expectations mount,” they added, noting that “it then follows that the reflationary impulse associated with further fiscal efforts will elevate inflation expectations — already evidenced by 10-year breakevens breaching 200bp.”

On Monday afternoon, Andrew Cuomo said New York state had confirmed its first case of the COVID variant in a 60-year-old Saratoga county man with no prior travel history. Apparently, New York has tested thousands of people looking for the mutated strain. “If other states could test as much as we were testing and tested for the UK strain as much as we’ve tested, they would be finding them,” Cuomo remarked.

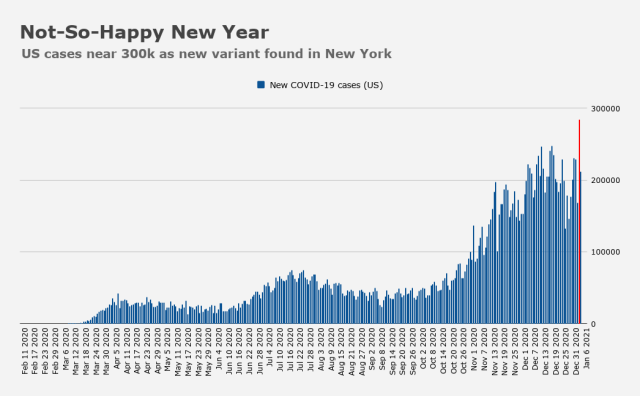

With US cases having already surged to almost 300,000 following New Year’s, it’s entirely possible that the presence of the new strain will exacerbate an already bad situation.

Stating the obvious, Oppenheimer’s John Stoltzfus wrote that stocks “will remain sensitive to developments tied to the pandemic.”

If you ask Stoltzfus, a Democratic victory in Georgia would not be a positive development for equities. “Should the Democrats win both seats, we expect the S&P 500 to become vulnerable to a downdraft in the neighborhood of 6% to 10%,” he remarked.

From a market perspective, gridlock is still seen as preferable by some. I would (again) suggest that one risk which may be flying under the radar is a Georgia outcome that sees one or both races contested.

Okay, campers, rise and shine, and don’t forget your booties ’cause it’s cooooold out there today.

It’s coooold out there every day. What is this, Miami Beach?

Any congressman who doesn’t see gridlock as the biggest threat to this nation, is doing his/her part to destroy American democracy.